Question: 1. 2. 3. 4. please answer questions completely using multiple choice. Verano Inc. has two business divisions a software product line and a waste water

1.

2.

3.

4.

please answer questions completely using multiple choice.

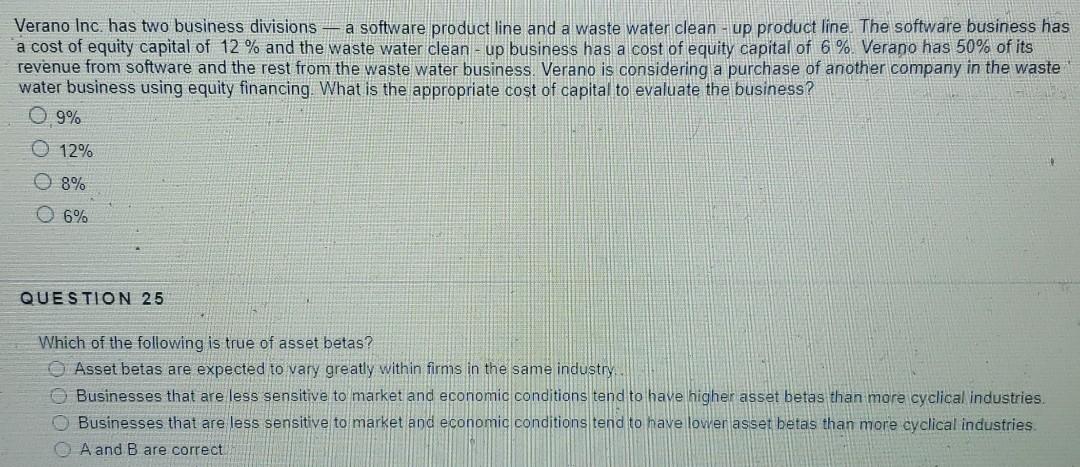

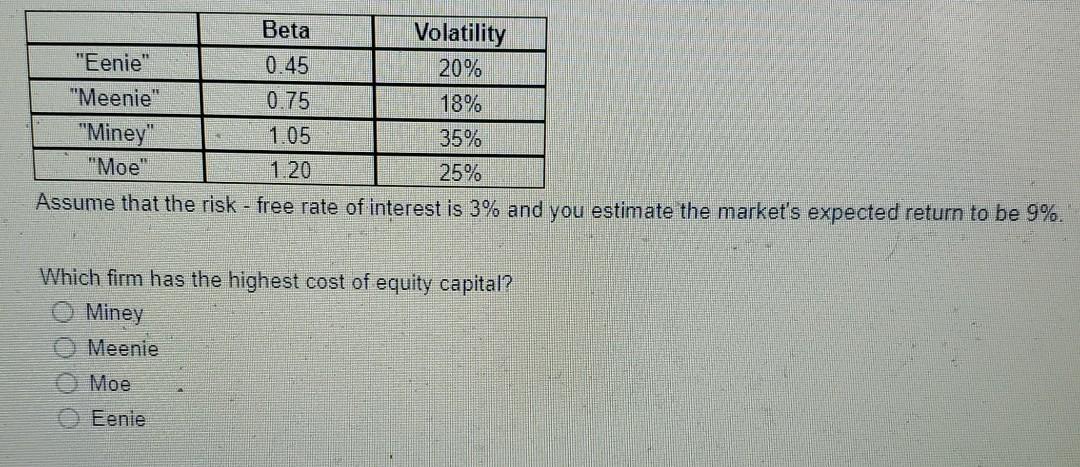

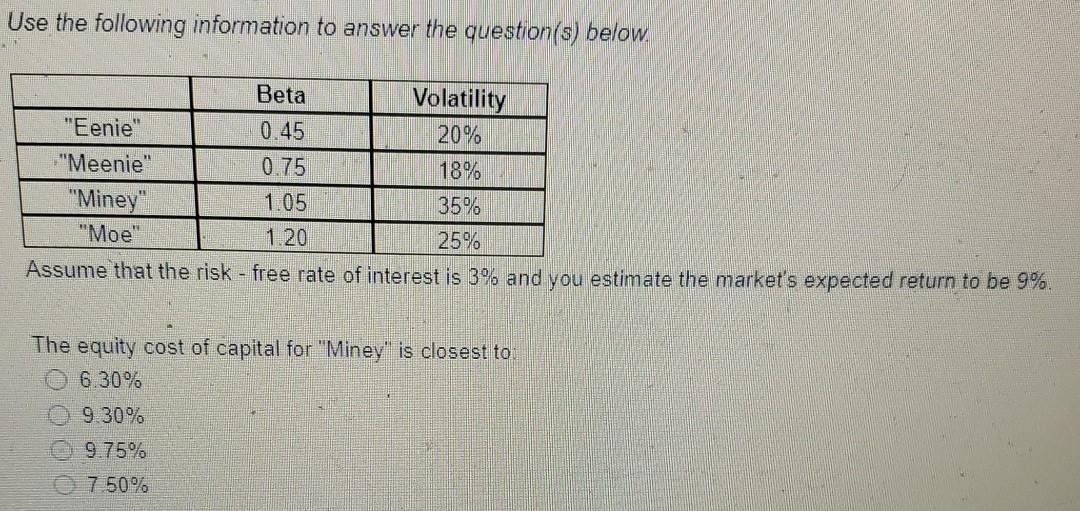

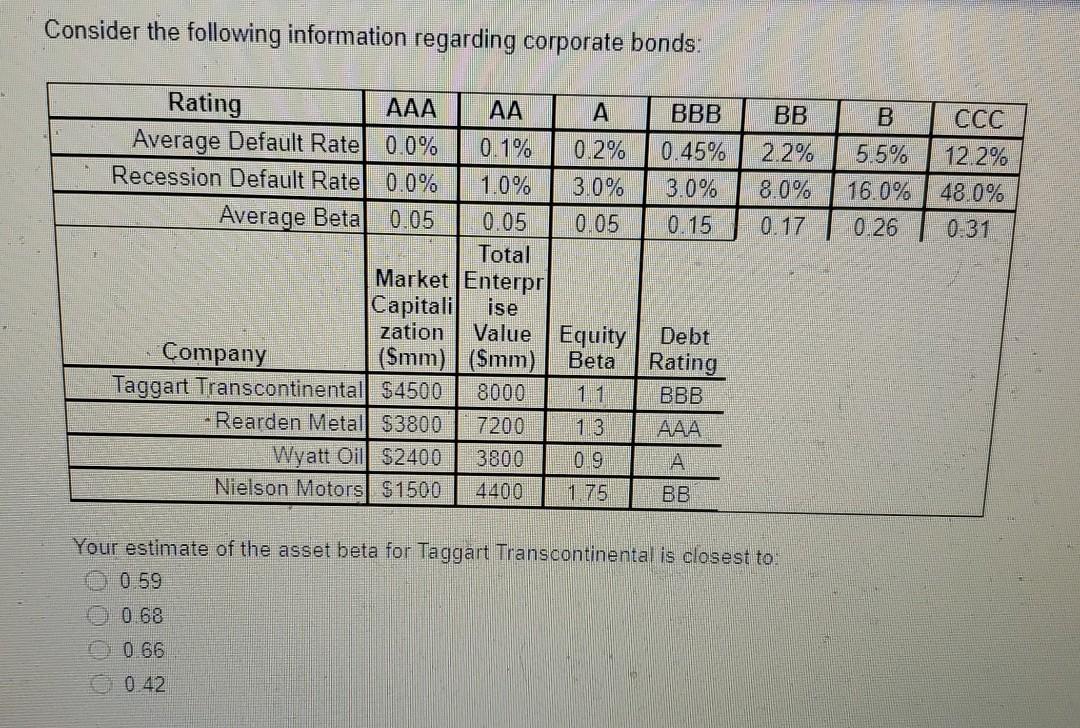

Verano Inc. has two business divisions a software product line and a waste water clean - up product line. The software business has a cost of equity capital of 12 % and the waste water clean - up business has a cost of equity capital of 6 %. Verano has 50% of its revenue from software and the rest from the waste water business. Verano is considering a purchase of another company in the waste water business using equity financing. What is the appropriate cost of capital to evaluate the business? 9% 12% 8% O 6% QUESTION 25 Which of the following is true of asset betas? Asset betas are expected to vary greatly within firms in the same industry Businesses that are less sensitive to market and economic conditions tend to have higher asset betas than more cyclical industries Businesses that are less sensitive to market and economic conditions tend to have lower asset betas than more cyclical industries A and B are correct Beta Volatility "Eenie" 0.45 20% "Meenie" 0.75 18% "Miney" 1.05 35% "Moe" 1.20 25% Assume that the risk - free rate of interest is 3% and you estimate the market's expected return to be 9%. Which firm has the highest cost of equity capital? Miney Meenie Moe Eenie Use the following information to answer the question(s) below. Beta Volatility "Eenie" 0.45 20% "Meenie 0.75 18% "Miney" 1.05 35% "Moe" 1.20 25% Assume that the risk - free rate of interest is 3% and you estimate the market's expected return to be 9%. The equity cost of capital for "Miney' is closest to 6.30% 9.30% 9.75% 7 50% Consider the following information regarding corporate bonds: BBB 0.45% 3.0% 0.15 BB 2.2% 8.0% 0.17 5.5% 16.0% 0.26 CCC 12 2% 48.0% 0.31 Rating AAA AA A Average Default Rate 0.0% 0.1% 0.2% Recession Default Rate 0.0% 1.0% 3.0% Average Beta 0.05 0.05 0.06 Total Market Enterpr Capitali ise zation Value Equity Company (Smm) (Smm) Beta Taggart Transcontinental $4500 8000 - Rearden Metal $3800 7200 1.3 Wyatt Oil $2400 3800 0.9 Nielson Motors S 1500 4400 1.75 Debt Rating BBB AAA A BB Your estimate of the asset beta for Taggart Transcontinental is closest to 0.59 0 68 10 66 0 42

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts