Question: 1. (13 points) You are considering buying a 1,000,000 square foot warehouse. All 1,000,000 square feet are leased to Amazon.com, Inc. which has 6 years

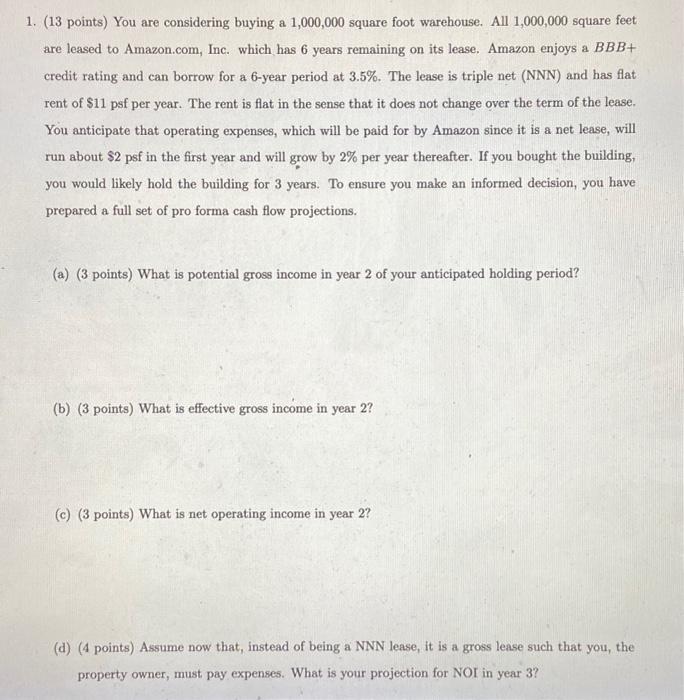

1. (13 points) You are considering buying a 1,000,000 square foot warehouse. All 1,000,000 square feet are leased to Amazon.com, Inc. which has 6 years remaining on its lease. Amazon enjoys a BBB+ credit rating and can borrow for a 6-year period at 3.5%. The lease is triple net (NNN) and has flat rent of $11 psf per year. The rent is flat in the sense that it does not change over the term of the lease. You anticipate that operating expenses, which will be paid for by Amazon since it is a net lease, will run about $2 psf in the first year and will grow by 2% per year thereafter. If you bought the building, you would likely hold the building for 3 years. To ensure you make an informed decision, you have prepared a full set of pro forma cash flow projections. (a) (3 points) What is potential gross income in year 2 of your anticipated holding period? (b) (3 points) What is effective gross income in year 2? (c) (3 points) What is net operating income in year 2? (d) (4 points) Assume now that, instead of being a NNN lease, it is a gross lease such that you, the property owner, must pay expenses. What is your projection for NOI in year 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts