Question: 1 2 : 0 2 . Il 5 G 8 3 : BCom FM Taxation for Indi... Done An older version of this document is

:

Il G

: BCom FM Taxation for Indi...

Done

An older version of this document is available.

Received from

Tetelo Yesterday

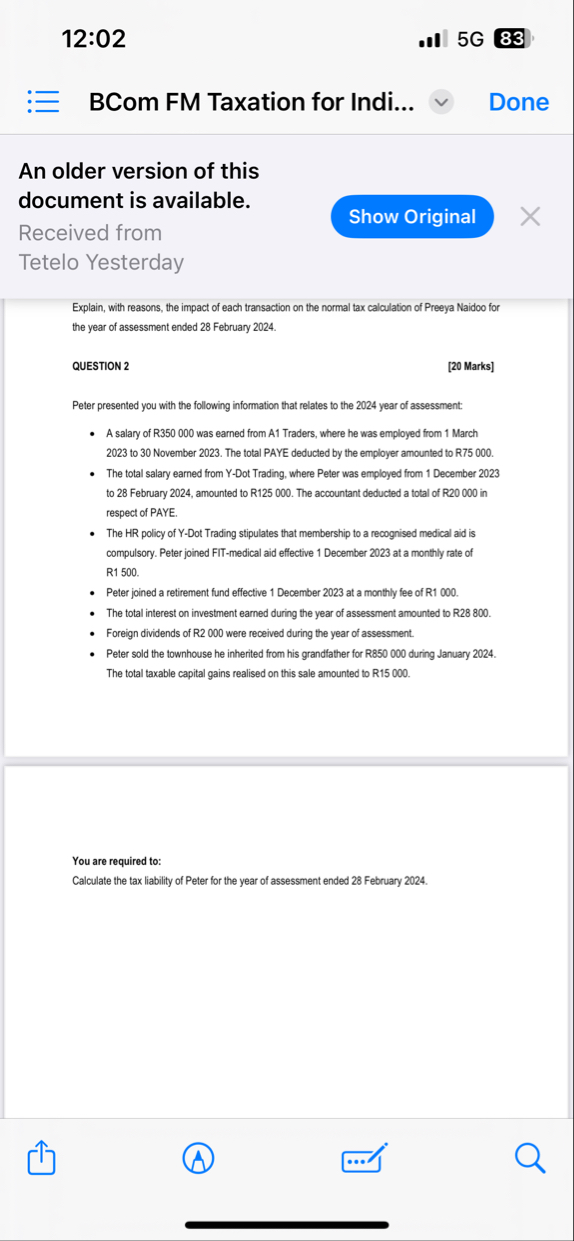

Explain, with reasons, the impact of each transaction on the normal tax calculation of Preeya Naidoo for the year of assessment ended February

QUESTION

Marks

Peter presented you with the following information that relates to the year of assessment:

A salary of R was earned from A Traders, where he was employed from March to November The total PAYE deducted by the employer amounted to R

The total salary earned from YDot Trading, where Peter was employed from December to February amounted to R The accountant deducted a total of R in respect of PAYE.

The HR policy of YDot Trading stipulates that membership to a recognised medical aid is compulsory. Peter joined FITmedical aid effective December at a monthly rate of R

Peter joined a retirement fund effective December at a monthly fee of R

The total interest on investment earned during the year of assessment amounted to R

Foreign dividends of R were received during the year of assessment.

Peter sold the townhouse he inherited from his grandlather for R during January The total taxable capital gains realised on this sale amounted to R

You are required to:

Calculate the tax liability of Peter for the year of assessment ended February

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock