Question: 1 2 3 4 5 6 Using a time line The financial manager at Starbuck Industries is considering an investment that requires an initial outlay

1 2

2 3

3 4

4

5

5

6

6

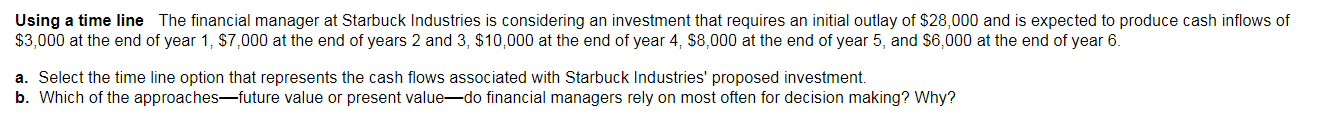

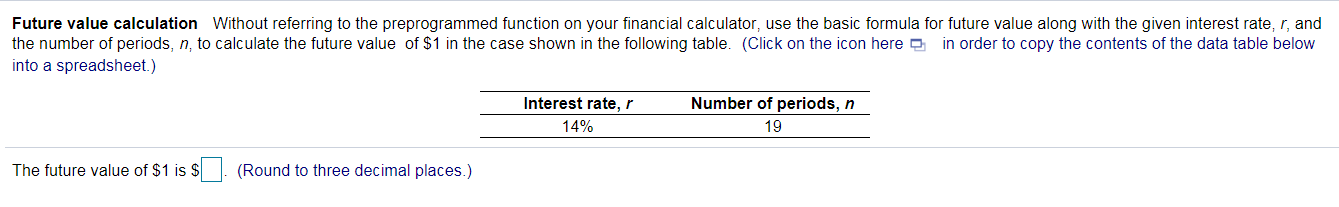

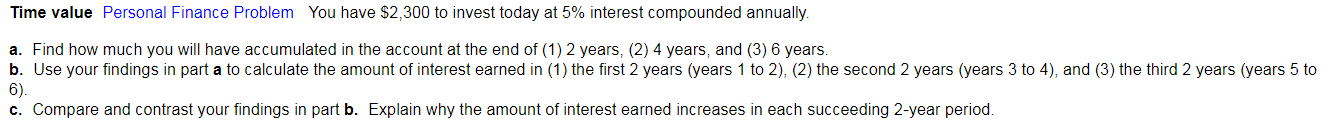

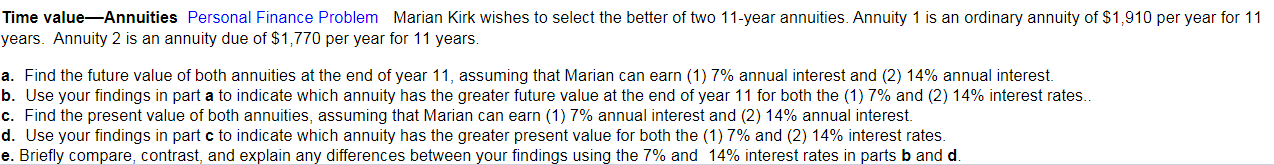

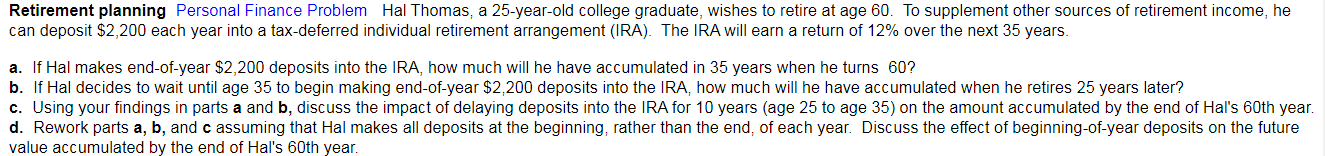

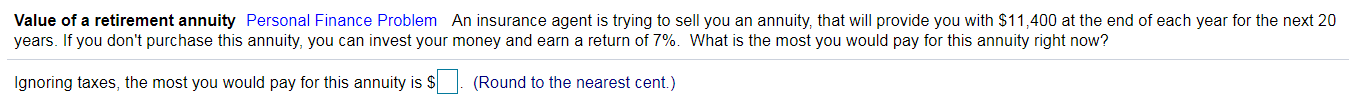

Using a time line The financial manager at Starbuck Industries is considering an investment that requires an initial outlay of $28,000 and is expected to produce cash inflows of $3,000 at the end of year 1, $7,000 at the end of years 2 and $10,000 at the end of year 4, $8,000 at the end of year 5, and $6,000 at the end of year 6. a. Select the time line option that represents the cash flows associated with Starbuck Industries' proposed investment b. Which of the approachesfuture value or present valuedo financial managers rely on most often for decision making? Why? Future value calculation Without referring to the preprogrammed function on your financial calculator, use the basic formula for future value along with the given interest rate, r, and the number of periods, n, to calculate the future value of $1 in the case shown in the following table. (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Interest rate, Number of periods, n 14% 19 The future value of $1 is $ (Round to three decimal places.) Time value Personal Finance Problem You have $2,300 to invest today at 5% interest compounded annually. a. Find how much you will have accumulated in the account at the end of (1) 2 years, (2) 4 years, and (3) 6 years. b. Use your findings in part a to calculate the amount of interest earned in (1) the first 2 years (years 1 to 2), (2) the second 2 years (years 3 to 4), and (3) the third 2 years (years 5 to 6). c. Compare and contrast your findings in part b. Explain why the amount of interest earned increases in each succeeding 2-year period. Time value-Annuities Personal Finance Problem Marian Kirk wishes to select the better of two 11-year annuities. Annuity 1 is an ordinary annuity of $1,910 per year for 11 years. Annuity 2 is an annuity due of $1,770 per year for 11 years. a. Find the future value of both annuities at the end of year 11, assuming that Marian can earn (1) 7% annual interest and (2) 14% annual interest. b. Use your findings in part a to indicate which annuity has the greater future value at the end of year 11 for both the (1) 7% and (2) 14% interest rates. c. Find the present value of both annuities, assuming that Marian can earn (1) 7% annual interest and (2) 14% annual interest. d. Use your findings in part c to indicate which annuity has the greater present value for both the (1) 7% and (2) 14% interest rates. e. Briefly compare, contrast, and explain any differences between your findings using the 7% and 14% interest rates in parts b and d. Retirement planning Personal Finance Problem Hal Thomas, a 25-year-old college graduate, wishes to retire at age 60. To supplement other sources of retirement income, he can deposit $2,200 each year into a tax-deferred individual retirement arrangement (IRA). The IRA will earn a return of 12% over the next 35 years. a. If Hal makes end-of-year $2,200 deposits into the IRA, how much will he have accumulated in 35 years when he turns 60? b. If Hal decides to wait until age 35 to begin making end-of-year $2,200 deposits into the IRA, how much will he have accumulated when he retires 25 years later? c. Using your findings in parts a and b, discuss the impact of delaying deposits into the IRA for 10 years (age 25 to age 35) on the amount accumulated by the end of Hal's 60th year. d. Rework parts a, b, and c assuming that Hal makes all deposits at the beginning, rather than the end, of each year. Discuss the effect of beginning-of-year deposits on the future value accumulated by the end of Hal's 60th year. Value of a retirement annuity Personal Finance Problem An insurance agent is trying to sell you an annuity, that will provide you with $11,400 at the end of each year for the next 20 years. If you don't purchase this annuity, you can invest your money and earn a return of 7%. What is the most you would pay for this annuity right now? Ignoring taxes, the most you would pay for this annuity is $ (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts