Question: . ( 1 2 % ) 1 . ( 7 % ) On May 3 , 2 0 2 6 , Eisler Company

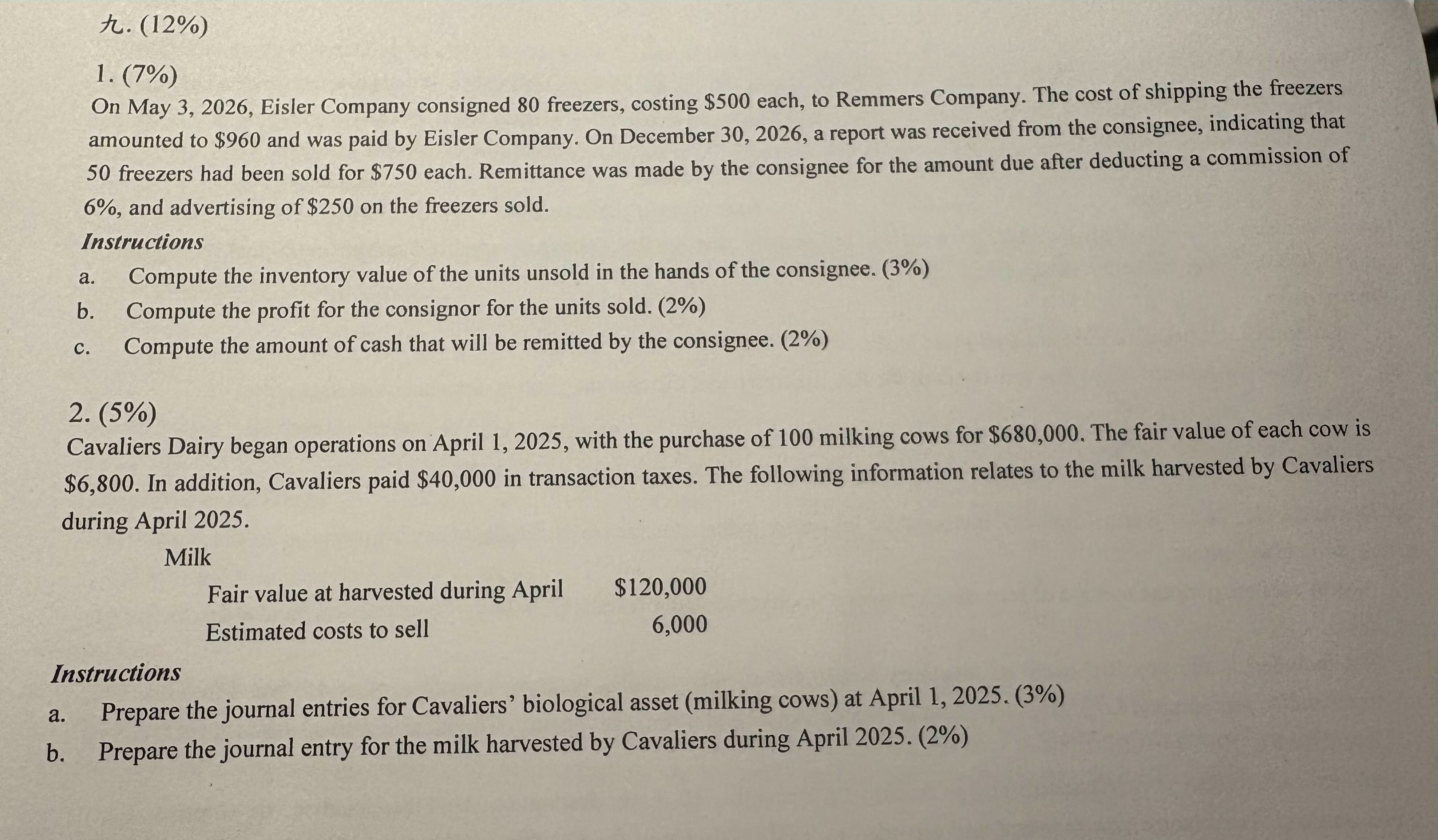

On May Eisler Company consigned freezers, costing $ each, to Remmers Company. The cost of shipping the freezers amounted to $ and was paid by Eisler Company. On December a report was received from the consignee, indicating that freezers had been sold for $ each. Remittance was made by the consignee for the amount due after deducting a commission of and advertising of $ on the freezers sold. Instructions a Compute the inventory value of the units unsold in the hands of the consignee. b Compute the profit for the consignor for the units sold. c Compute the amount of cash that will be remitted by the consignee. Cavaliers Dairy began operations on April with the purchase of milking cows for $ The fair value of each cow is $ In addition, Cavaliers paid $ in transaction taxes. The following information relates to the milk harvested by Cavaliers during April Milk Instructions a Prepare the journal entries for Cavaliers' biological asset milking cows at April b Prepare the journal entry for the milk harvested by Cavaliers during April

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock