Question: 1) (15 marks) Consider a binomial option model defined by the triple of (u, d,q) under the risk-neutral measure, where the parameters u and d

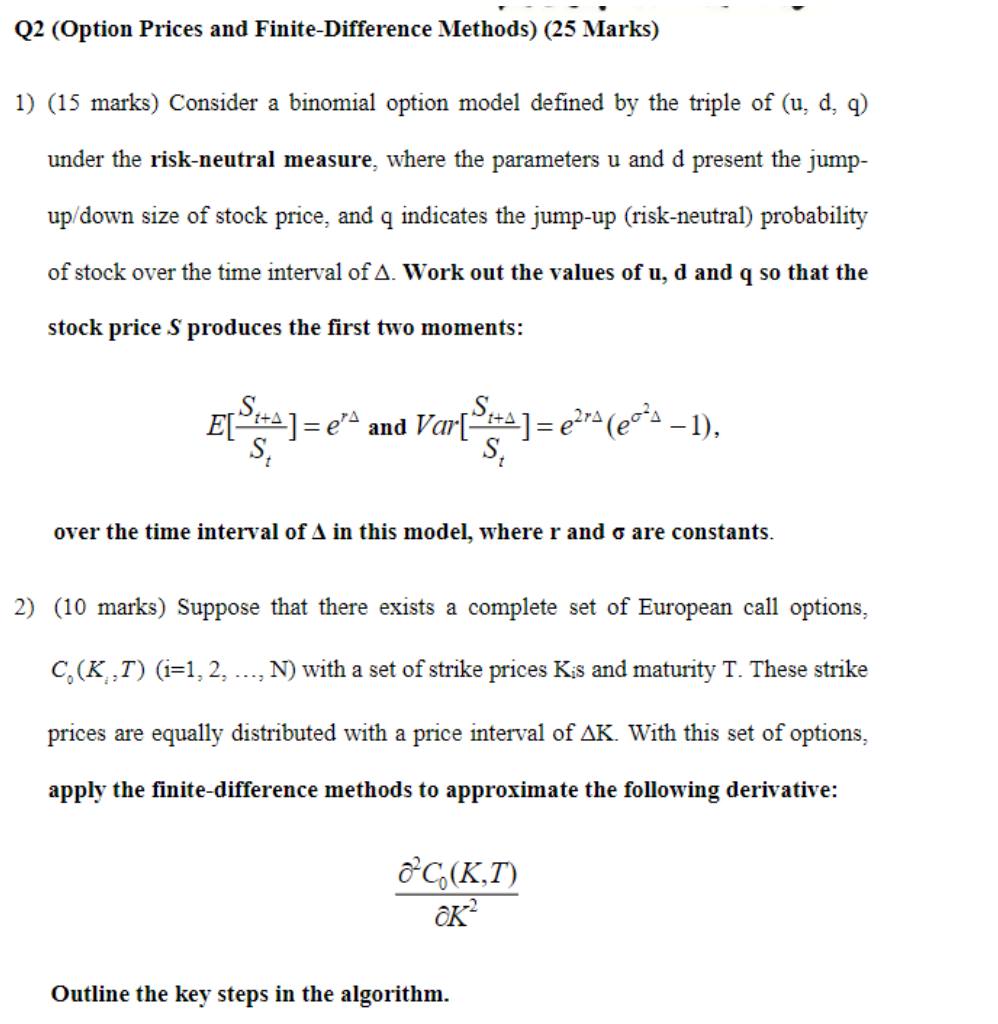

1) (15 marks) Consider a binomial option model defined by the triple of (u, d,q) under the risk-neutral measure, where the parameters u and d present the jumpup/down size of stock price, and q indicates the jump-up (risk-neutral) probability of stock over the time interval of . Work out the values of u,d and q so that the stock price S produces the first two moments: E[StSt+]=erandVar[StSt+]=e2r(e21) over the time interval of in this model, where r and are constants. 2) (10 marks) Suppose that there exists a complete set of European call options, C0(Ki,T)(i=1,2,,N) with a set of strike prices KiS and maturity T. These strike prices are equally distributed with a price interval of K. With this set of options, apply the finite-difference methods to approximate the following derivative: K22C0(K,T) Outline the key steps in the algorithm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts