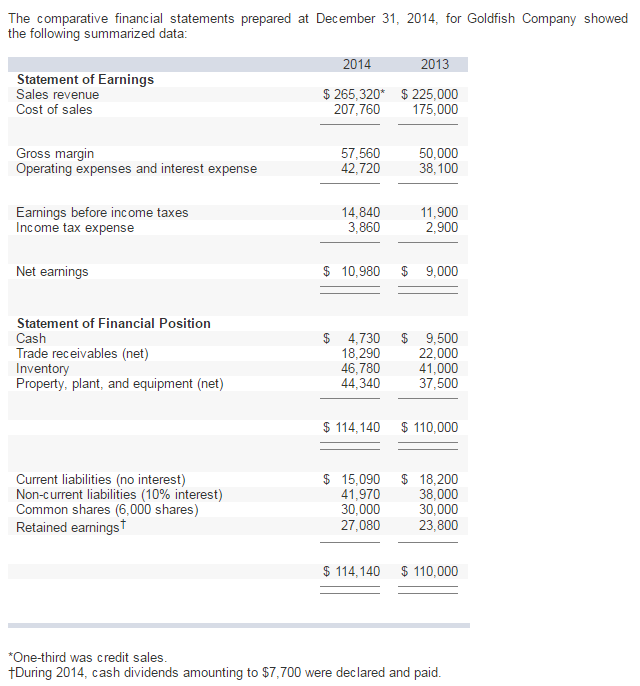

Question: 1) 2) 3) 4) 5) 6) 7) The comparative financial statements prepared at December 31, 2014, for Goldfish Company showed the following summarized data: 2013

1)

2)

3)

4)

5)

6)

7)

The comparative financial statements prepared at December 31, 2014, for Goldfish Company showed the following summarized data: 2013 2014 Statement of Earnings Sales revenue 265,320* $225,000 Cost of sales 207,760 175.000 Gross margin 57,560 50,000 42,720 38,100 Operating expenses and interest expense Earnings before income taxes 14,840 11,900 Income tax expense 3,860 2.900 Net earnings 10,980 9,000 Statement of Financial Position 4,730 9,500 Cash Trade receivables (net) 18.290 22,000 46,780 41.000 Inventory Property, plant, and equipment (net) 44,340 37,500 114,140 110,000 Current liabilities (no interest) 15,090 18,200 41,970 38.000 Non-current liabilities (10% interest) 30,000 Common shares (6,000 shares) 30,000 27.080 23,800 Retained earnings 114,140 110,000 *One-third was credit sales. tDuring 2014, cash dividends amounting to $7,700 were declared and paid

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts