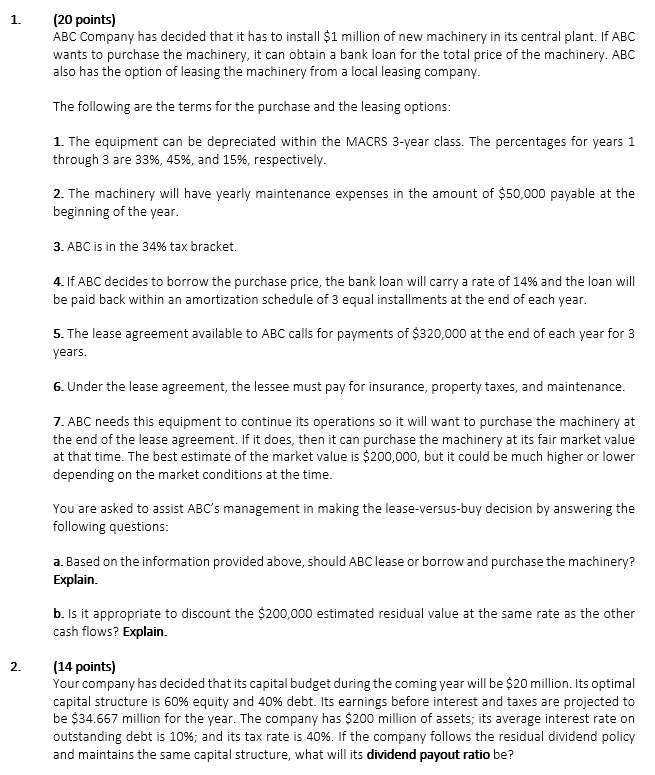

Question: 1 . ( 2 0 points ) ABC Company has decided that it has to install ( $ 1 ) million of

points

ABC Company has decided that it has to install $ million of new machinery in its central plant. If ABC wants to purchase the machinery, it can obtain a bank loan for the total price of the machinery. A B C also has the option of leasing the machinery from a local leasing company.

The following are the terms for the purchase and the leasing options:

The equipment can be depreciated within the MACRS year class. The percentages for years through are and respectively.

The machinery will have yearly maintenance expenses in the amount of $ payable at the beginning of the year.

A B C is in the tax bracket.

If ABC decides to borrow the purchase price, the bank loan will carry a rate of and the loan will be paid back within an amortization schedule of equal installments at the end of each year.

The lease agreement available to ABC calls for payments of $ at the end of each year for years.

Under the lease agreement, the lessee must pay for insurance, property taxes, and maintenance.

A B C needs this equipment to continue its operations so it will want to purchase the machinery at the end of the lease agreement. If it does, then it can purchase the machinery at its fair market value at that time. The best estimate of the market value is $ but it could be much higher or lower depending on the market conditions at the time.

You are asked to assist ABC's management in making the leaseversusbuy decision by answering the following questions:

a Based on the information provided above, should ABC lease or borrow and purchase the machinery? Explain.

b Is it appropriate to discount the $ estimated residual value at the same rate as the other cash flows? Explain.

points

Your company has decided that its capital budget during the coming year will be $ million. Its optimal capital structure is equity and debt. Its earnings before interest and taxes are projected to be $ million for the year. The company has $ million of assets; its average interest rate on outstanding debt is ; and its tax rate is If the company follows the residual dividend policy and maintains the same capital structure, what will its dividend payout ratio be

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock