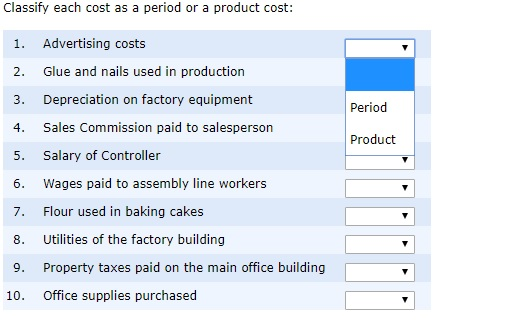

Question: 1. 2. 3. 4. Classify each cost as a period or a product cost: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Advertising

1.

2.

3.

4.

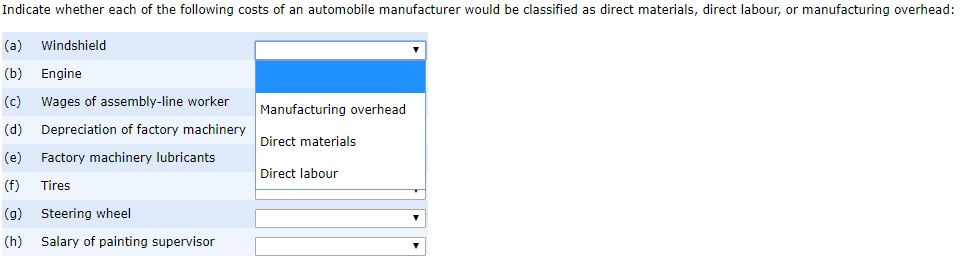

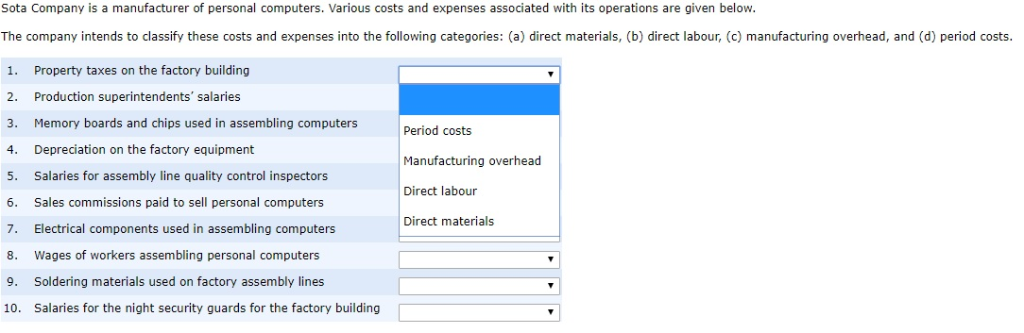

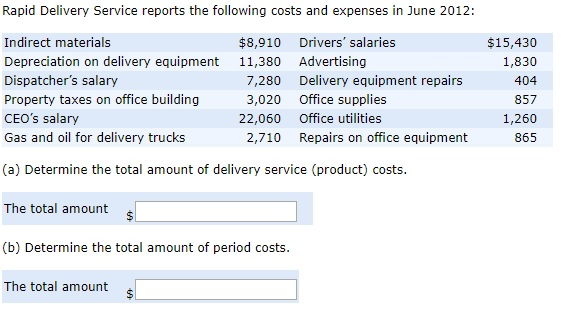

Classify each cost as a period or a product cost: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Advertising costs Glue and nails used in production Depreciation on factory equipment Sales Commission paid to salesperson Salary of Controller Wages paid to assembly line workers Flour used in baking cakes Utilities of the factory building Property taxes paid on the main office building Office supplies purchased Period Product Indicate whether each of the following costs of an automobile manufacturer would be classified as direct materials, direct labour, or manufacturing overhead (a) Windshield (b) Engine (c) Wages of assembly-line worker (d) Depreciation of factory machinery (e) Factory machinery lubricants () Tires (g) Steering wheel (h) Salary of painting supervisor Manufacturing overhead Direct materials Direct labour Sota Company is a manufacturer of personal computers. Various costs and expenses associated with its operations are given below The company intends to classify these costs and expenses into the following categories: (a) direct materials, (b) direct labour, (c) manufacturing overhead, and (d) period costs. 1. Property taxes on the factory building 2. Production superintendents' salaries 3. Memory boards and chips used in assembling computers 4. Depreciation on the factory equipment 5. Salaries for assembly line quality control inspectors 6. Sales commissions paid to sell personal computers 7. Electrical components used in assembling computers 8. Wages of workers assembling personal computers 9. Soldering materials used on factory assembly lines 10. Salaries for the night security guards for the factory building Period costs Manufacturing overhead Direct labour Direct materials Rapid Delivery Service reports the following costs and expenses in June 2012: Indirect materials Depreciation on delivery equipment Dispatcher's salary Property taxes on office building CEO's salary Gas and oil for delivery trucks $15,430 1,830 404 857 1,260 865 $8,910 Drivers' salaries 11,380 7,280 3,020 Advertising Delivery equipment repairs Office supplies 22,060 Office utilities 2,710 Repairs on office equipment (a) Determine the total amount of delivery service (product) costs The total amount (b) Determine the total amount of period costs The total amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts