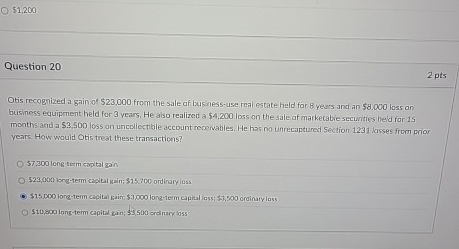

Question: $ 1 , 2 0 0 Question 2 0 2 pts Otis recognized a gain of $ 2 3 , 0 0 0 from the

$

Question

pts

Otis recognized a gain of $ from the sale of businessuse real estate held for years and an loss on business equipment held for years. He also realizen a loss on the sale of marketabie secunities held for is months and a $ loss on uncollecthble account roceivables. He has no unrecaptumect section thasses from prior years. How would Otis treat these transactions?

long term capital gain

$ingterm cheitat yinit $ ordinary lass

$ longterm cipital gain $ longterm capial iass; $ ordifary lass

$ longterm capital gain; $ ond nary boss

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock