Question: 1 2 : 0 1 5 G Chapter 1 0 Graded Assignment Problems... Switch To Light Mode Chapter 1 0 Group Assignment Problems E 1

:

G

Chapter Graded Assignment Problems...

Switch To Light Mode

Chapter Group Assignment Problems

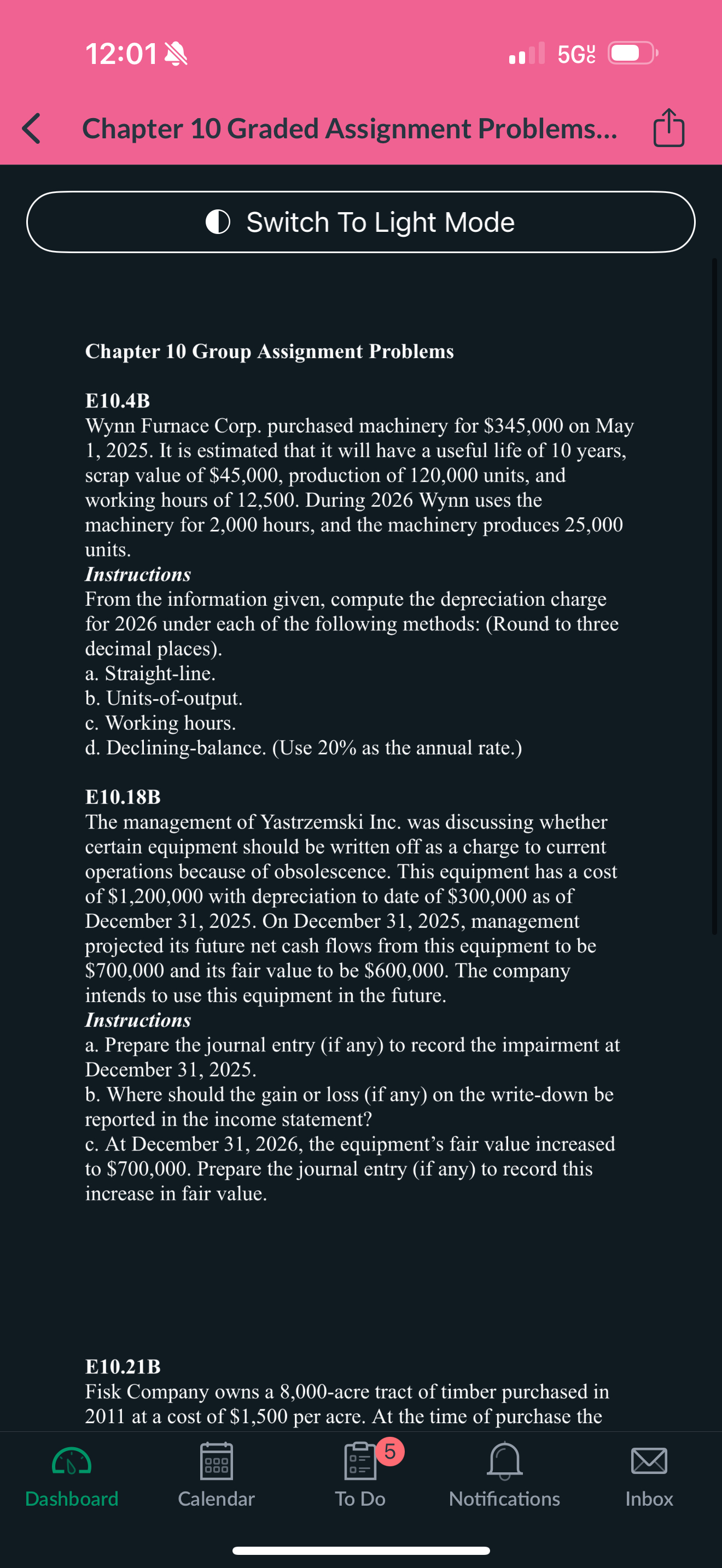

EB

Wynn Furnace Corp. purchased machinery for $ on May It is estimated that it will have a useful life of years, scrap value of $ production of units, and working hours of During Wynn uses the machinery for hours, and the machinery produces units.

Instructions

From the information given, compute the depreciation charge for under each of the following methods: Round to three decimal places

a Straightline.

b Unitsofoutput.

c Working hours.

d Decliningbalance. Use as the annual rate.

EB

The management of Yastrzemski Inc. was discussing whether certain equipment should be written off as a charge to current operations because of obsolescence. This equipment has a cost of $ with depreciation to date of $ as of December On December management projected its future net cash flows from this equipment to be $ and its fair value to be $ The company intends to use this equipment in the future.

Instructions

a Prepare the journal entry if any to record the impairment at December

b Where should the gain or loss if any on the writedown be reported in the income statement?

c At December the equipment's fair value increased to $ Prepare the journal entry if any to record this increase in fair value.

EB

Fisk Company owns a acre tract of timber purchased in at a cost of $ per acre. At the time of purchase the

Dashboard

Calendar

To Do

Notifications

Inbox:

Chapter Graded Assignment Problems...

Switch To Light Mode

reported in the income statement?

c At December the equipment's fair value increased to $ Prepare the journal entry if any to record this increase in fair value.

EB

Fisk Company owns a acre tract of timber purchased in at a cost of $ per acre. At the time of purchase the land was estimated to have a value of $ per acre without the timber. Fisk Company has not logged this tract since it was purchased. In Fisk had the timber cruised. The cruise appraiser estimated that each acre contained board feet of timber. In Fisk built miles of roads at a cost of $ per mile. After the roads were completed, Fisk logged and sold trees containing board feet.

Instructions

a Determine the cost of timber sold related to depletion for

b If Fisk depreciates the logging roads on the basis of timber cut, determine the depreciation expense for

c If Fisk plants five seedlings at a cost of $ per seedling for each tree cut, how should Fisk treat the reforestation?

EB

The Annual Report of Brinker International contains the following information: in millions

June

June

Total assets $

Total liabilities

$

Net sales

Net income

Instructions

Compute the following ratios for Brinker International for :

a Asset turnover ratio.

b Rate of return on assets.

c Profit margin on sales.

d How can the asset turnover ratio be used to compute the rate of return on assets?

Dashboard

Calendar

To Do

Notifications

Inbox

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock