Question: 1- 2 - 3- 4 - Cost flow methods The following three identical units of Item P401C are purchased during April: Item Beta Units Cost

1-

2 -

3-

4 -

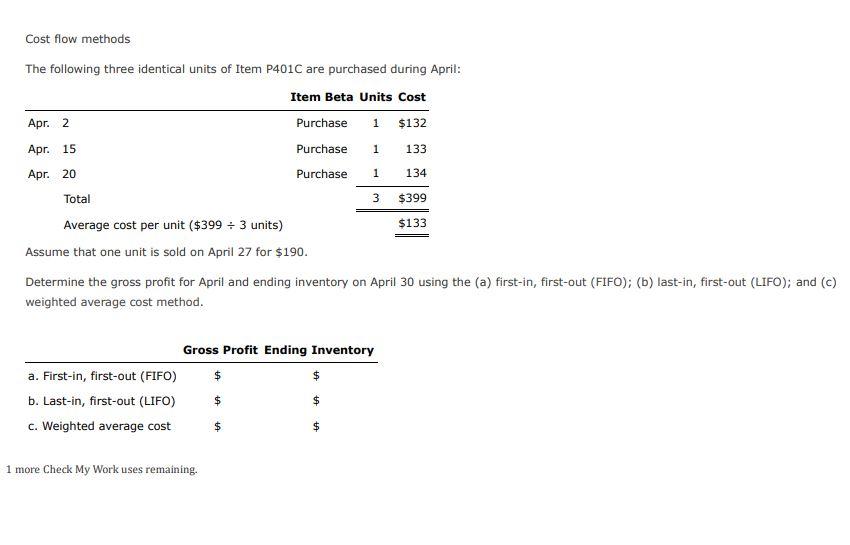

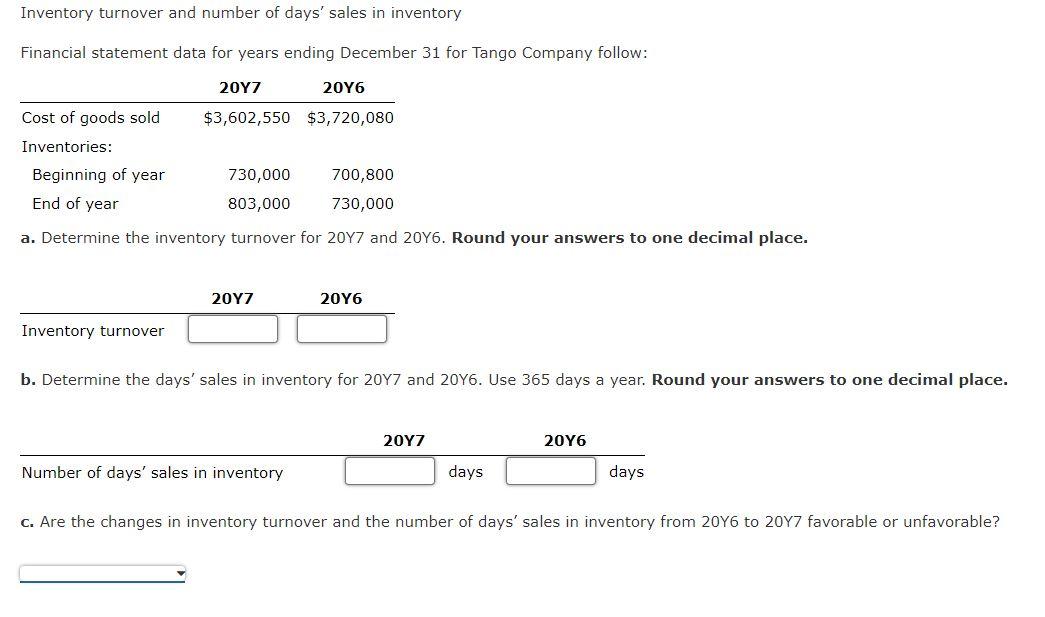

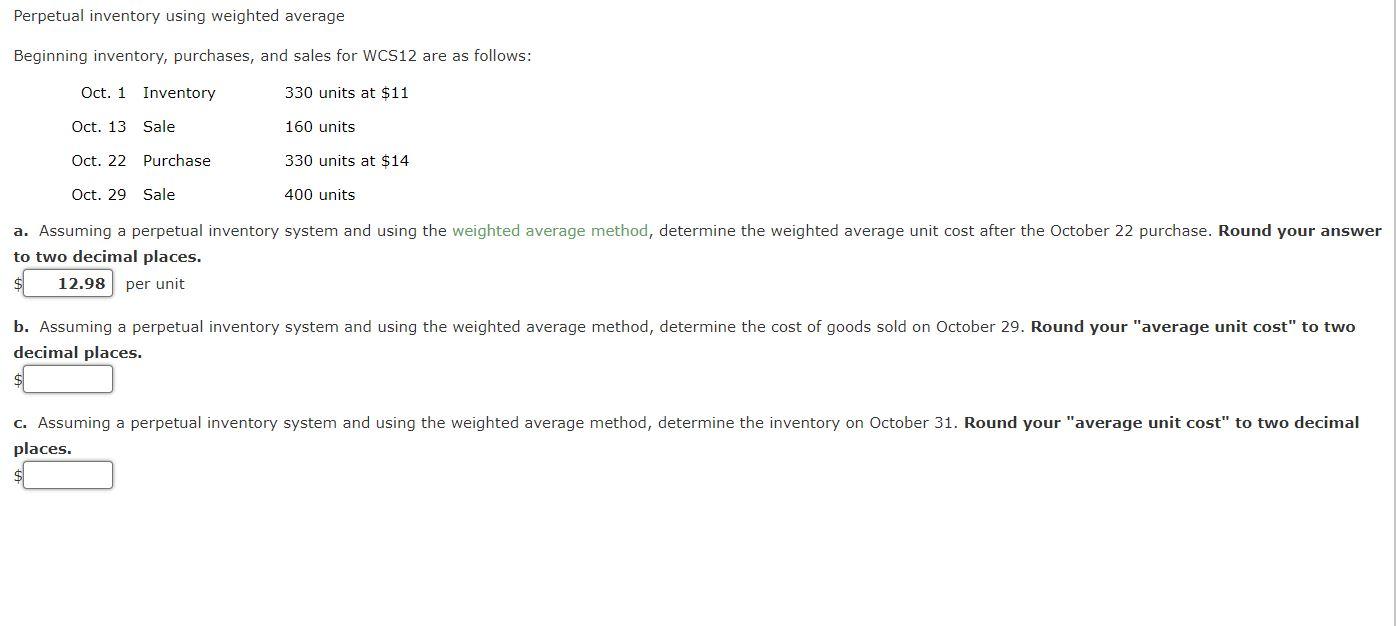

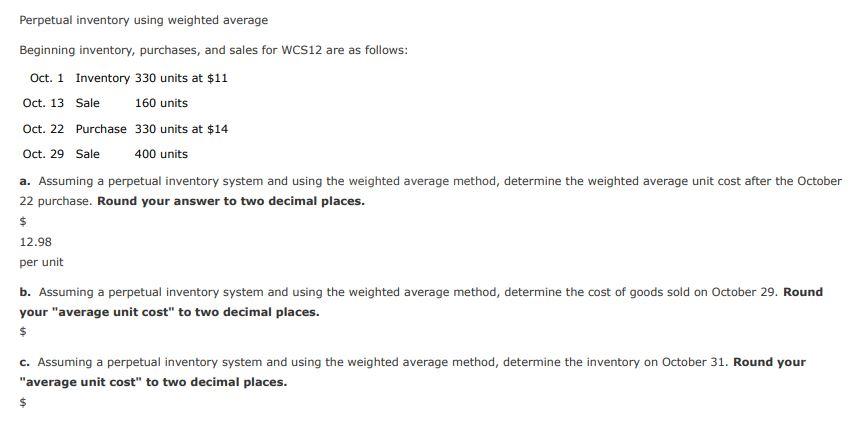

Cost flow methods The following three identical units of Item P401C are purchased during April: Item Beta Units Cost Apr. 2 Purchase 1 $132 Apr. 15 Purchase 1 133 Apr. 201 Purchase 1 134 Total 3 $399 Average cost per unit ($399 3 units) $133 Assume that one unit is sold on April 27 for $190. Determine the gross profit for April and ending inventory on April 30 using the (a) first-in, first-out (FIFO); (b) last-in, first-out (LIFO); and (c) weighted average cost method. Gross Profit Ending Inventory a. First-in, first-out (FIFO) $ b. Last-in, first-out (LIFO) $ $ c. Weighted average cost $ 1 more Check My Work uses remaining. Inventory turnover and number of days' sales in inventory Financial statement data for years ending December 31 for Tango Company follow: 20Y7 20Y6 Cost of goods sold $3,602,550 $3,720,080 Inventories: Beginning of year 730,000 700,800 End of year 803,000 730,000 a. Determine the inventory turnover for 20Y7 and 20Y6. Round your answers to one decimal place. 20Y7 20Y6 Inventory turnover b. Determine the days' sales in inventory for 20Y7 and 20Y6. Use 365 days a year. Round your answers to one decimal place. 20Y6 20Y7 days Number of days' sales in inventory days. c. Are the changes in inventory turnover and the number of days' sales in inventory from 20Y6 to 20Y7 favorable or unfavorable? Perpetual inventory using weighted average Beginning inventory, purchases, and sales for WCS12 are as follows: Oct. 1 Inventory 330 units at $11 Oct. 13 Sale 160 units Oct. 22 Purchase 330 units at $14 Oct. 29 Sale 400 units a. Assuming a perpetual inventory system and using the weighted average method, determine the weighted average unit cost after the October 22 purchase. Round your answer to two decimal places. 12.98 per unit b. Assuming a perpetual inventory system and using the weighted average method, determine the cost of goods sold on October 29. Round your "average unit cost" to two decimal places. c. Assuming a perpetual inventory system and using the weighted average method, determine the inventory on October 31. Round your "average unit cost" to two decimal places. Perpetual inventory using weighted average Beginning inventory, purchases, and sales for WCS12 are as follows: Oct. 1 Inventory 330 units at $11 Oct. 13 Sale 160 units Oct. 22 Purchase 330 units at $14 Oct. 29 Sale 400 units a. Assuming a perpetual inventory system and using the weighted average method, determine the weighted average unit cost after the October 22 purchase. Round your answer to two decimal places. $ 12.98 per unit b. Assuming a perpetual inventory system and using the weighted average method, determine the cost of goods sold on October 29. Round your "average unit cost" to two decimal places. $ c. Assuming a perpetual inventory system and using the weighted average method, determine the inventory on October 31. Round your "average unit cost" to two decimal places. $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts