Question: 1. 2. 3. 4. ASSIGNMENT 2 Comparative financial statements for Heritage Services for the fiscal year ending December 31 appear in the next couple pages.

1.

2.

3.

4.

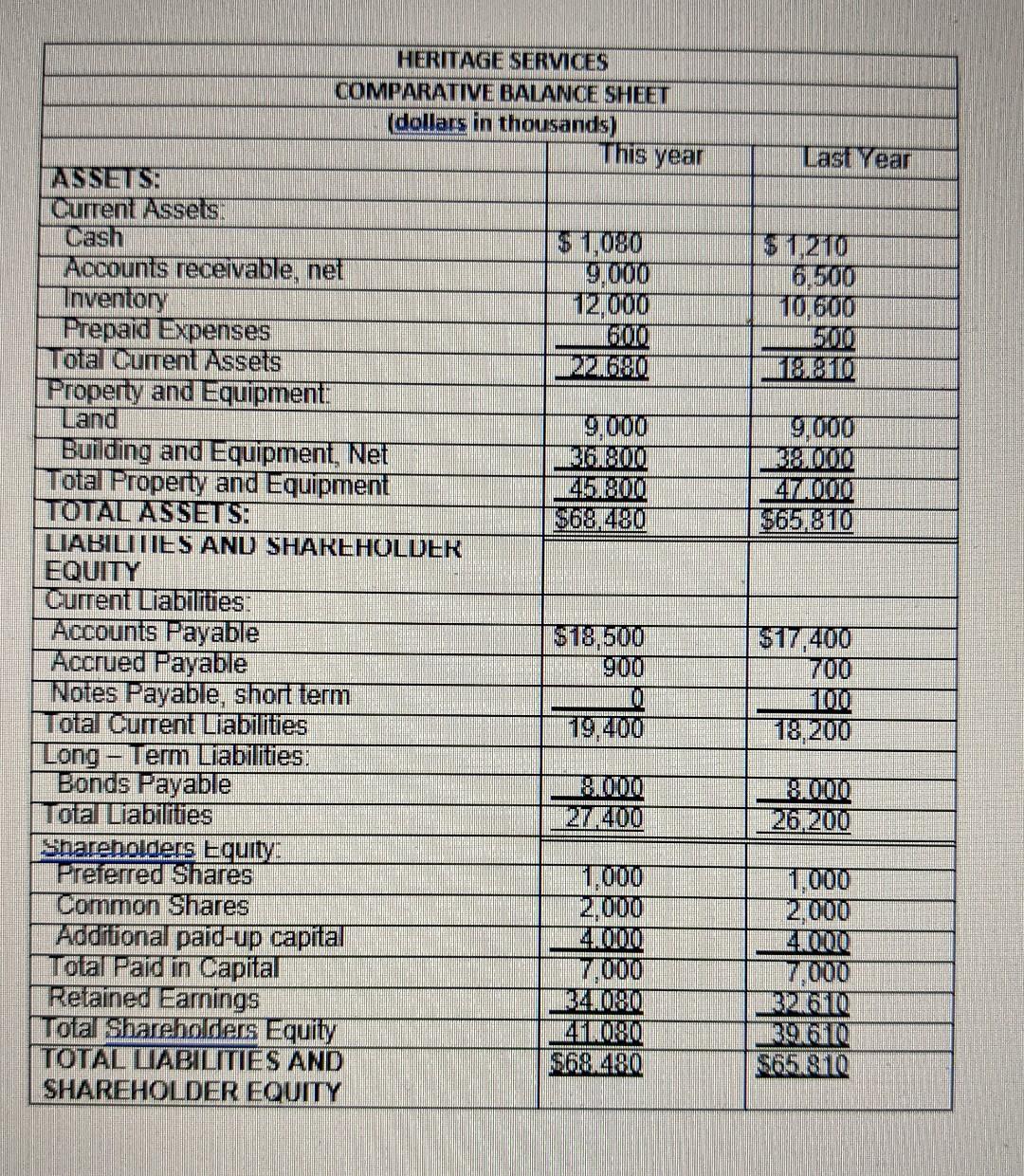

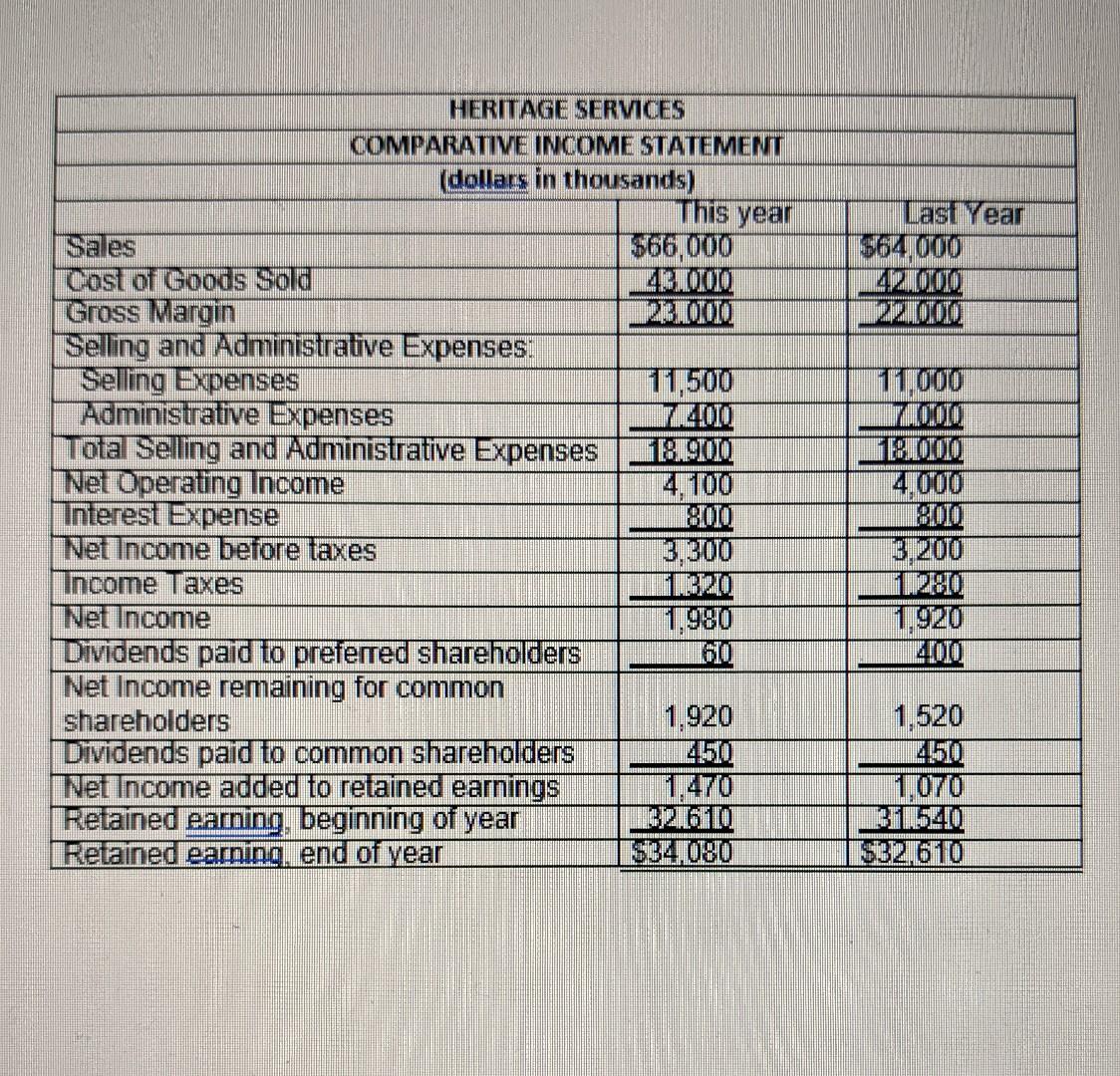

ASSIGNMENT 2 Comparative financial statements for Heritage Services for the fiscal year ending December 31 appear in the next couple pages. The company did not issue any new common or preferred shares during the year. A total of 600 common shares were outstanding The interest rate on the bond payable is 14%, the income tax rate was 40% and the dividend per share for the common shares were $0.75. The market value of the common share at the end of the year was $26. All of the sales for the company are on account. I Last Year $ 1,210 6,500 10.600 1,5010 1920 9,000 3120000 47100IDOT $65,810 HERITAGE SERVICES COMPARATIVE BALANCE SHEET (dollars in thousands) This year ASSETS Current Assets Cash $ 1,080 Accounts receivable, net 9,000 Inventory 12,000 Prepaid Expenses 16000 Total Current Assets 271001400 Property and Equipment: Land 9,000 Building and Equipment, Net 3620 Total Property and Equipment 25 BODO TOTALASSETS: $68,480 LIABILITIES AND SHAREHOLDER EQUITY Current Liabilities: Accounts Payable $18,500 Accrued Payable 900 Notes Payable, short term Total Current Liabilities 19,400 Long Term Liabilities: Bonds Payable Total Liabilities Shareholders Equity: Preferred Shares 1.000 Common Shares 2,000 Additional paid-up capital Total Paid in Capital 17.000 Retained Earnings 340180 Tofal Shareholders Equity LITORIO TOTAL LIABILITIES AND $69480 SHAREHOLDER EQUITY $17,400 700 18,200 BOTO 26,200 1,000 2,000 7,000 1326 3961) $6.5 810 Last Year $64,000 ZITTO 221000000 T1000 HERITAGE SERVICES COMPARATIVE INCOME STATEMENT (dollars in thousands) This year $66,000 Cost of Goods Sold ER OTOTO Gross Margin 221000010 Selling and Administrative Expenses. Selling Expenses 11,500 Administrative Expenses 720020 Total Selling and Administrative Expenses EBPO Net Operating Income 4,100 Tnterest Expense Net Income before taxes 3,300 Income Taxes 630 Net Income 1,980 Dividends paid to preferred shareholders Net Income remaining for common shareholders 1.920 Dividends paid to common shareholders Net Income added to retained earnings 1,470 Retained earning, beginning of year 1326600 Retained earning, end of year 1534080 EBOO 4.000 BIO 3.200 1,920 2000 1,520 250 1,070 - 31165400 $32,6510 REQUIRMENT: Compute the following ratios for this year: 1. Gross Margin Percentage 2. Earnings per share for common shareholders 3. Price-earnings ratio 4. Dividend payout ratio. 5. Dividend yield ratio. 6. Return on total assets. 7. Return on common stockholders' equity. 8. Book value per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts