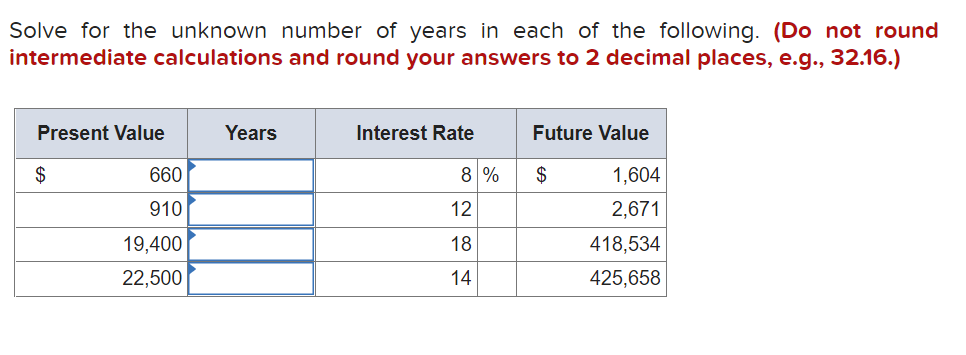

Question: 1. 2. 3. 4. 5. 6. 7. Solve for the unknown number of years in each of the following. (Do not round intermediate calculations and

1.

2.

2.  3.

3. 4.

4.

5.

6.

6.

7.

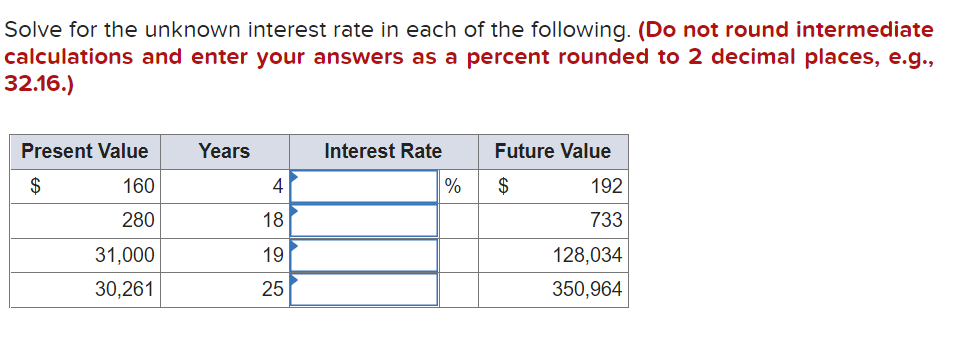

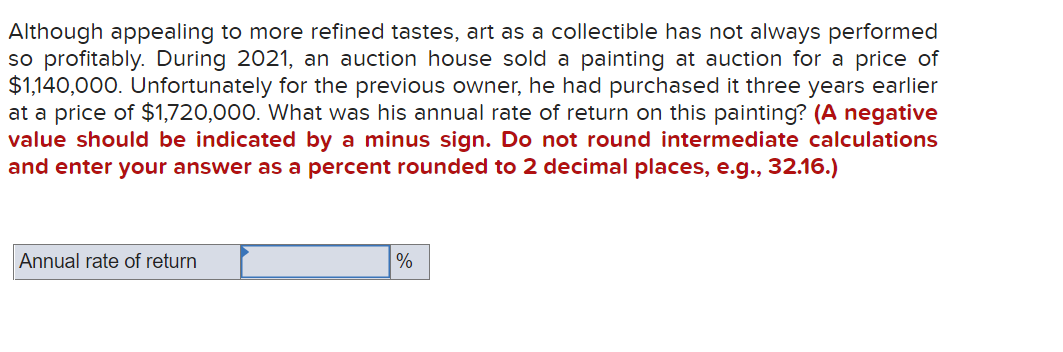

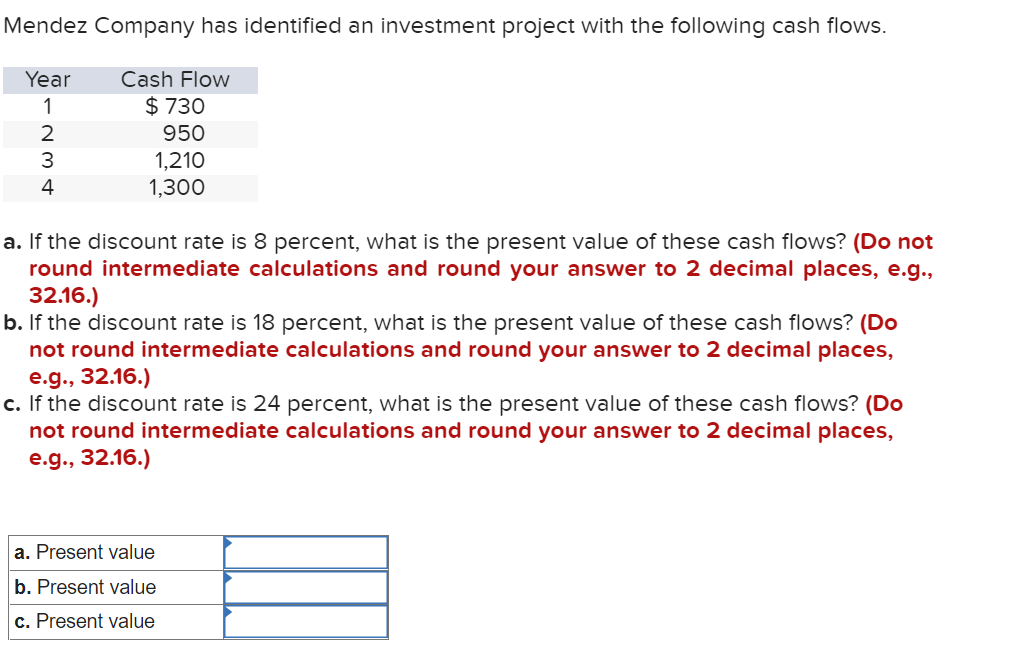

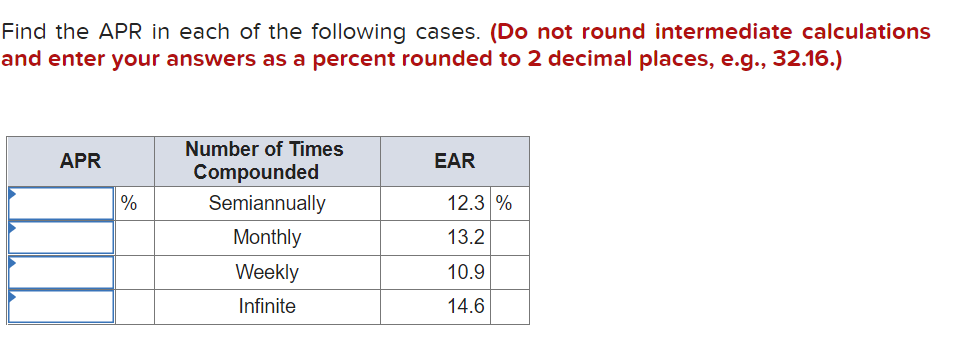

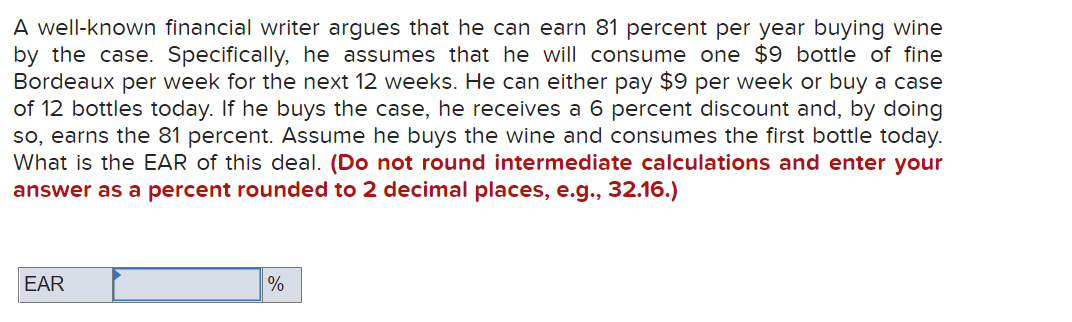

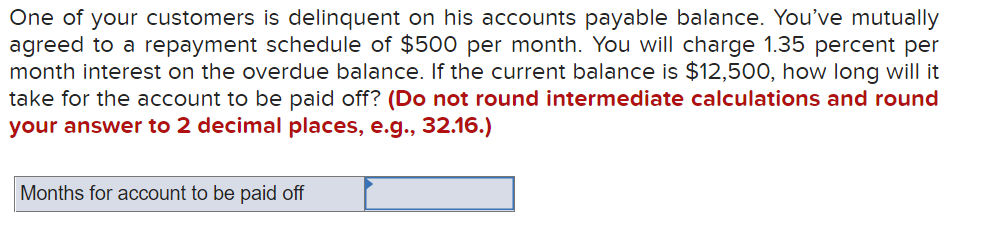

Solve for the unknown number of years in each of the following. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Solve for the unknown interest rate in each of the following. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Although appealing to more refined tastes, art as a collectible has not always performed so profitably. During 2021, an auction house sold a painting at auction for a price of $1,140,000. Unfortunately for the previous owner, he had purchased it three years earlier at a price of $1,720,000. What was his annual rate of return on this painting? (A negative value should be indicated by a minus sign. Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Mendez Company has identified an investment project with the following cash flows. a. If the discount rate is 8 percent, what is the present value of these cash flows? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. If the discount rate is 18 percent, what is the present value of these cash flows? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. If the discount rate is 24 percent, what is the present value of these cash flows? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Find the APR in each of the following cases. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) A well-known financial writer argues that he can earn 81 percent per year buying wine by the case. Specifically, he assumes that he will consume one $9 bottle of fine Bordeaux per week for the next 12 weeks. He can either pay $9 per week or buy a case of 12 bottles today. If he buys the case, he receives a 6 percent discount and, by doing so, earns the 81 percent. Assume he buys the wine and consumes the first bottle today. What is the EAR of this deal. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) One of your customers is delinquent on his accounts payable balance. You've mutually agreed to a repayment schedule of $500 per month. You will charge 1.35 percent per month interest on the overdue balance. If the current balance is $12,500, how long will it take for the account to be paid off? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts