Question: 1. 2. 3. 1 and 3 are the same question. C Video Planet (VP) sells a big screen TV package consisting of a 60-inch plasma

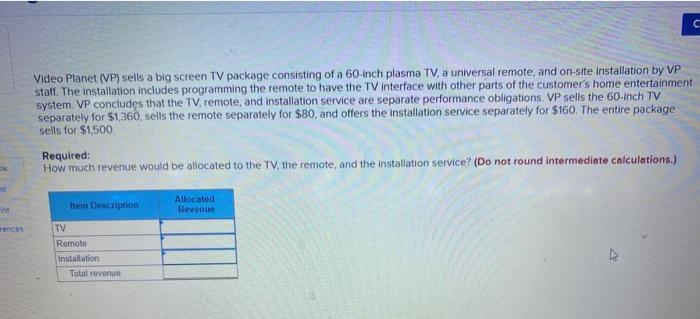

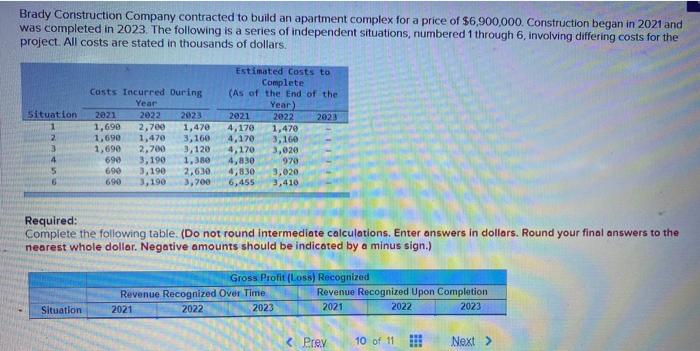

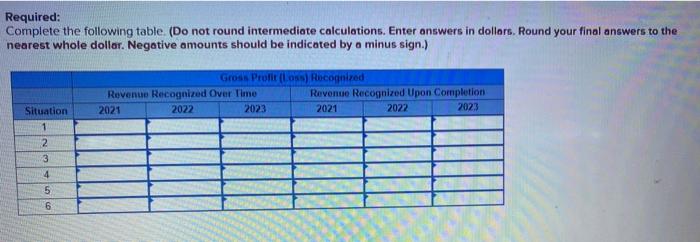

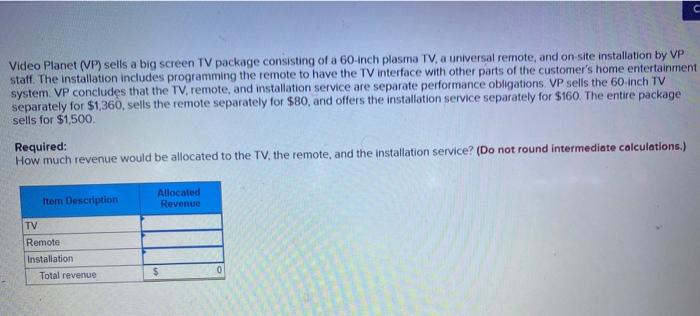

C Video Planet (VP) sells a big screen TV package consisting of a 60-inch plasma TV, a universal remote, and on-site installation by VP staff. The installation includes programming the remote to have the TV interface with other parts of the customer's home entertainment system. VP concludes that the TV remote, and installation service are separate performance obligations VP sells the 60-Inch TV separately for $1,360, sells the remote separately for $80, and offers the Installation service separately for $160. The entire package sells for $1,500 Required: How much revenue would be allocated to the TV, the remote, and the Installation service? (Do not round Intermediate calculations.) Item Description Allocated Revenue rences TV Remote Installation Total revenue Brady Construction Company contracted to build an apartment complex for a price of $6,900,000. Construction began in 2021 and was completed in 2023. The following is a series of independent situations, numbered 1 through 6, involving differing costs for the project. All costs are stated in thousands of dollars. Situation Estimated costs to Complete (As of the End of the Year) 2021 2022 2023 4,170 1,470 4,170 3,160 4,170 3,020 4,830 970 4,830 3,020 6,455 3,410 costs Incurred During Year 2021 2022 2023 1,690 2,700 1,470 1,690 1,470 3,160 1,690 2,700 3,120 690 3,190 1,380 690 3,190 2,630 690 3,190 3,700 2 3 4 Required: Complete the following table. (Do not round intermediate calculations. Enter answers in dollars. Round your final answers to the nearest whole dollar. Negative amounts should be indicated by a minus sign.) Gross Profit (Loss) Recognized Revenue Recognized Over Time Revenue Recognized Upon Completion 2021 2022 2023 2021 2022 2023 Situation C Video Planet (VP) sells a big screen TV package consisting of a 60-inch plasma TV, a universal remote, and on-site installation by VP staff. The installation includes programming the remote to have the TV interface with other parts of the customer's home entertainment system. VP concludes that the TV remote, and installation service are separate performance obligations VP sells the 60-inch TV separately for $1,360, sells the remote separately for $80, and offers the installation service separately for $160. The entire package sells for $1,500 Required: How much revenue would be allocated to the TV, the remote, and the installation service? (Do not round intermediate calculations.) Item Description Allocated Revenue TV Remote Installation Total revenue $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts