Question: 1) 2) 3) 4) 5) 6) 7) 8) 9) 10) Blue Fin started the current year with assets of $840,000, liabilities of $420,000 and common

1)

2) 3)

3) 4)

4)

5)

5)  6)

6) 7)

7)  8)

8)  9)

9)  10)

10)

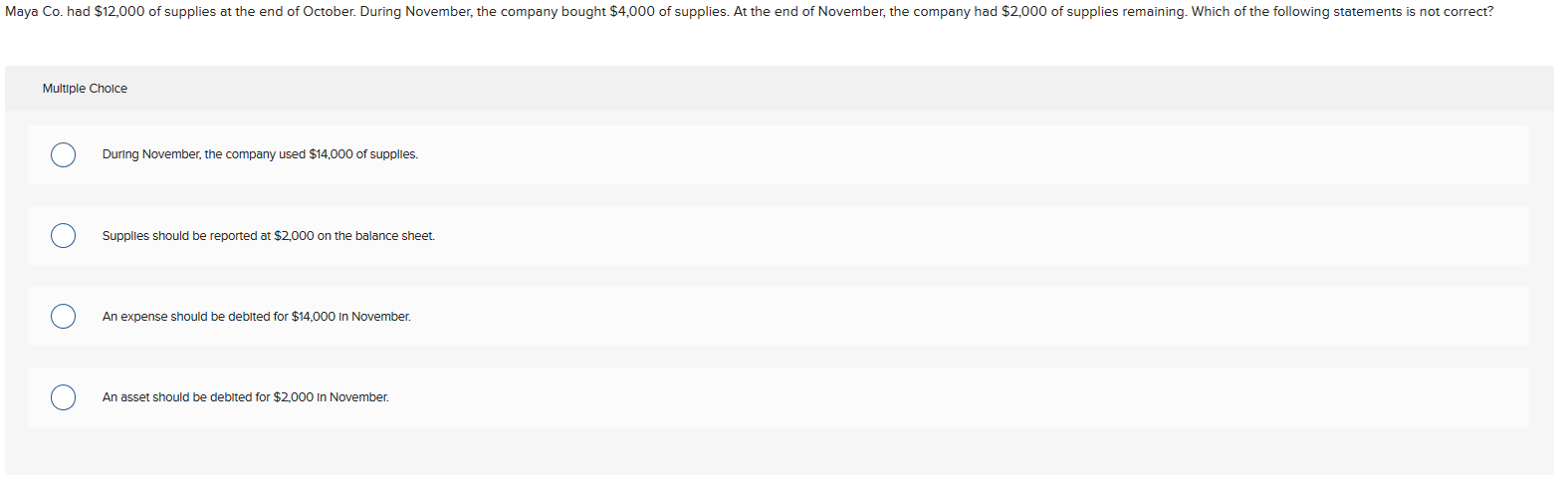

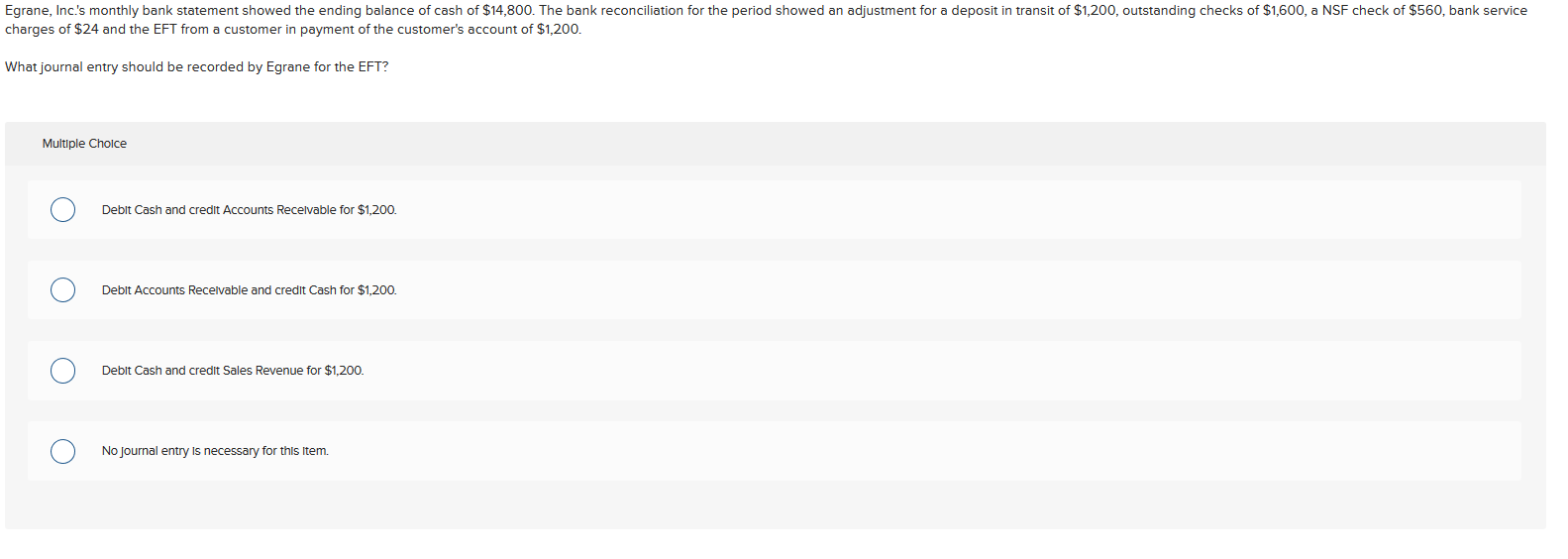

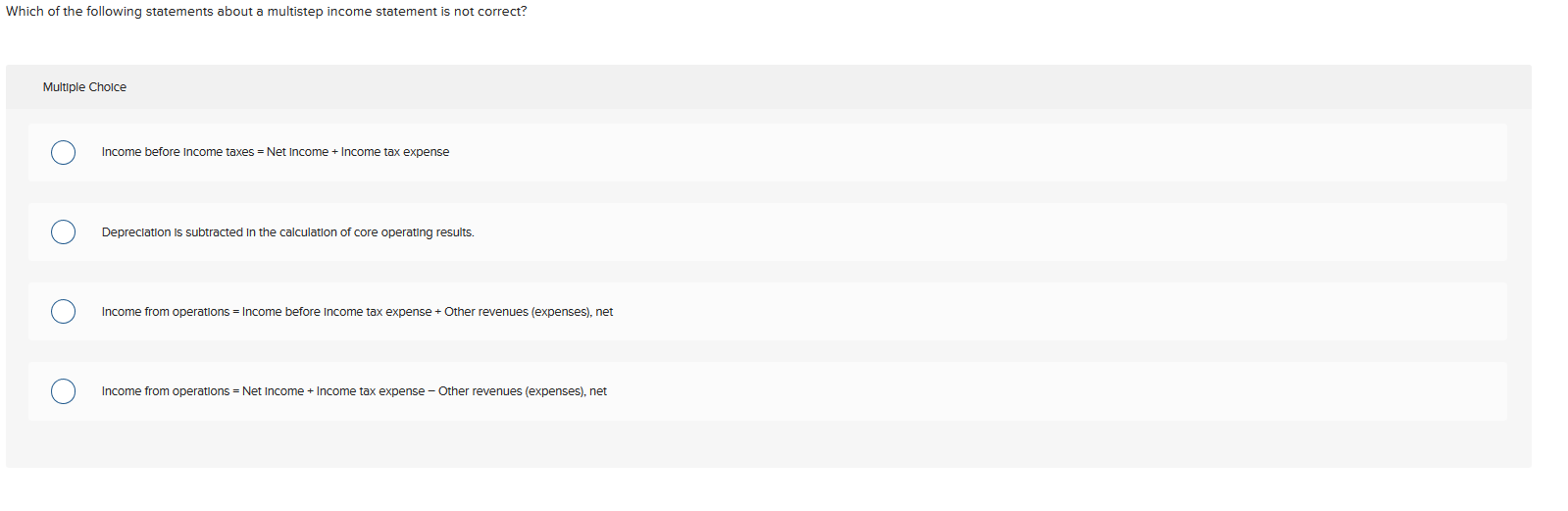

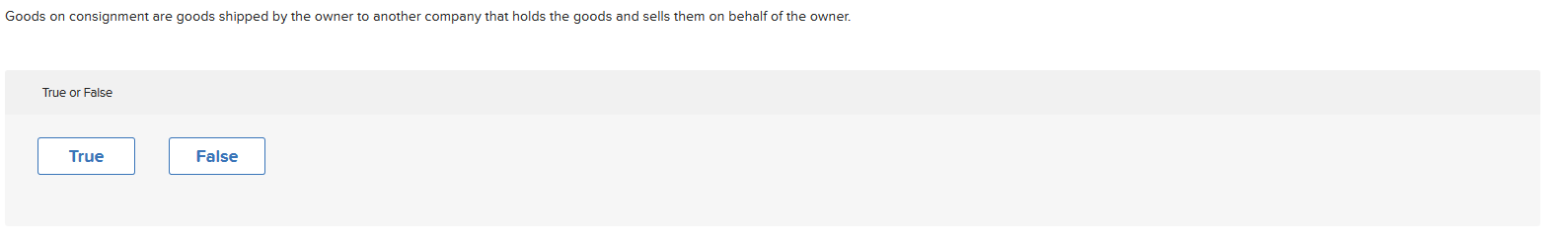

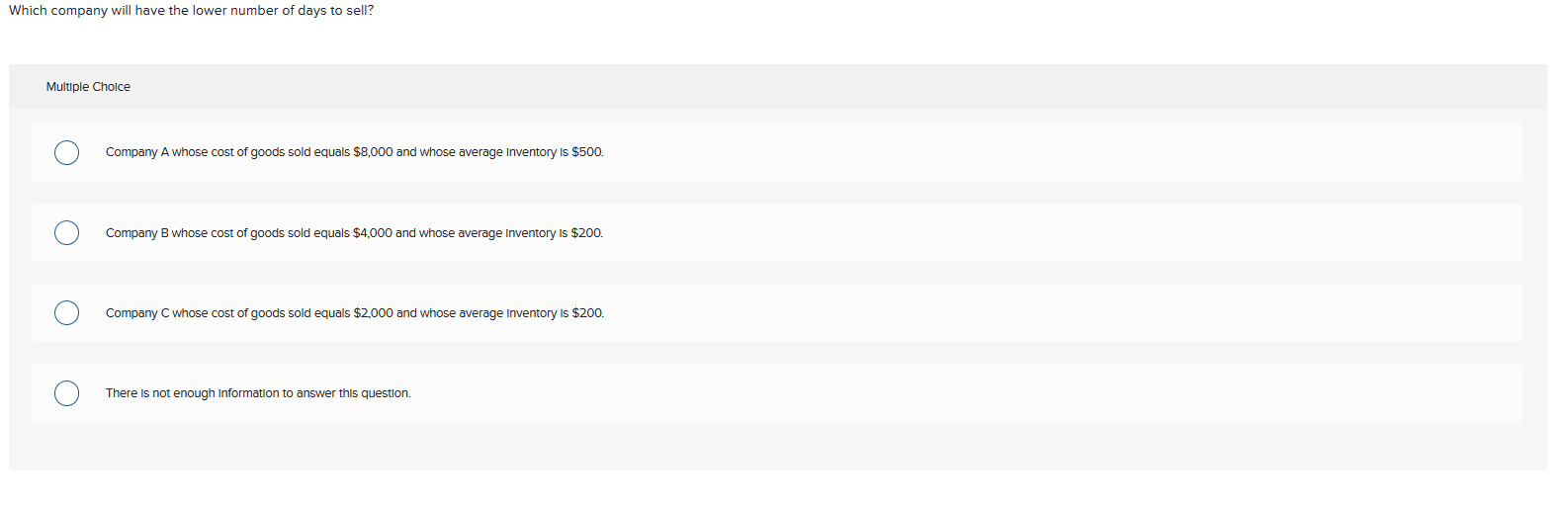

Blue Fin started the current year with assets of $840,000, liabilities of $420,000 and common stock of $240,000. During the current year, assets increased by $480,000, liabilities decreased by $60,000 and common stock increased by $330,000. There was no payment of dividends to owners during the year. What was the amount of Blue Fin's net income for the year? Multiple Choice $270,000 $330,000 O O $210,000 O $540,000 Which of the following statements about normal account balances is correct? Multiple Choice Assets have debit balances and liabilities have credit balances. Assets and liabilities have credit balances. O O Assets have credit balances and liabilities have debit balances. O Assets and liabilities have debit balances. Which of the following accounts does not have a normal credit balance? Multiple Choice O Deferred Revenue O Prepaid Rent O Accounts Payable O Service Revenue Maya Co. had $12,000 of supplies at the end of October. During November, the company bought $4,000 of supplies. At the end of November, the company had $2,000 of supplies remaining. Which of the following statements is not correct? Multiple Choice During November, the company used $14,000 of supplies. Supplies should be reported at $2,000 on the balance sheet. a An expense should be debited for $14,000 in November. o An asset should be debited for $2,000 in November. Egrane, Inc.'s monthly bank statement showed the ending balance of cash of $14,800. The bank reconciliation for the period showed an adjustment for a deposit in transit of $1,200, outstanding checks of $1,600, a NSF check of $560, bank service charges of $24 and the EFT from a customer in payment of the customer's account of $1,200. What journal entry should be recorded by Egrane for the EFT? Multiple Choice Debit Cash and credit Accounts Recelvable for $1,200. Debit Accounts Recelvable and credit Cash for $1,200. Debit Cash and credit Sales Revenue for $1,200 O O No Journal entry is necessary for this Item. Which of the following statements about a multistep income statement is not correct? Multiple Choice Income before Income taxes = Net Income + Income tax expense Depreciation is subtracted in the calculation of core operating results. a Income from operations = Income before Income tax expense + Other revenues (expenses), net U Income from operations = Net Income + Income tax expense - Other revenues (expenses), net When the periodic inventory system is in use, the choice of an inventory costing method usually has no impact on gross profit or cost of goods sold. True or False True False Goods on consignment are goods shipped by the owner to another company that holds the goods and sells them on behalf of the owner. True or False True False When a company sells goods, it removes their cost from the balance sheet and reports the cost on the income statement as: Multiple Choice Selling Expenses. Cost of Goods Sold. O Finished Goods Inventory Inventory Which company will have the lower number of days to sell? Multiple Choice Company A whose cost of goods sold equals $8,000 and whose average Inventory is $500. Company B whose cost of goods sold equals $4,000 and whose average Inventory is $200. Company C whose cost of goods sold equals $2,000 and whose average Inventory is $200. There is not enough Information to answer this question. O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts