Question: 1 - 2 3 - 4- 5 - Asset turnover ratio Financial statement data for years ended December 31, 20Y3 and 20Y2, for Edison Company

1 -

2  3 -

3 -

4-

5 -

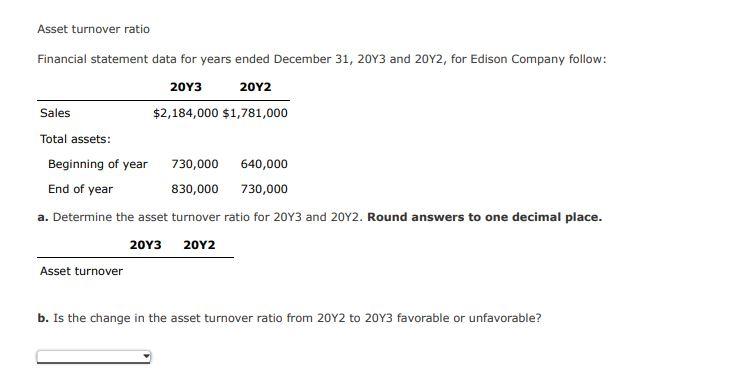

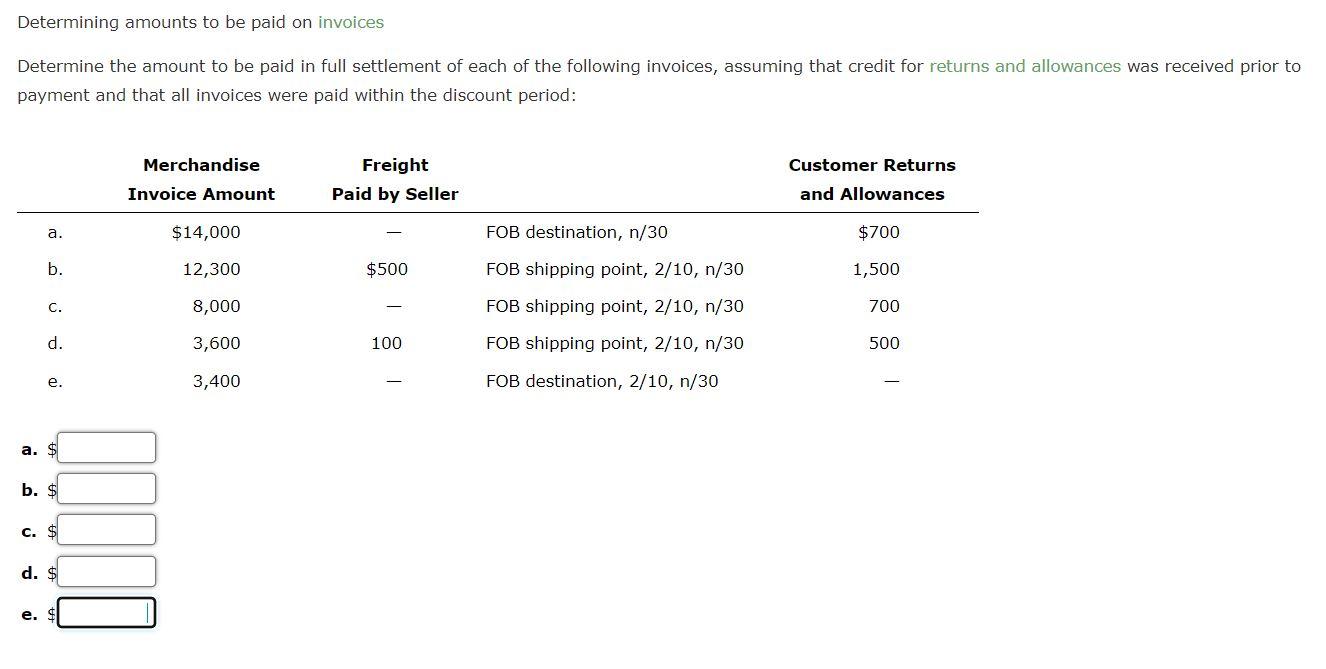

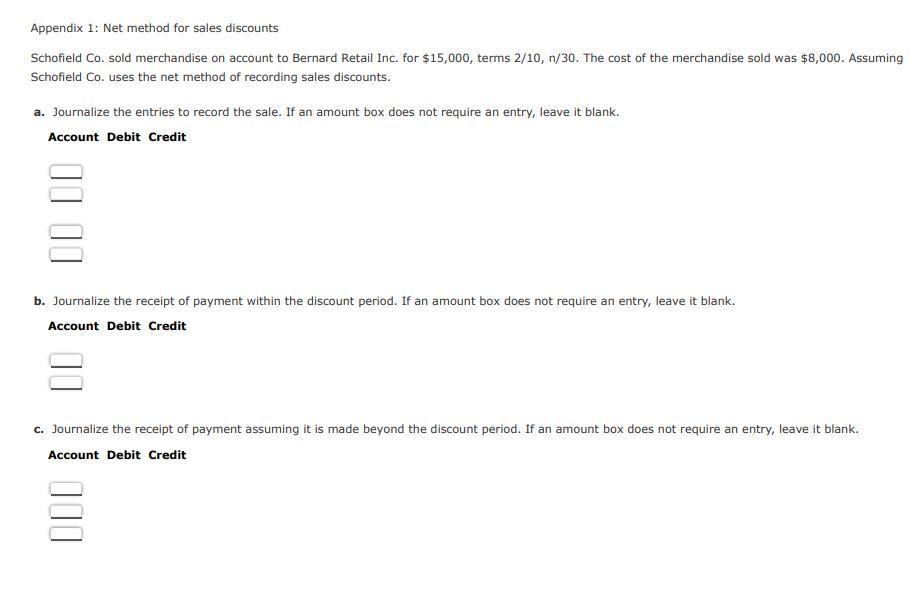

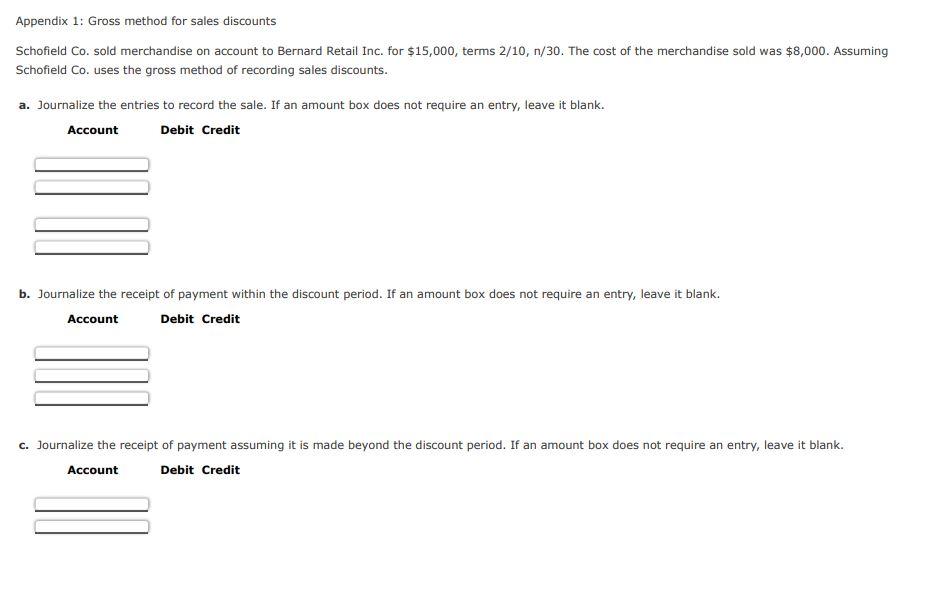

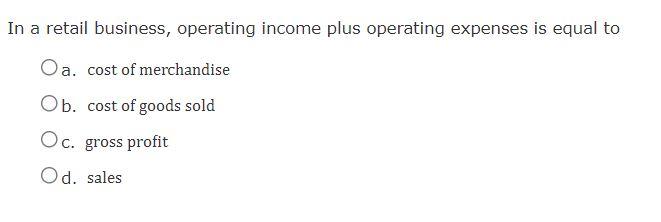

Asset turnover ratio Financial statement data for years ended December 31, 20Y3 and 20Y2, for Edison Company follow: 20Y3 20Y2 Sales $2,184,000 $1,781,000 Total assets: Beginning of year 730,000 640,000 End of year 830,000 730,000 a. Determine the asset turnover ratio for 20Y3 and 20Y2. Round answers to one decimal place. 20Y3 20Y2 Asset turnover b. Is the change in the asset turnover ratio from 20Y2 to 20Y3 favorable or unfavorable? Determining amounts to be paid on invoices Determine the amount to be paid in full settlement of each of the following invoices, assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period: Merchandise Freight Customer Returns Invoice Amount Paid by Seller and Allowances a. $14,000 FOB destination, n/30 $700 b. 12,300 $500 FOB shipping point, 2/10, n/30 1,500 C. 8,000 FOB shipping point, 2/10, n/30 700 d. 3,600 100 FOB shipping point, 2/10, n/30 500 e. 3,400 FOB destination, 2/10, n/30 a. $ b. $ c. $ d. $ e. Appendix 1: Net method for sales discounts Schofield Co. sold merchandise on account to Bernard Retail Inc. for $15,000, terms 2/10, n/30. The cost of the merchandise sold was $8,000. Assuming Schofield Co. uses the net method of recording sales discounts. a. Journalize the entries to record the sale. If an amount box does not require an entry, leave it blank. Account Debit Credit b. Journalize the receipt of payment within the discount period. If an amount box does not require an entry, leave it blank. Account Debit Credit c. Journalize the receipt of payment assuming it is made beyond the discount period. If an amount box does not require an entry, leave it blank. Account Debit Credit Appendix 1: Gross method for sales discounts Schofield Co. sold merchandise on account to Bernard Retail Inc. for $15,000, terms 2/10, n/30. The cost of the merchandise sold was $8,000. Assuming Schofield Co. uses the gross method of recording sales discounts. a. Journalize the entries to record the sale. If an amount box does not require an entry, leave it blank. Account Debit Credit b. Journalize the receipt of payment within the discount period. If an amount box does not require an entry, leave it blank. Account Debit Credit c. Journalize the receipt of payment assuming it is made beyond the discount period. If an amount box does not require an entry, leave it blank. Account Debit Credit In a retail business, operating income plus operating expenses is equal to Oa. cost of merchandise Ob. cost of goods sold Oc. gross profit Od. sales

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts