Question: 1 2 3 4 5 6 7 8 9 10 (Market value analysis) The balance sheet for Larry Underwood Motors shows a book value of

1

2

3

4

5

6

7

8

9

10

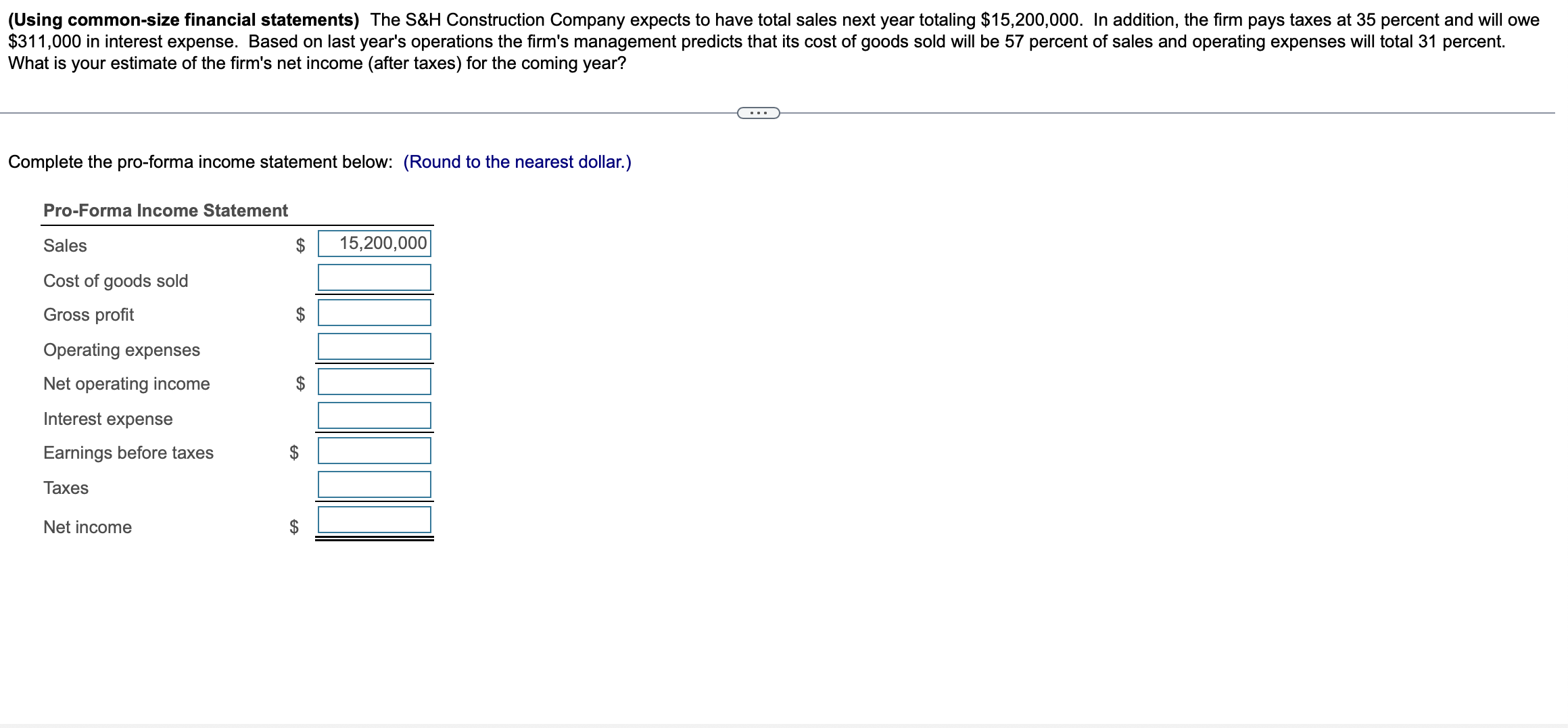

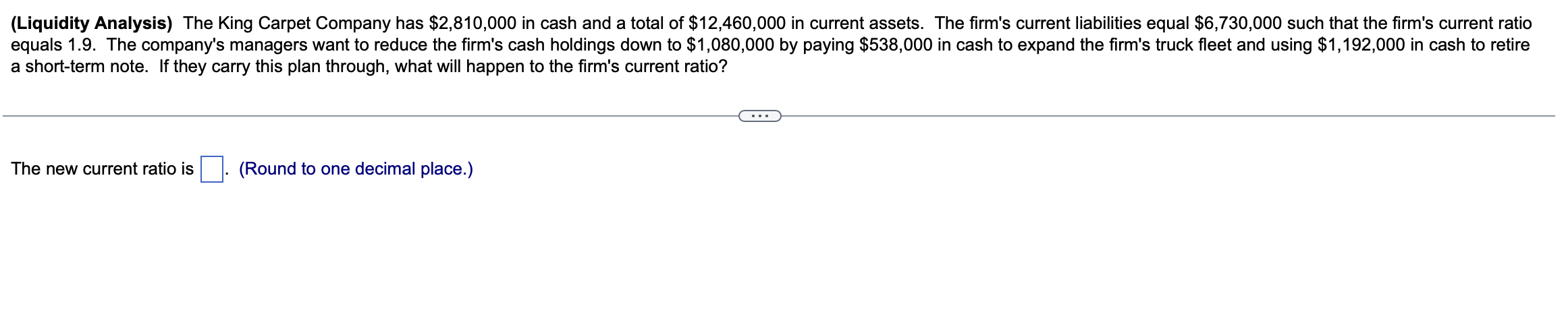

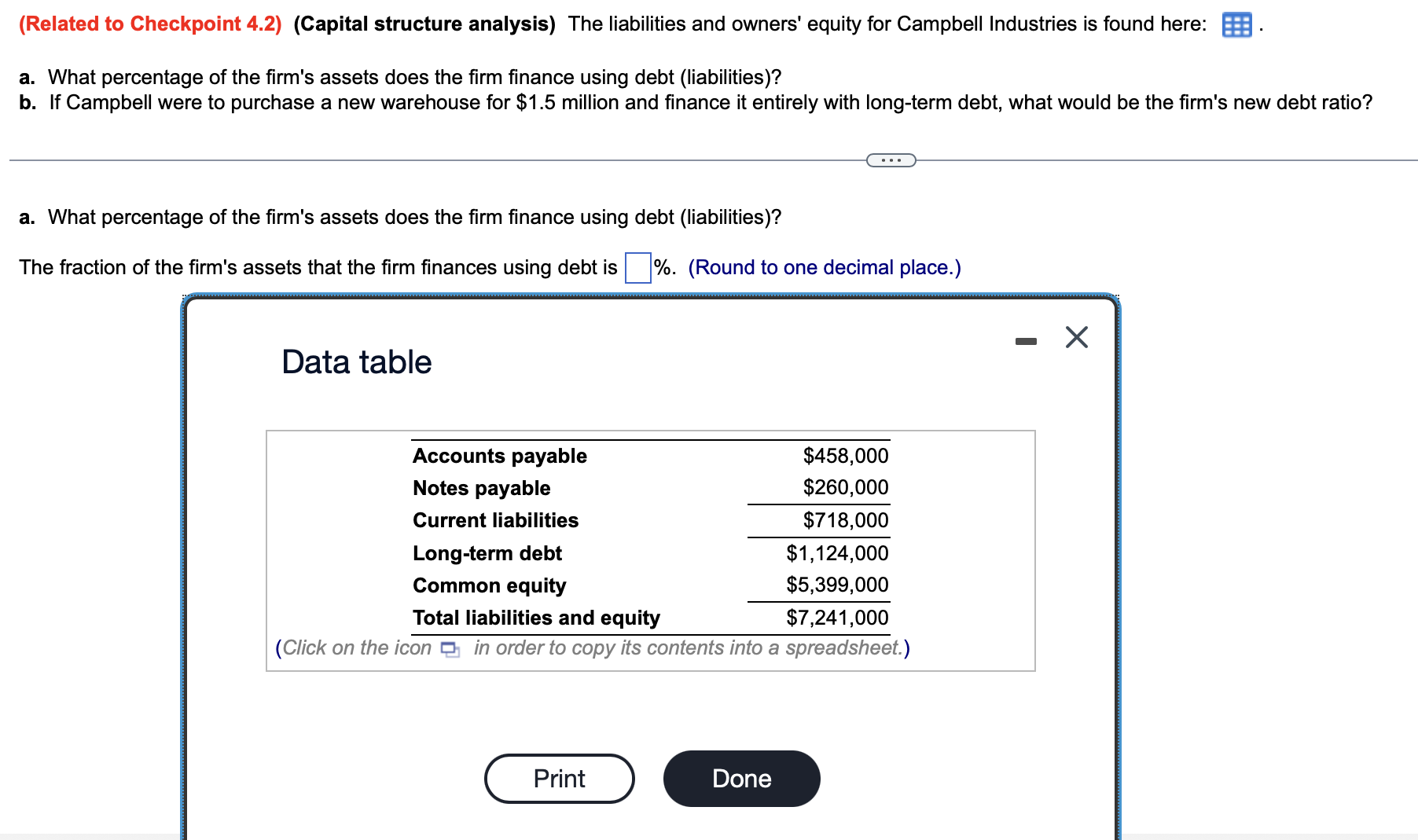

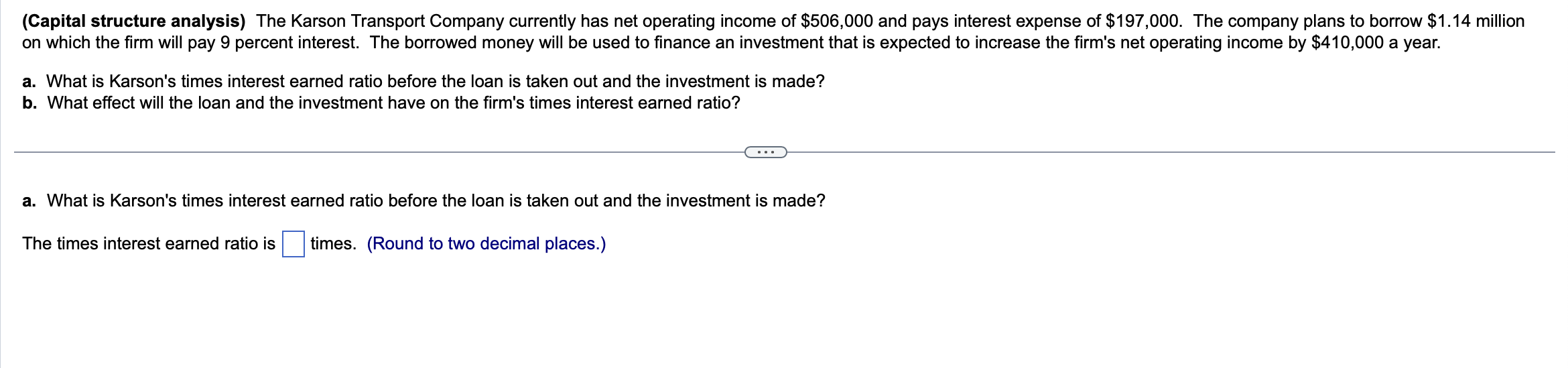

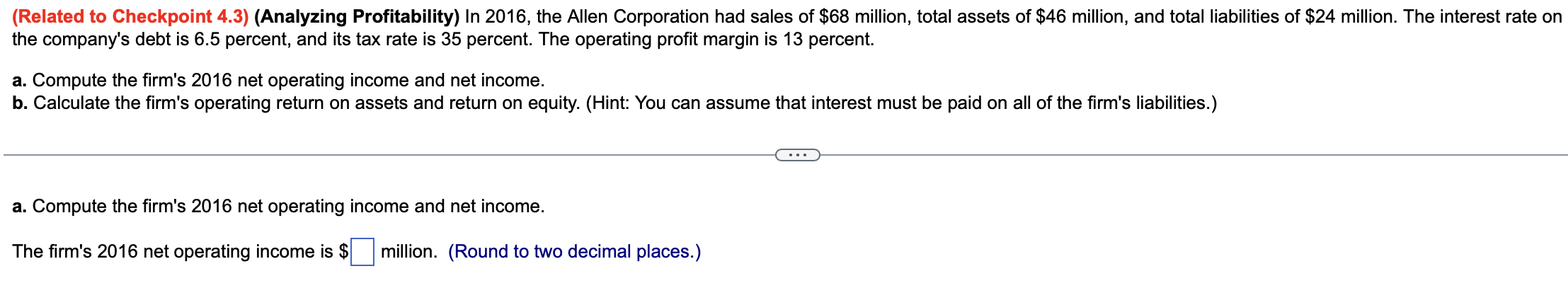

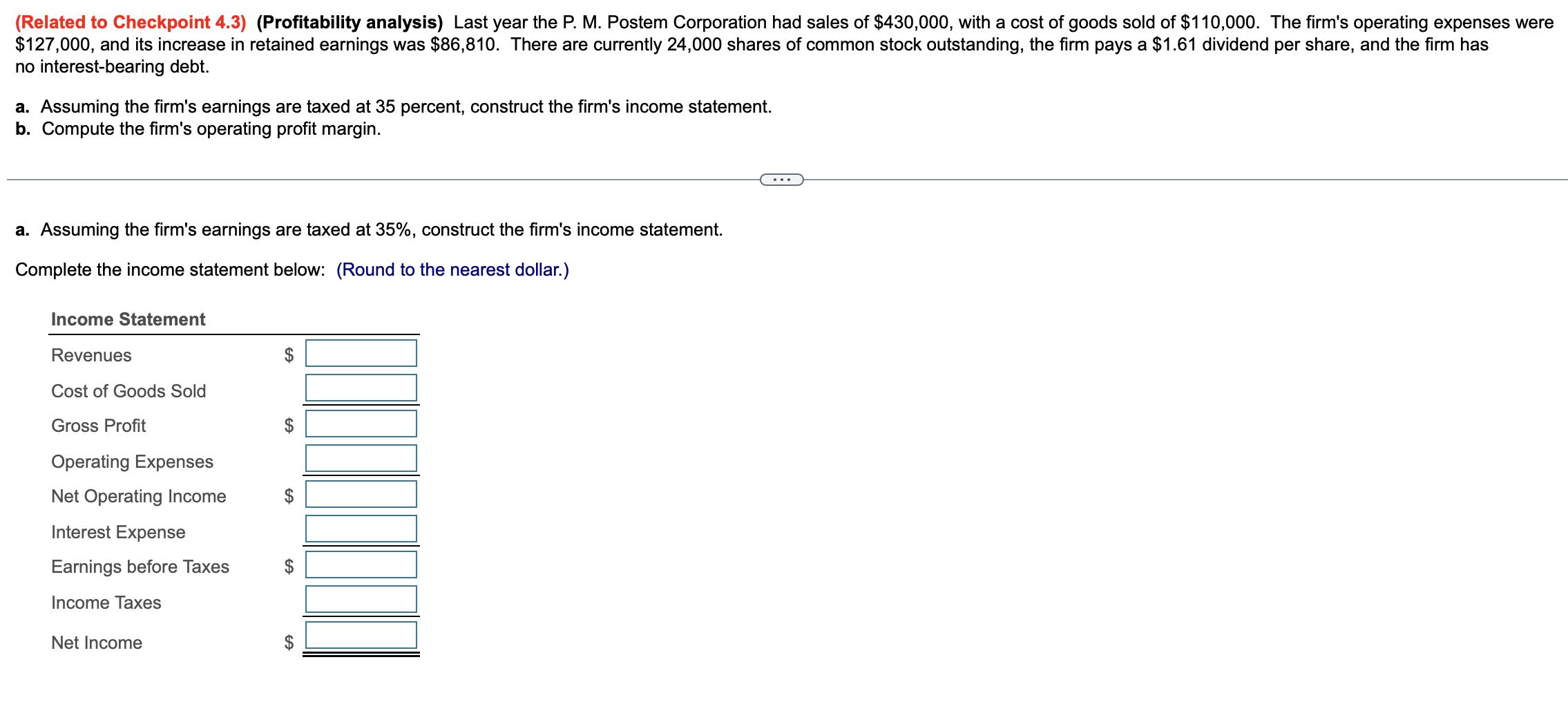

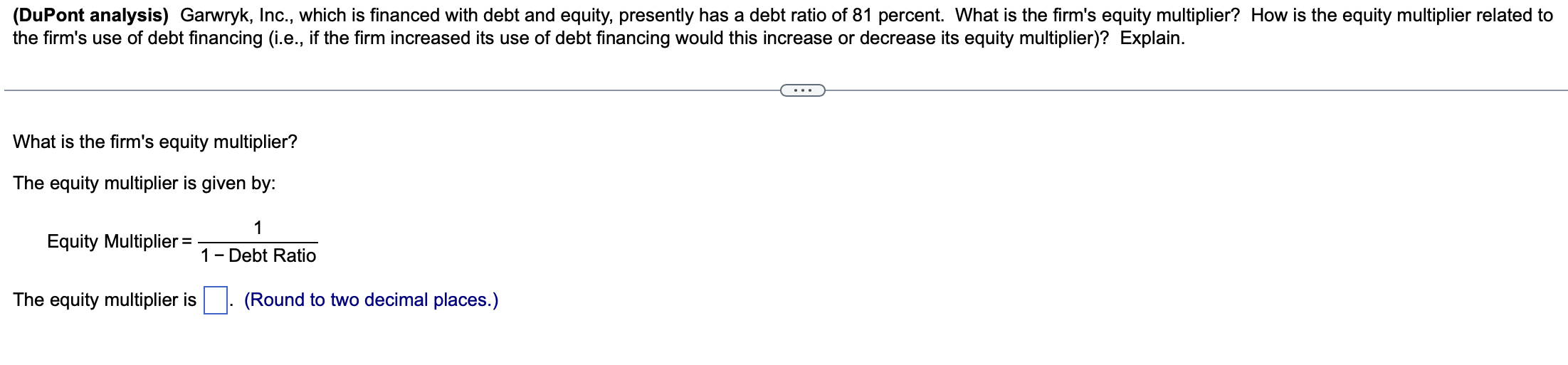

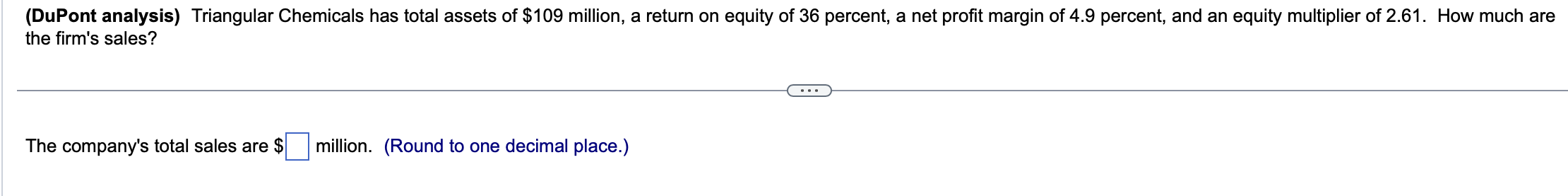

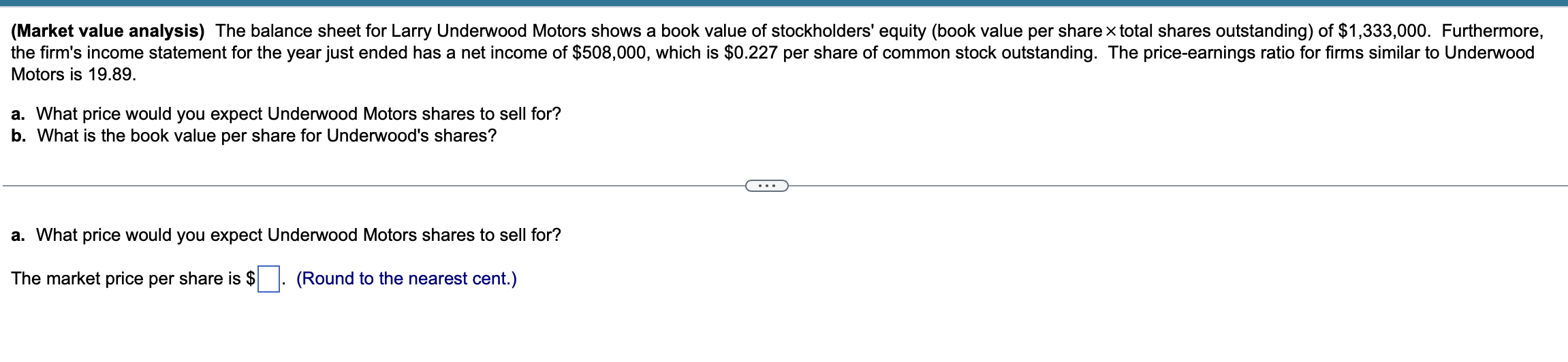

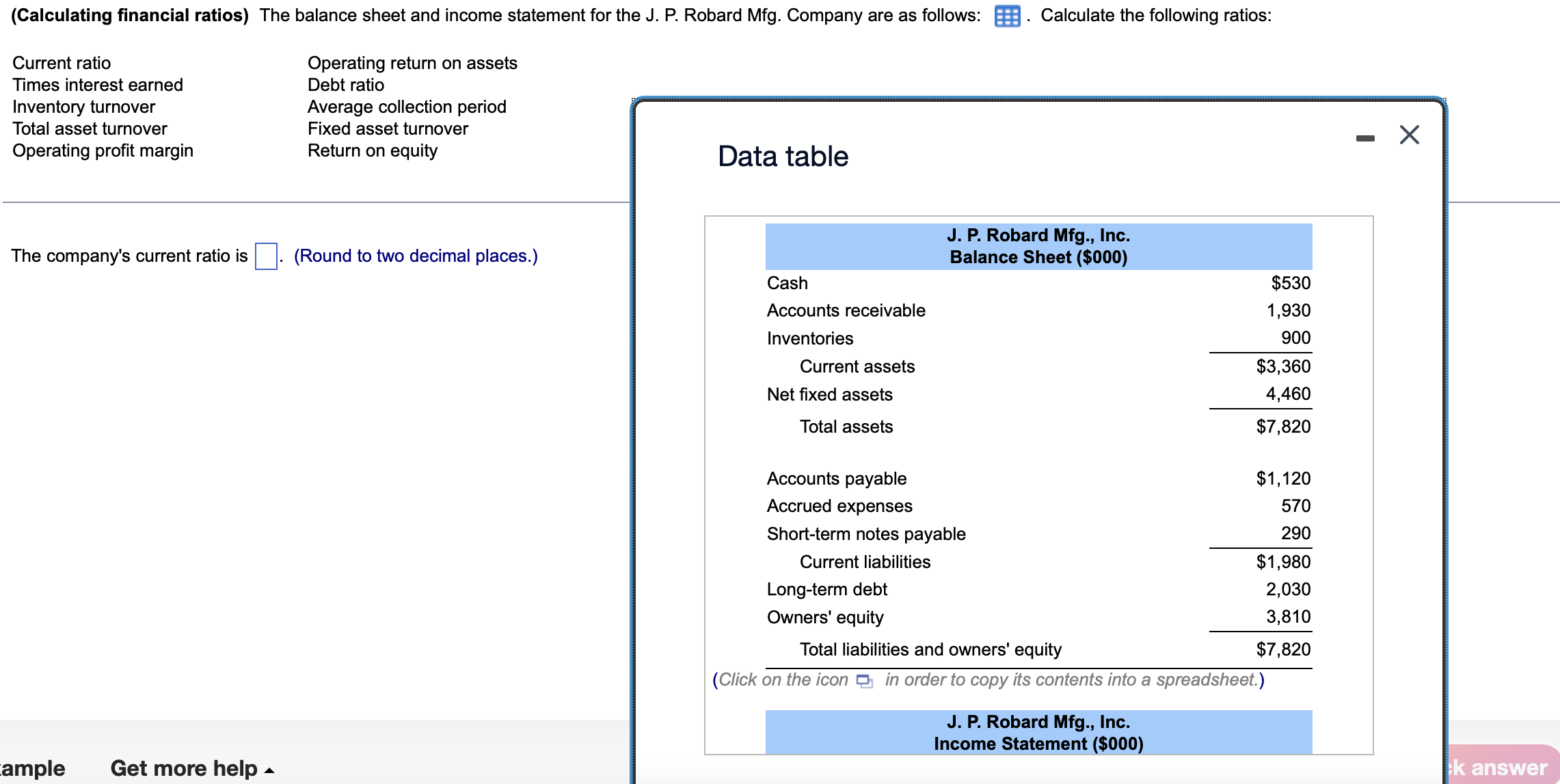

(Market value analysis) The balance sheet for Larry Underwood Motors shows a book value of stockholders' equity (book value per share total shares outstanding) of $1,333,000. Furthermore, the firm's income statement for the year just ended has a net income of $508,000, which is $0.227 per share of common stock outstanding. The price-earnings ratio for firms similar to Underwood Motors is 19.89 . a. What price would you expect Underwood Motors shares to sell for? b. What is the book value per share for Underwood's shares? a. What price would you expect Underwood Motors shares to sell for? The market price per share is $ (Round to the nearest cent.) (DuPont analysis) Triangular Chemicals has total assets of $109 million, a return on equity of 36 percent, a net profit margin of 4.9 percent, and an equity multiplier of 2.61 . How much a the firm's sales? The company's total sales are $ million. (Round to one decimal place.) Data table The company's current ratio is (Round to two decimal places.) (DuPont analysis) Garwryk, Inc., which is financed with debt and equity, presently has a debt ratio of 81 percent. What is the firm's equity multiplier? How is the equity multiplier related to the firm's use of debt financing (i.e., if the firm increased its use of debt financing would this increase or decrease its equity multiplier)? Explain. What is the firm's equity multiplier? The equity multiplier is given by: EquityMultiplier=1DebtRatio1 The equity multiplier is (Round to two decimal places.) (Capital structure analysis) The Karson Transport Company currently has net operating income of $506,000 and pays interest expense of $197,000. The company plans to borrow $1.14 million on which the firm will pay 9 percent interest. The borrowed money will be used to finance an investment that is expected to increase the firm's net operating income by $410,000 a year. a. What is Karson's times interest earned ratio before the loan is taken out and the investment is made? b. What effect will the loan and the investment have on the firm's times interest earned ratio? a. What is Karson's times interest earned ratio before the loan is taken out and the investment is made? The times interest earned ratio is times. (Round to two decimal places.) (Liquidity Analysis) The King Carpet Company has $2,810,000 in cash and a total of $12,460,000 in current assets. The firm's current liabilities equal $6,730,000 such that the firm's current ratio equals 1.9. The company's managers want to reduce the firm's cash holdings down to $1,080,000 by paying $538,000 in cash to expand the firm's truck fleet and using $1,192,000 in cash to retire a short-term note. If they carry this plan through, what will happen to the firm's current ratio? The new current ratio is (Round to one decimal place.) (Related to Checkpoint 4.3) (Profitability analysis) Last year the P. M. Postem Corporation had sales of $430,000, with a cost of goods sold of $110,000. The firm's operating expenses were $127,000, and its increase in retained earnings was $86,810. There are currently 24,000 shares of common stock outstanding, the firm pays a $1.61 dividend per share, and the firm has no interest-bearing debt. a. Assuming the firm's earnings are taxed at 35 percent, construct the firm's income statement. b. Compute the firm's operating profit margin. a. Assuming the firm's earnings are taxed at 35%, construct the firm's income statement. Complete the income statement below: (Round to the nearest dollar.) (Using common-size financial statements) The S\&H Construction Company expects to have total sales next year totaling $15,200,000. In addition, the firm pays taxes at 35 percent and will owe $311,000 in interest expense. Based on last year's operations the firm's management predicts that its cost of goods sold will be 57 percent of sales and operating expenses will total 31 percent. What is your estimate of the firm's net income (after taxes) for the coming year? Complete the pro-forma income statement below: (Round to the nearest dollar.) (Related to Checkpoint 4.3) (Analyzing Profitability) In 2016, the Allen Corporation had sales of $68 million, total assets of $46 million, and total liabilities of $24 million. The interest rate on the company's debt is 6.5 percent, and its tax rate is 35 percent. The operating profit margin is 13 percent. a. Compute the firm's 2016 net operating income and net income. b. Calculate the firm's operating return on assets and return on equity. (Hint: You can assume that interest must be paid on all of the firm's liabilities.) a. Compute the firm's 2016 net operating income and net income. The firm's 2016 net operating income is \$ million. (Round to two decimal places.) (Related to Checkpoint 4.2) (Capital structure analysis) The liabilities and owners' equity for Campbell Industries is found here: a. What percentage of the firm's assets does the firm finance using debt (liabilities)? b. If Campbell were to purchase a new warehouse for $1.5 million and finance it entirely with long-term debt, what would be the firm's new debt ratio? a. What percentage of the firm's assets does the firm finance using debt (liabilities)? The fraction of the firm's assets that the firm finances using debt is \%. (Round to one decimal place.) Data table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts