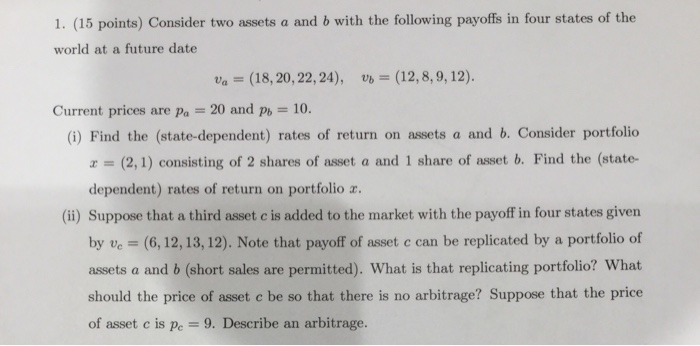

Question: 1. (15 points) Consider two assets a and b with the following payoffs in four states of the world at a future date a (18,

1. (15 points) Consider two assets a and b with the following payoffs in four states of the world at a future date a (18, 20, 22,24), (12,8,9,12). Current prices are Pa 20 and pb 10 (i) Find the (state-dependent) rates of return on assets a and b. Consider portfolio r (2,1) consisting of 2 shares of asset a and 1 share of asset b. Find the (state- dependent) rates of return on portfolio a. (ii) Suppose that a third asset c is added to the market with the payoff in four states given by v (6, 12, 13, 12). Note that payoff of asset c can be replicated by a portfolio of assets a and b (short sales are permitted). What is that replicating portfolio? What should the price of asset c be so that there is no arbitrage? Suppose that the price of asset c is pe-9. Describe an arbitrage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts