Question: 1. 2. 3. 4. 5. 6. 7. please answer as soon as possible. very much appreciated! 11 A bond pays a 7% coupon and makes

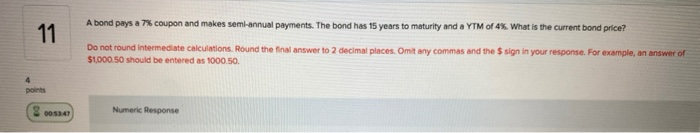

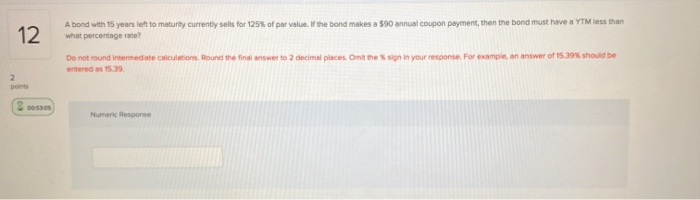

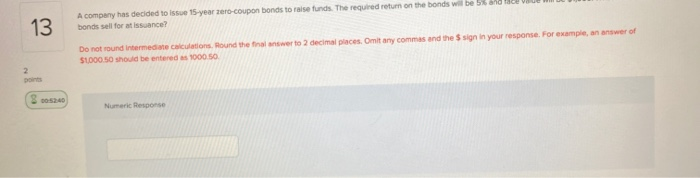

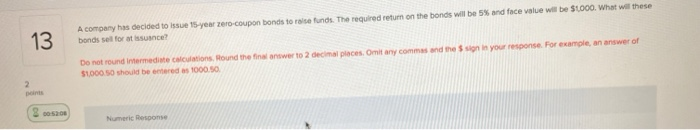

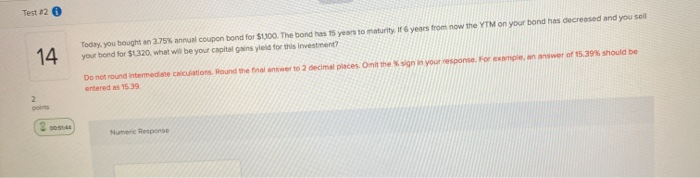

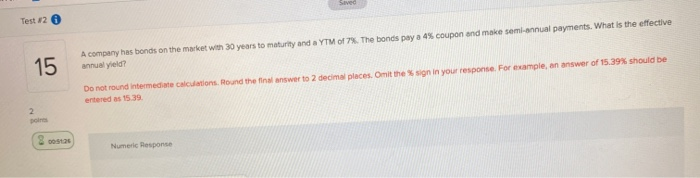

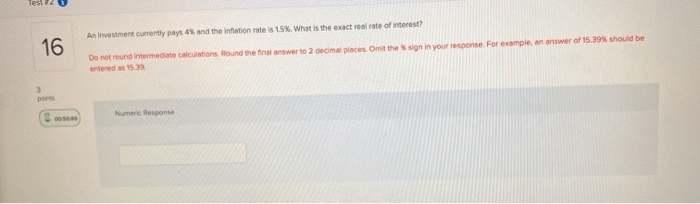

11 A bond pays a 7% coupon and makes semi-annual payments. The bond has 15 years to maturity and a YTM of 4%. What is the current bond price? Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit any commes and the $ sign in your response. For example, an answer of $1000.50 should be entered as 1000.50. points 00:53:41 Numeric Response 12 A bond with 15 years left to maturity currently sells for 125% of par value. If the bond makes a $90 annual coupon payment, then the bond must have a YTM less than what percentage rate? Do not round Intermediate calculation. Round the final answer to 2 decimal places on the sign in your response. For example, an answer of 15.39% should be entered as 15:39 2 points 00:53 Numan Resore 13 A company has decided to issue 15-year zero-coupon bonds to raise funds. The required return on the bonds will be bonds sell for at issuance? Do not round Intermediate calculations. Hound the final answer to 2 decimal places, Omit any commas and the S sign in your response. For example, an answer of S1000.50 should be entered as 1000.50 2 05240 Numeric Response 13 A company has decided to issue 15 year zero-coupon bonds to raise funds. The required return on the bonds will be 5% and face value will be $1000. What will these bonds set for at issuance? Do not round Intermediate calculations. Hound the final answer to 2 decimal places. Omit any commes and the sign in your response. For example, an answer of 51000 50 should be red as 1000.50 2 09 30-50 Numer Response Test 12 14 Today, you bought an 2.75% annual coupon bond for $100. The bond has 15 years to maturity. If 6 years from now the YTM on your bond has decreased and you sell your bond for $1320, what will be your capital gains yield for this investment? Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit the sign in your response. For example answer of 15.39% should be entered as 1539 2 Numere Response Seved Test 2 15 A company has bonds on the market with 30 years to maturity and a YTM of 7%. The bonds pay a 4% coupon and make semi-annual payments. What is the effective annual yield? Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit the sign in your response. For example, an answer of 15.39% should be entered as 15:39 2 pole & sosial Numeric Response Test An Investment currently pays 4% and the inflation rate is 15%. What is the exact real rate of interest? 16 Do not round Intermediate calculations. Round the final answer to 2 decimal places. Omit the sign in your response. For example, an answer of 15.39% should be entered as 15.39 3 Numer Response 11 A bond pays a 7% coupon and makes semi-annual payments. The bond has 15 years to maturity and a YTM of 4%. What is the current bond price? Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit any commes and the $ sign in your response. For example, an answer of $1000.50 should be entered as 1000.50. points 00:53:41 Numeric Response 12 A bond with 15 years left to maturity currently sells for 125% of par value. If the bond makes a $90 annual coupon payment, then the bond must have a YTM less than what percentage rate? Do not round Intermediate calculation. Round the final answer to 2 decimal places on the sign in your response. For example, an answer of 15.39% should be entered as 15:39 2 points 00:53 Numan Resore 13 A company has decided to issue 15-year zero-coupon bonds to raise funds. The required return on the bonds will be bonds sell for at issuance? Do not round Intermediate calculations. Hound the final answer to 2 decimal places, Omit any commas and the S sign in your response. For example, an answer of S1000.50 should be entered as 1000.50 2 05240 Numeric Response 13 A company has decided to issue 15 year zero-coupon bonds to raise funds. The required return on the bonds will be 5% and face value will be $1000. What will these bonds set for at issuance? Do not round Intermediate calculations. Hound the final answer to 2 decimal places. Omit any commes and the sign in your response. For example, an answer of 51000 50 should be red as 1000.50 2 09 30-50 Numer Response Test 12 14 Today, you bought an 2.75% annual coupon bond for $100. The bond has 15 years to maturity. If 6 years from now the YTM on your bond has decreased and you sell your bond for $1320, what will be your capital gains yield for this investment? Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit the sign in your response. For example answer of 15.39% should be entered as 1539 2 Numere Response Seved Test 2 15 A company has bonds on the market with 30 years to maturity and a YTM of 7%. The bonds pay a 4% coupon and make semi-annual payments. What is the effective annual yield? Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit the sign in your response. For example, an answer of 15.39% should be entered as 15:39 2 pole & sosial Numeric Response Test An Investment currently pays 4% and the inflation rate is 15%. What is the exact real rate of interest? 16 Do not round Intermediate calculations. Round the final answer to 2 decimal places. Omit the sign in your response. For example, an answer of 15.39% should be entered as 15.39 3 Numer Response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts