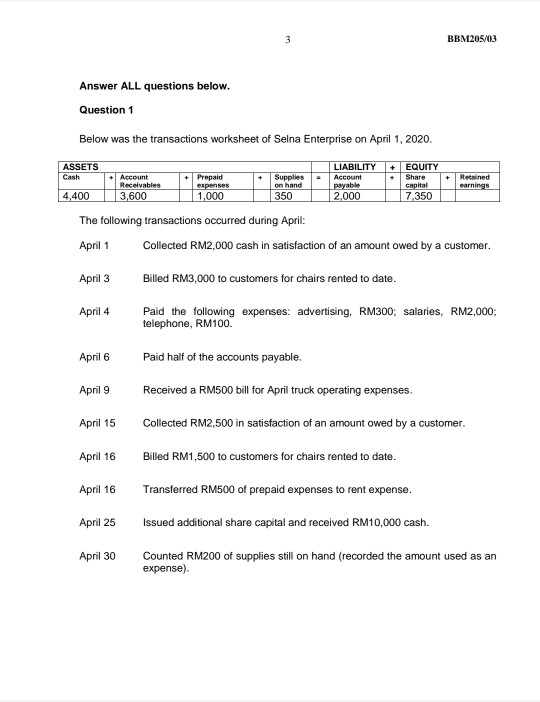

Question: 1) 2) 3) 4) 5) 3 BBM205/03 Answer ALL questions below. Question 1 Below was the transactions worksheet of Selna Enterprise on April 1, 2020.

1)

2)

3)

4)

5)

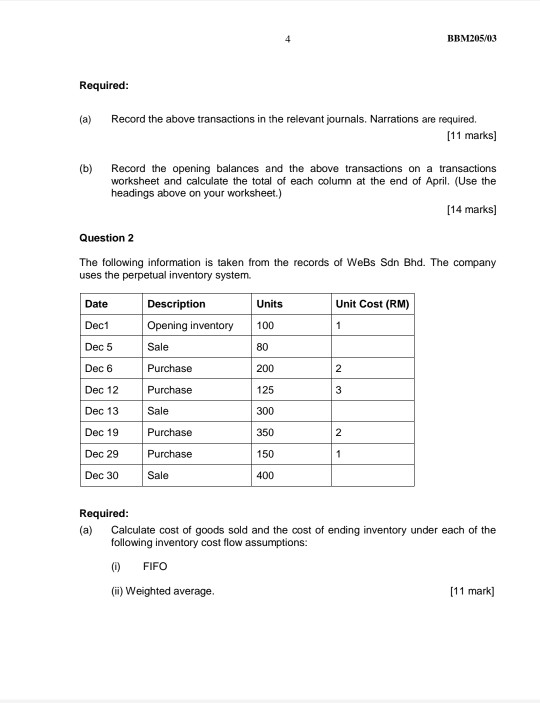

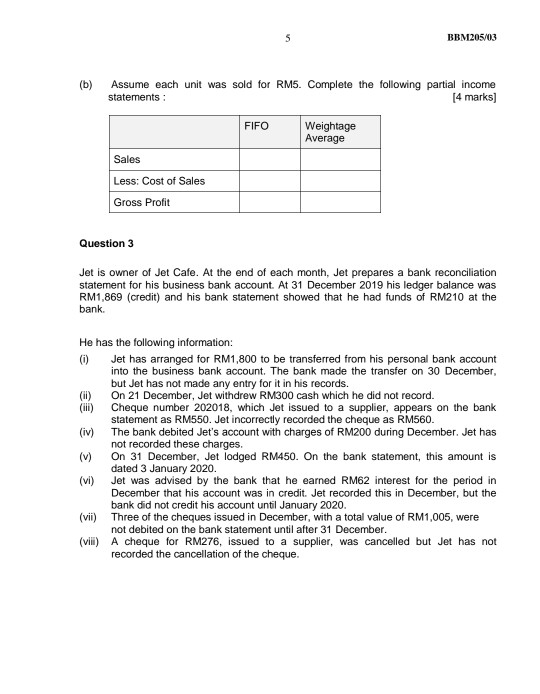

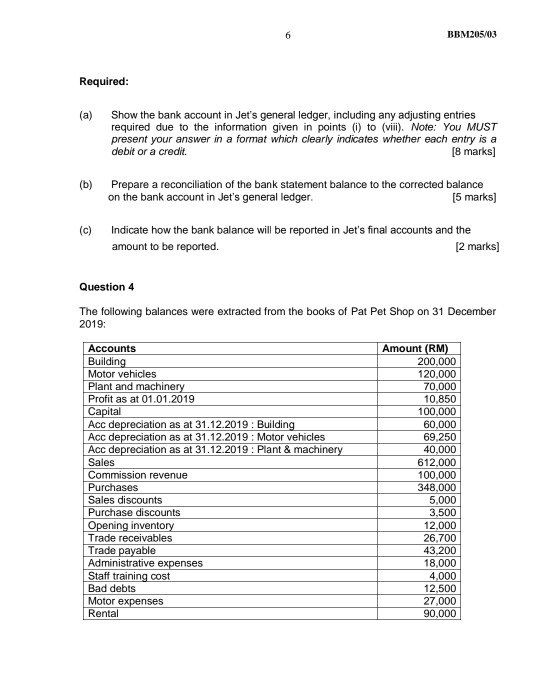

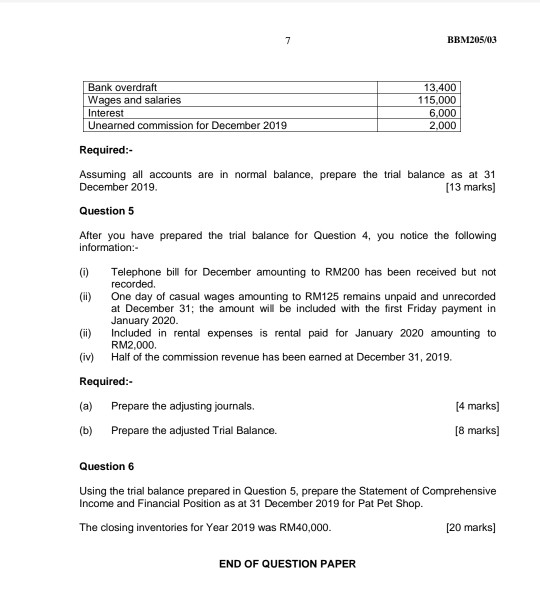

3 BBM205/03 Answer ALL questions below. Question 1 Below was the transactions worksheet of Selna Enterprise on April 1, 2020. + ASSETS Cash + + Account Receivables 3,600 Prepaid expenses 1,000 Supplies on hand 350 EQUITY Share capital 7,350 Retained earnings LIABILITY Account payable 4,400 2,000 The following transactions occurred during April: April 1 Collected RM2,000 cash in satisfaction of an amount owed by a customer. April 3 Billed RM3,000 to customers for chairs rented to date. April 4 Paid the following expenses: advertising, RM300; salaries, RM2,000; telephone, RM100 April 6 Paid half of the accounts payable, April 9 Received a RM500 bill for April truck operating expenses. April 15 Collected RM2,500 in satisfaction of an amount owed by a customer. April 16 Billed RM1,500 to customers for chairs rented to date. April 16 Transferred RM500 of prepaid expenses to rent expense. April 25 Issued additional share capital and received RM10,000 cash. April 30 Counted RM200 of supplies still on hand (recorded the amount used as an expense) 4 BBM205/03 Required: (a) Record the above transactions in the relevant journals. Narrations are required. [11 marks) (b) Record the opening balances and the above transactions on a transactions worksheet and calculate the total of each column at the end of April. (Use the headings above on your worksheet.) [14 marks] Question 2 The following information is taken from the records of Webs Sdn Bhd. The company uses the perpetual inventory system. Units Unit Cost (RM) Description Opening inventory Sale 100 1 80 Date Dect Dec 5 Dec 6 Dec 12 Dec 13 Dec 19 Purchase 200 2 Purchase 125 3 Sale 300 Purchase 350 2 Dec 29 Purchase 150 1 Dec 30 Sale 400 Required: (a) Calculate cost of goods sold and the cost of ending inventory under each of the following inventory cost flow assumptions: (0) FIFO (m) Weighted average [11 mark] 5 BBM205/03 (b) Assume each unit was sold for RM5. Complete the following partial income statements : [4 marks) FIFO Weightage Average Sales Less: Cost of Sales Gross Profit Question 3 Jet is owner of Jet Cafe. At the end of each month, Jet prepares a bank reconciliation statement for his business bank account. At 31 December 2019 his ledger balance was RM1,869 (credit) and his bank statement showed that he had funds of RM210 at the bank He has the following information: (0) Jet has arranged for RM1,800 to be transferred from his personal bank account into the business bank account. The bank made the transfer on 30 December, but Jet has not made any entry for it in his records. (ii) On 21 December, Jet withdrew RM300 cash which he did not record. (ili) Cheque number 202018, which Jet issued to a supplier, appears on the bank statement as RM550. Jet incorrectly recorded the cheque as RM560. (iv) The bank debited Jet's account with charges of RM200 during December. Jet has not recorded these charges. () On 31 December, Jet lodged RM450. On the bank statement, this amount is dated 3 January 2020. (vi) Jet was advised by the bank that he earned RM62 interest for the period in December that his account was in credit. Jet recorded this in December, but the bank did not credit his account until January 2020. (vii) Three of the cheques issued in December, with a total value of RM1,005, were not debited on the bank statement until after 31 December. (vii) A cheque for RM276, issued to a supplier, was cancelled but Jet has not recorded the cancellation of the cheque. 6 BBM205/03 Required: Show the bank account in Jet's general ledger, including any adjusting entries required due to the information given in points (i) to (vii). Note: You MUST present your answer in a format which clearly indicates whether each entry is a debit or a credit [8 marks) (b) Prepare a reconciliation of the bank statement balance to the corrected balance on the bank account in Jet's general ledger. (5 marks] (c) Indicate how the bank balance will be reported in Jet's final accounts and the amount to be reported [2 marks] Question 4 The following balances were extracted from the books of Pat Pet Shop on 31 December 2019: Accounts Amount (RM) Building 200,000 Motor vehicles 120,000 Plant and machinery 70,000 Profit as at 01.01.2019 10,850 Capital 100,000 Acc depreciation as at 31.12.2019: Building 60,000 Acc depreciation as at 31.12.2019: Motor vehicles 69,250 Acc depreciation as at 31.12.2019: Plant & machinery 40,000 Sales 612,000 Commission revenue 100,000 Purchases 348,000 Sales discounts 5,000 Purchase discounts 3,500 Opening inventory 12,000 Trade receivables 26,700 Trade payable 43,200 Administrative expenses 18,000 Staff training cost 4,000 Bad debts 12,500 Motor expenses 27,000 Rental 90,000 7 BBM205/03 Bank overdraft 13,400 Wages and salaries 115,000 Interest 6,000 Unearned commission for December 2019 2.000 Required:- Assuming all accounts are in normal balance, prepare the trial balance as at 31 December 2019 [13 marks] Question 5 After you have prepared the trial balance for Question 4, you notice the following information:- (0) Telephone bill for December amounting to RM200 has been received but not recorded. One day of casual wages amounting to RM125 remains unpaid and unrecorded at December 31; the amount will be included with the first Friday payment in January 2020. Included in rental expenses is rental paid for January 2020 amounting to RM2,000. (iv) Half of the commission revenue has been earned at December 31, 2019. Required: (a) Prepare the adjusting journals. (4 marks) (b) Prepare the adjusted Trial Balance. [8 marks) Question 6 Using the trial balance prepared in Question 5, prepare the Statement of Comprehensive Income and Financial Position as at 31 December 2019 for Pat Pet Shop. The closing inventories for Year 2019 was RM40,000. [20 marks] END OF QUESTION PAPER

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts