Question: 1. 2. 3. 4. ebook Problem Walkthrough Project requires an initial outlayatto of $50,000, its expected cash in lows are $15,000 per year for years,

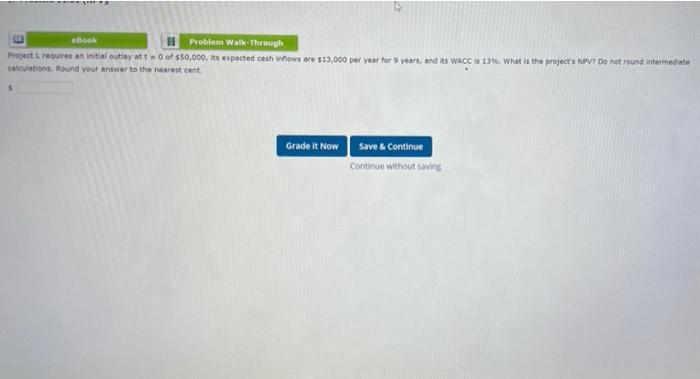

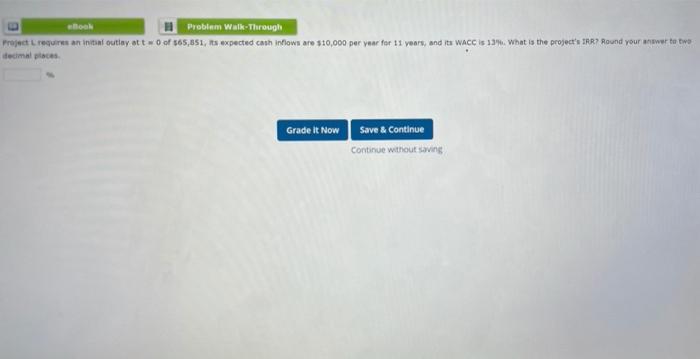

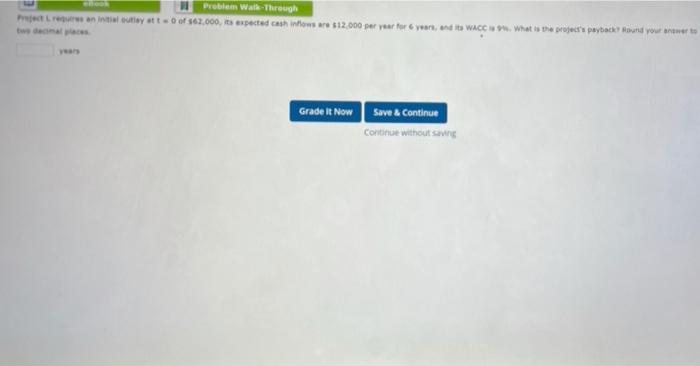

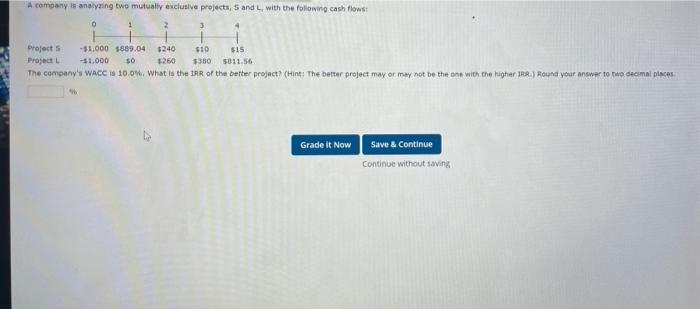

ebook Problem Walkthrough Project requires an initial outlayatto of $50,000, its expected cash in lows are $15,000 per year for years, and its WACC is 13. What is the projects PV? Do not round intermediate calculations. Round your answer to the nearest cent Grade it Now Save & Continue Continue without saving 11 Problem Walkthrough Project requires an initial outlay at 0 of 565,651, its expected cash inflows are $10,000 per year for 11 years, and its WACC is 13%. What is the project's RR? Round your answer to two Grade It Now Save & Continue Continue without saving Problem Wald-Through regret an initial stay atteo 567.000, espected cash flow we 112,000 per year for years, and its accu. What is the project's peyoacker round your womer to Grade It Now Save & Continue Continue without saving A company analyzing two mutually exclusive projects, Sand, with the following cash flows o 2 3 4 Projects -$1,000 5889.04 $240 $10 $15 Project -$1,000 50 5260 $350 5811.56 The company's WACC # 10.09. What is the IRR of the better project? (Hint: The better project may or may not be the one with the higher 188.) Round your answer to the decimi places Grade It Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts