Question: 1 2 1 point Under Circular 2 3 0 , for tax returns: A practitioner must return all client records at the request of the

point

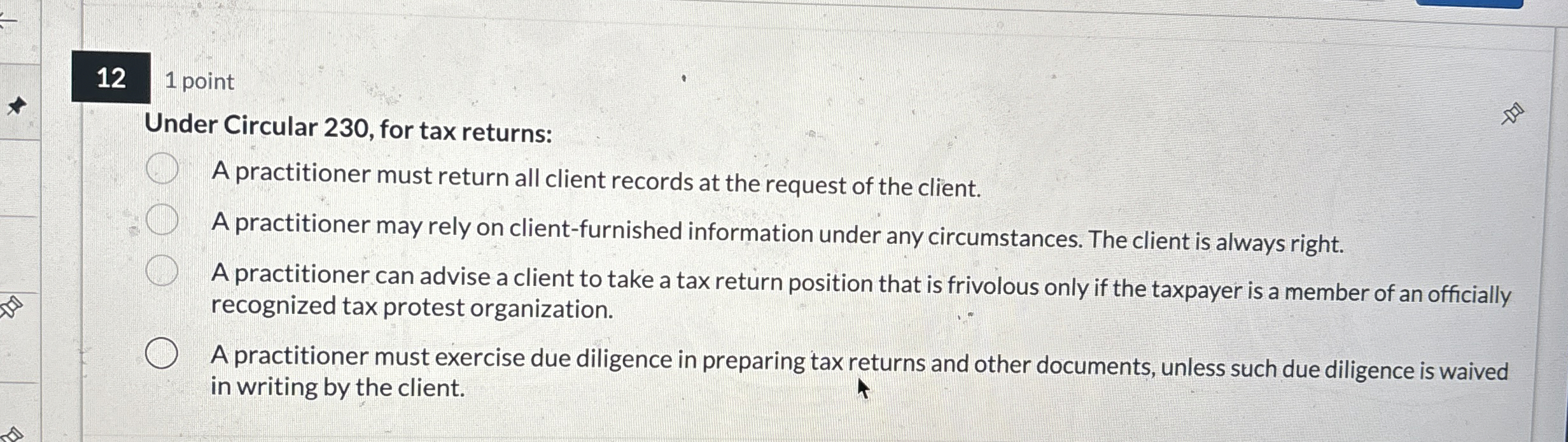

Under Circular for tax returns:

A practitioner must return all client records at the request of the client.

A practitioner may rely on clientfurnished information under any circumstances. The client is always right.

A practitioner can advise a client to take a tax return position that is frivolous only if the taxpayer is a member of an officially recognized tax protest organization.

A practitioner must exercise due diligence in preparing tax returns and other documents, unless such due diligence is waived in writing by the client.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock