Question: 1. ( 14 Points ) You are working for a private equity firm and your team is assigned the task of determining the enterprise value

1. (14 Points) You are working for a private equity firm and your team is assigned the task of

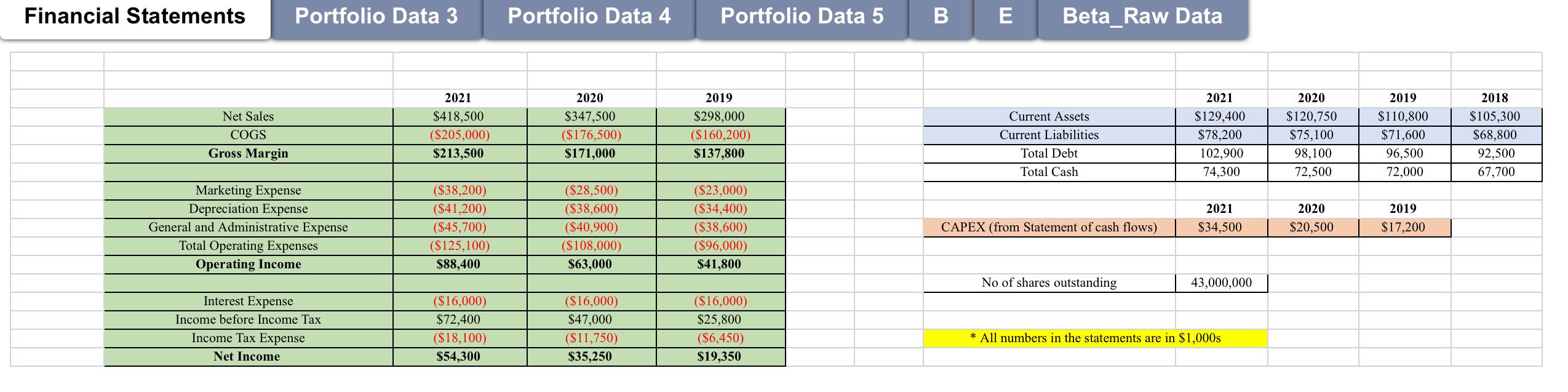

determining the enterprise value of a target firm. This target firms past and current Income

statements and other key accounts (from the Balance Sheet and the Statement of Cash Flows)

are presented in the MS Excel file (attached).

Based on your teams analysis, you expect the following net sales growth for this target firm:

| Year | Expected Net Sales Growth |

| 2022 | 9.00% |

| 2023 | 8.40% |

| 2024 | 7.60% |

| 2025 | 7.10% |

| 2026 | 6.50% |

| 2027 | 6.00% |

| 2028onwards | 3.50% |

During your team meetings, you agreed upon using the following rules in the enterprise value

calculation:

The EBIT to Net Sales ratio will be constant in the future, and it is equal to the average EBIT to

Net Sales ratio of the last three years.

Capital Expenditures (CAPEX) will be 8% of Net Sales each year.

Depreciation Expense will be 120% of the Capital Expenditures each year.

Net Working Capital change will be 12% of the Net Sales change each year.

a. (8 Points) If your team believes that the proper discount rate for this target firm valuation is

14.10% pa, what is the enterprise value (EV) of this target firm as of January 2022?

b. (3 Points) If this firm has 43M shares outstanding, what is the fair value of this target firms

stock?

c. (3 Points) If this firms stock was trading at $18 per share in the market, what kind of (and how

big of) a correction did you expect to see? (Please calculate the percentage change you expect

to see and briefly explain your logic)

Financial Statements Portfolio Data 3 Portfolio Data 4 Portfolio Data 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts