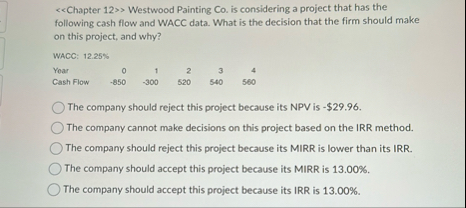

Question: 1 2 . 2 5 % - $ 2 9 . 9 6 1 3 . 0 0 % 1 3 . 0 0 %

$ Westwood Painting considering a project that has the following cash flow and WACC data. What the decision that the firm should make this project, and why?

WACC:

The company should reject this project because its $

The company cannot make decisions this project based the IRR method.

The company should reject this project because its MIRR lower than its IRR.

The company should accept this project because its MIRR

The company should accept this project because its IRR

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock