Question: 1) 2) 3) 4) Exercise 12-7 (Part Level Submission) On January 1, Zabel Corporation purchased a 25% equity in Helbert Corporation for $186,500. At December

1)

2)

3)

4)

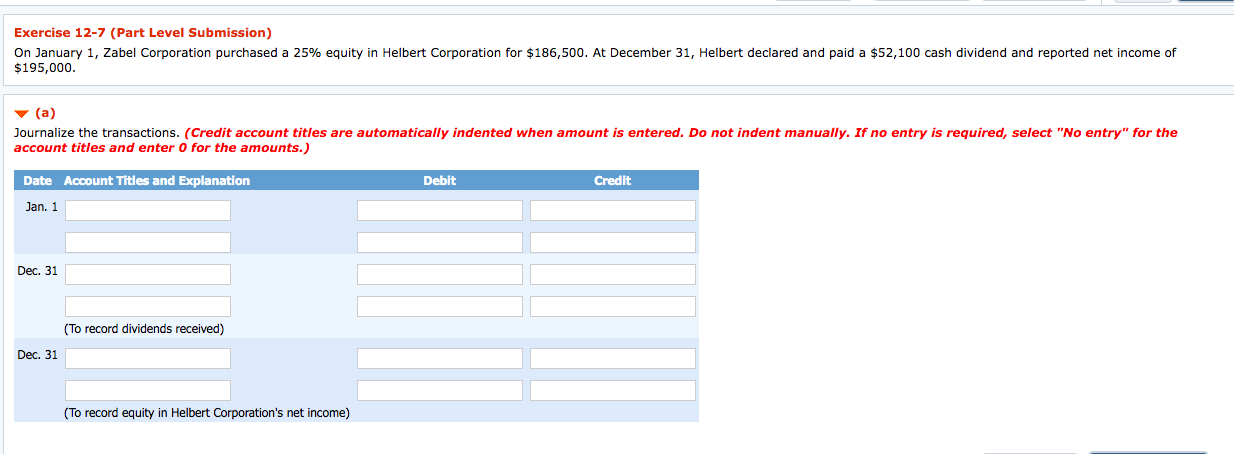

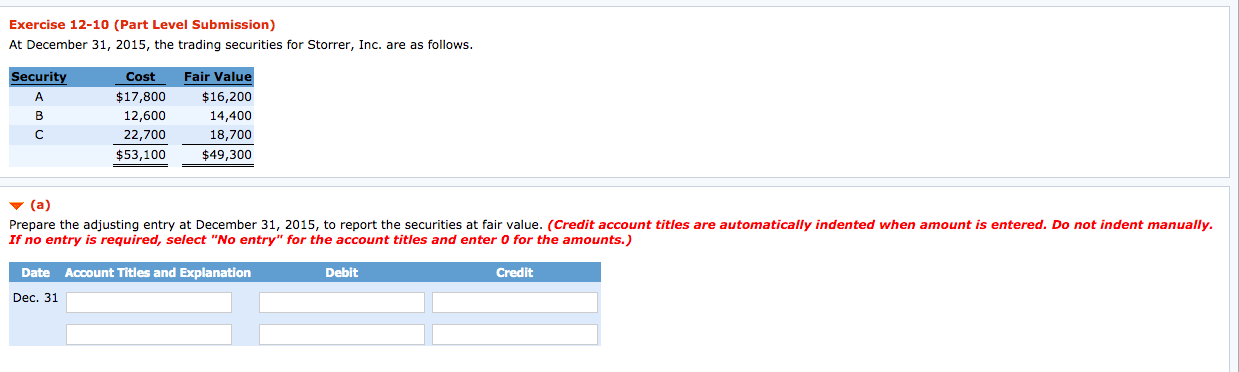

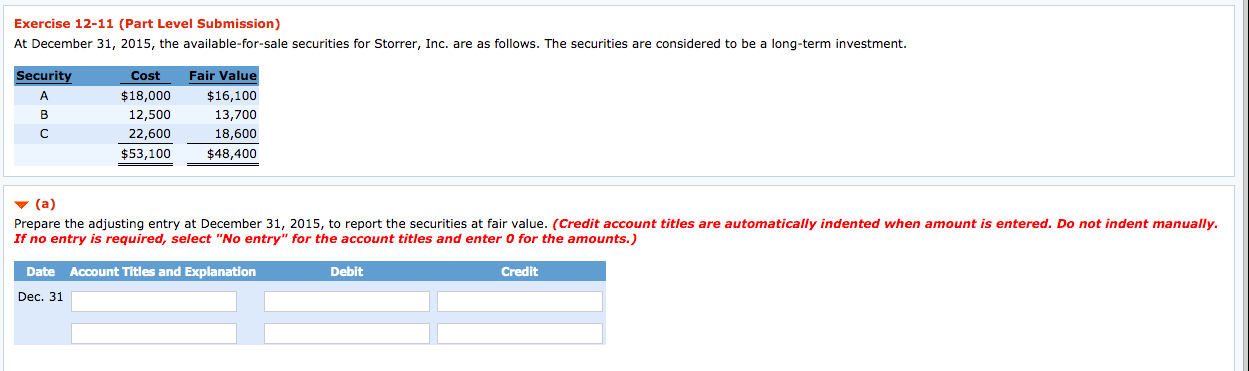

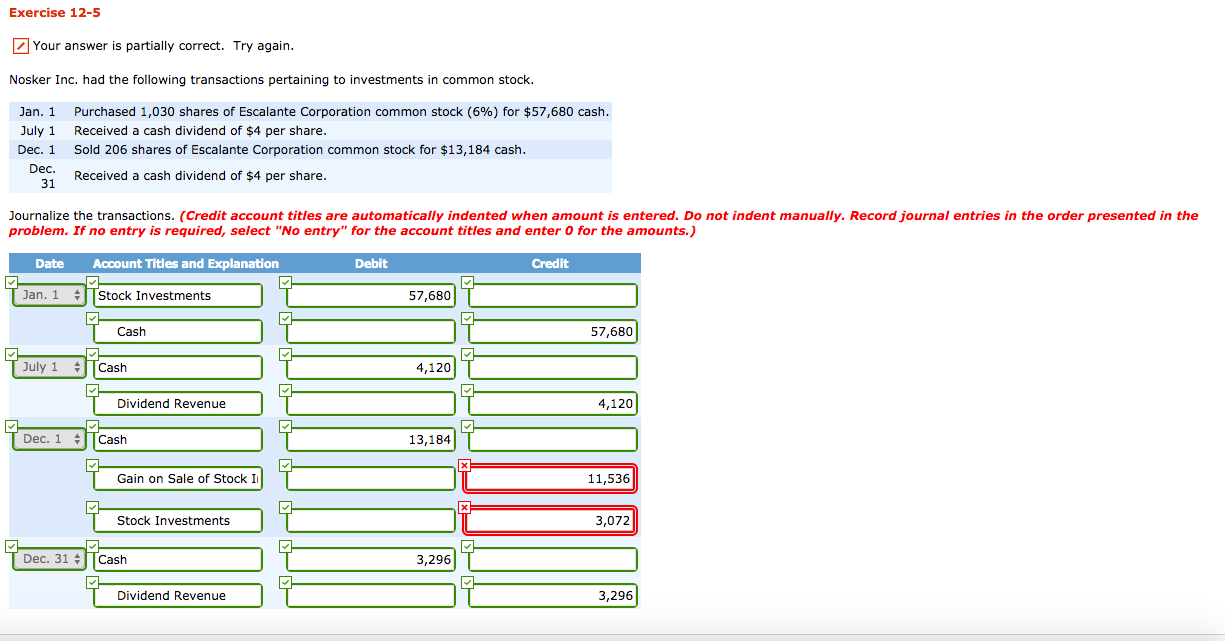

Exercise 12-7 (Part Level Submission) On January 1, Zabel Corporation purchased a 25% equity in Helbert Corporation for $186,500. At December 31, Helbert declared and paid a $52,100 cash dividend and reported net income of $195,000. (a) Journalize the transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit Jan. 1 Dec. 31 (To record dividends received) Dec. 31 (To record equity in Helbert Corporation's net income) Exercise 12-10 (Part Level Submission) At December 31, 2015, the trading securities for Storrer, Inc. are as follows. Security Cost $17,800 12,600 22,700 $53,100 Fair Value $16,200 14,400 18,700 $49,300 v (a) Prepare the adjusting entry at December 31, 2015, to report the securities at fair value. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter o for the amounts.) Debit Credit Date Account Titles and Explanation Dec. 31 Exercise 12-11 (Part Level Submission) At December 31, 2015, the available-for-sale securities for Storrer, Inc. are as follows. The securities are considered to be a long-term investment. Security Cost $18,000 12,500 22,600 $53,100 Fair Value $16,100 13,700 18,600 $48,400 Prepare the adjusting entry at December 31, 2015, to report the securities at fair value. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31 Exercise 12-5 Your answer is partially correct. Try again. Nosker Inc. had the following transactions pertaining to investments in common stock. Jan. 1 July 1 Dec. 1 Purchased 1,030 shares of Escalante Corporation common stock (6%) for $57,680 cash. Received a cash dividend of $4 per share. Sold 206 shares of Escalante Corporation common stock for $13,184 cash. Received a cash dividend of $4 per share. Journalize the transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. If no entry is required, select "No entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit Jan. 1 Stock Investments 57,680 Cash 57,680 July 1 Cash Dividend Revenue 4,120 Dec. 1 3 'Cash 13,184 T Gain on Sale of Stock Il 11,536 1 Stock Investments L 3,072 Dec. 31 - Tcash Dividend Revenue 3,296

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts