Question: 1 2 - 1 . In 2 0 1 2 AT&T ( T ) borrowed $ 3 billion by issuing bonds in the public bond

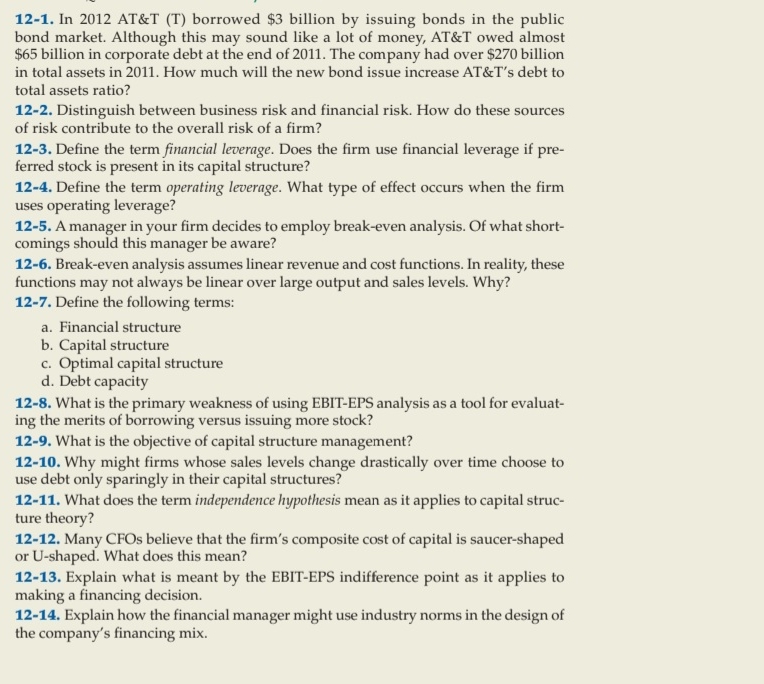

In AT&T T borrowed $ billion by issuing bonds in the public bond market. Although this may sound like a lot of money, AT&T owed almost $ billion in corporate debt at the end of The company had over $ billion in total assets in How much will the new bond issue increase AT&Ts debt to total assets ratio?

Distinguish between business risk and financial risk. How do these sources of risk contribute to the overall risk of a firm?

Define the term financial leverage. Does the firm use financial leverage if preferred stock is present in its capital structure?

Define the term operating leverage. What type of effect occurs when the firm uses operating leverage?

A manager in your firm decides to employ breakeven analysis. Of what shortcomings should this manager be aware?

Breakeven analysis assumes linear revenue and cost functions. In reality, these functions may not always be linear over large output and sales levels. Why?

Define the following terms:

a Financial structure

b Capital structure

c Optimal capital structure

d Debt capacity

What is the primary weakness of using EBITEPS analysis as a tool for evaluating the merits of borrowing versus issuing more stock?

What is the objective of capital structure management?

Why might firms whose sales levels change drastically over time choose to use debt only sparingly in their capital structures?

What does the term independence hypothesis mean as it applies to capital structure theory?

Many CFOs believe that the firm's composite cost of capital is saucershaped or Ushaped. What does this mean?

Explain what is meant by the EBITEPS indifference point as it applies to making a financing decision.

Explain how the financial manager might use industry norms in the design of the company's financing mix.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock