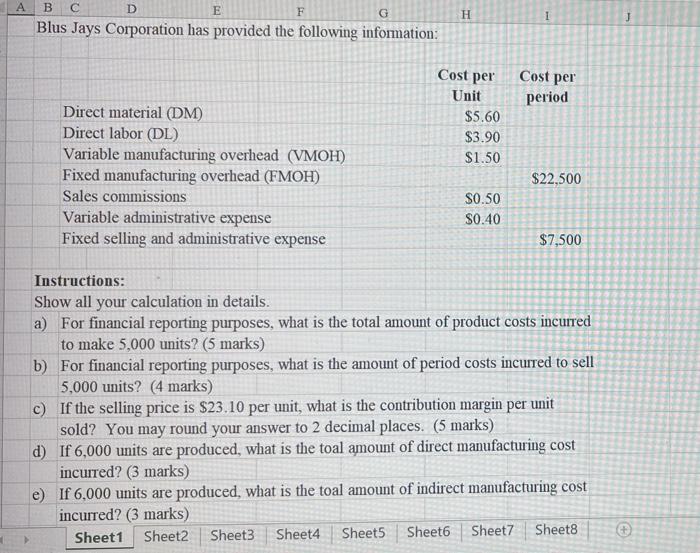

Question: 1 2 3 3 A B D E F H 1 Blus Jays Corporation has provided the following information: Cost per Cost per period Unit

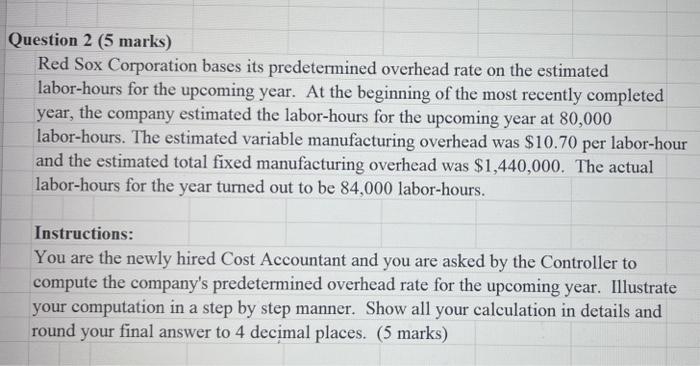

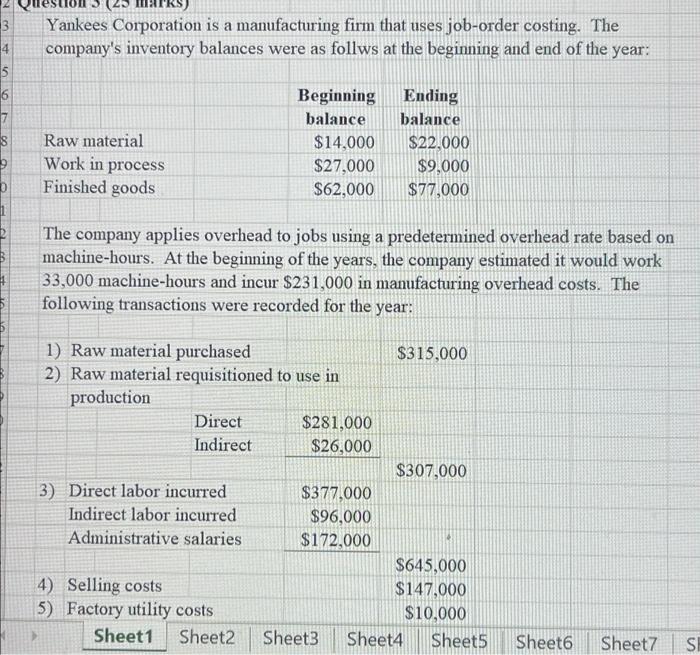

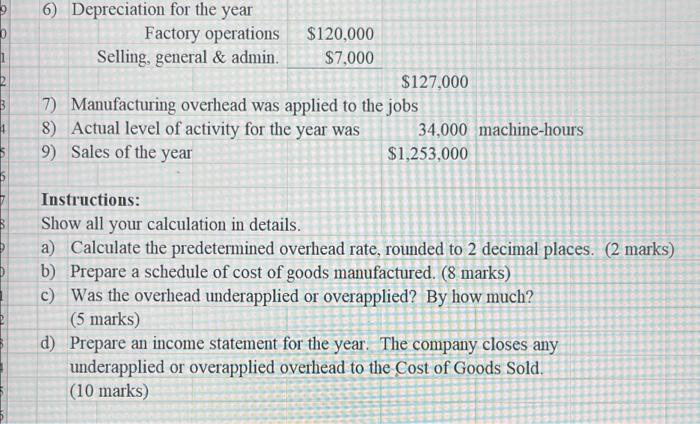

A B D E F H 1 Blus Jays Corporation has provided the following information: Cost per Cost per period Unit $5.60 $3.90 $1.50 Direct material (DM) Direct labor (DL) Variable manufacturing overhead (VMOH) Fixed manufacturing overhead (FMOH) Sales commissions Variable administrative expense Fixed selling and administrative expense $22,500 S0.50 $0.40 $7,500 Instructions: Show all your calculation in details. a) For financial reporting purposes, what is the total amount of product costs incurred to make 5,000 units? (5 marks) b) For financial reporting purposes, what is the amount of period costs incurred to sell 5,000 units? (4 marks) c) If the selling price is $23.10 per unit, what is the contribution margin per unit sold? You may round your answer to 2 decimal places. (5 marks) d) If 6,000 units are produced, what is the toal amount of direct manufacturing cost incurred? (3 marks) e) If 6.000 units are produced, what is the toal amount of indirect manufacturing cost incurred? (3 marks) Sheet1 Sheet2 Sheet3 Sheet4 Sheets Sheet6 Sheet7 Sheets Question 2 (5 marks) Red Sox Corporation bases its predetermined overhead rate on the estimated labor-hours for the upcoming year. At the beginning of the most recently completed year, the company estimated the labor-hours for the upcoming year at 80,000 labor-hours. The estimated variable manufacturing overhead was $10.70 per labor-hour and the estimated total fixed manufacturing overhead was $1,440,000. The actual labor-hours for the year turned out to be 84,000 labor-hours. Instructions: You are the newly hired Cost Accountant and you are asked by the Controller to compute the company's predetermined overhead rate for the upcoming year. Illustrate your computation in a step by step manner. Show all your calculation in details and round your final answer to 4 decimal places. (5 marks) TES) a 3 4 5 6 Yankees Corporation is a manufacturing firm that uses job-order costing. The company's inventory balances were as follws at the beginning and end of the year: 8 Raw material Work in process Finished goods Beginning balance $14,000 $27,000 $62,000 Ending balance $22.000 $9.000 $77,000 0 1 The company applies overhead to jobs using a predetermined overhead rate based on machine-hours. At the beginning of the years, the company estimated it would work 33,000 machine-hours and incur $231,000 in manufacturing overhead costs. The following transactions were recorded for the year: 1) Raw material purchased $315,000 2) Raw material requisitioned to use in production Direct $281,000 Indirect $26.000 $307,000 3) Direct labor incurred $377,000 Indirect labor incurred $96,000 Administrative salaries $172,000 $645.000 4) Selling costs $147,000 5) Factory utility costs $10,000 Sheet1 Sheet2 Sheets Sheet4 Sheets Sheet6 Sheet 7 SI 1 6) Depreciation for the year Factory operations $120,000 Selling, general & admin. $7,000 $127,000 7) Manufacturing overhead was applied to the jobs 8) Actual level of activity for the year was 34,000 machine-hours 9) Sales of the year $1,253,000 Instructions: Show all your calculation in details. a) Calculate the predetermined overhead rate, rounded to 2 decimal places. (2 marks) b) Prepare a schedule of cost of goods manufactured. (8 marks) c) Was the overhead underapplied or overapplied? By how much? (5 marks) d) Prepare an income statement for the year. The company closes any underapplied or overapplied overhead to the Cost of Goods Sold. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts