Question: 1. (15 points) David is considering buying two bonds in order to service a payment due in 5 years. Bond A is a 5 year

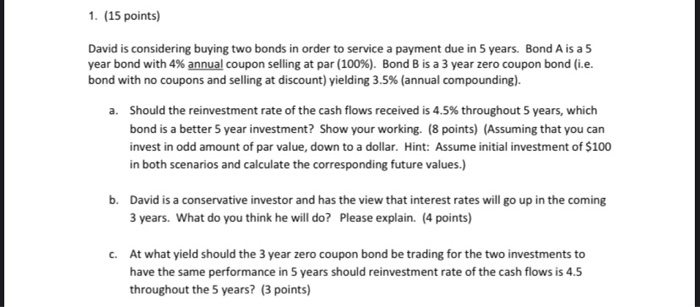

1. (15 points) David is considering buying two bonds in order to service a payment due in 5 years. Bond A is a 5 year bond with 4% annual coupon selling at par (100%). Bond B is a 3 year zero coupon bond (i.e. bond with no coupons and selling at discount) yielding 3.5% (annual compounding). a. Should the reinvestment rate of the cash flows received is 4.5% throughout 5 years, which bond is a better 5 year investment? Show your working. (8 points) (Assuming that you can invest in odd amount of par value, down to a dollar. Hint: Assume initial investment of $100 in both scenarios and calculate the corresponding future values.) b. David is a conservative investor and has the view that interest rates will go up in the coming 3 years. What do you think he will do? Please explain. (4 points) c. At what yield should the 3 year zero coupon bond be trading for the two investments to have the same performance in 5 years should reinvestment rate of the cash flows is 4.5 throughout the 5 years? (3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts