Question: 1) (15 marks) Consider a one-period securities model with three states (i,1=1,2,3) in which one Arrow security e(i) pays unit payoff when the state i

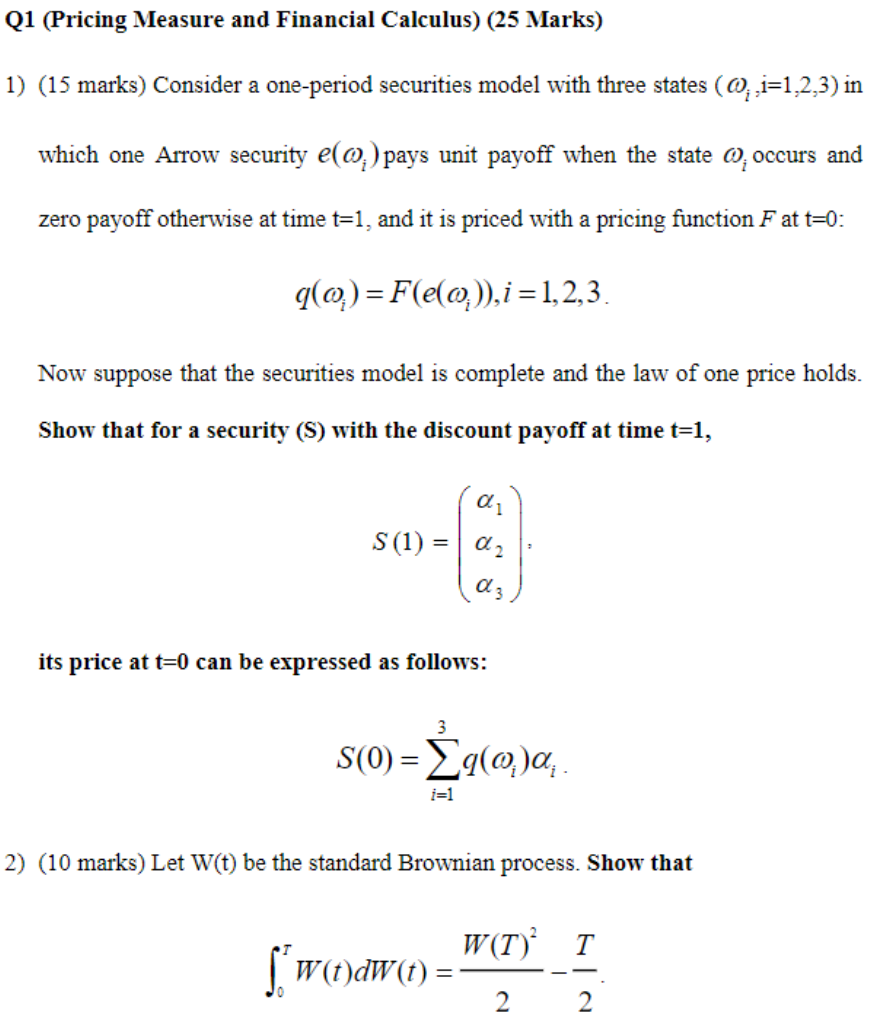

1) (15 marks) Consider a one-period securities model with three states (i,1=1,2,3) in which one Arrow security e(i) pays unit payoff when the state i occurs and zero payoff otherwise at time t=1, and it is priced with a pricing function F at t=0 : q(i)=F(e(i)),i=1,2,3. Now suppose that the securities model is complete and the law of one price holds. Show that for a security (S) with the discount payoff at time t=1, S(1)=123 its price at t=0 can be expressed as follows: S(0)=i=13q(i)i 2) (10 marks) Let W(t) be the standard Brownian process. Show that 0TW(t)dW(t)=2W(T)22T

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts