Question: 1. 2. 3. 4. Sheffield ple purchased a computer for 8,960 on January 1, 2021. Straight-line depreciation is used, based on a 5-year life and

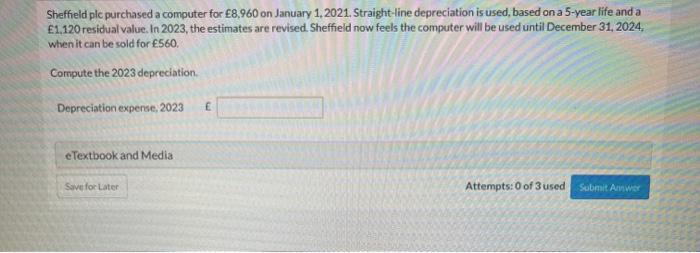

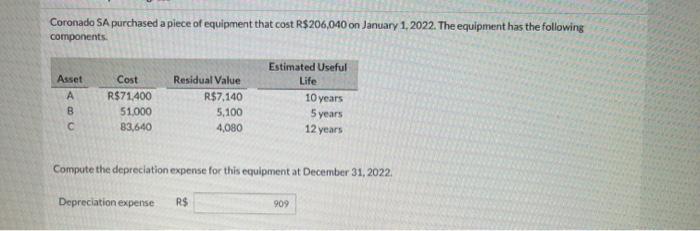

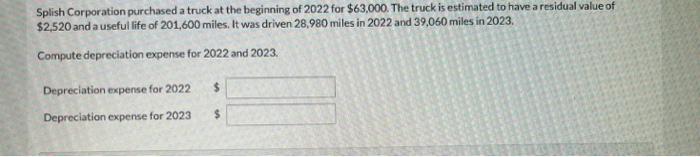

Sheffield ple purchased a computer for 8,960 on January 1, 2021. Straight-line depreciation is used, based on a 5-year life and a 1,120 residual value. In 2023, the estimates are revised. Sheffield now feels the computer will be used until December 31, 2024. when it can be sold for 560. Compute the 2023 depreciation Depreciation expense, 2023 E eTextbook and Media Save for Later Attempts: 0 of 3 used Submit Anw Coronado SA purchased a piece of equipment that cost R$206,040 on January 1, 2022. The equipment has the following components Asset B C Cost R$71.400 51,000 83,640 Residual Value R$7.140 5.100 4.080 Estimated Useful Life 10 years 5 years 12 years Compute the depreciation expense for this equipment at December 31, 2022 Depreciation expense R$ 909 Splish Corporation purchased a truck at the beginning of 2022 for $63,000. The truck is estimated to have a residual value of $2,520 and a useful life of 201,600 miles. It was driven 28,980 miles in 2022 and 39,060 miles in 2023. Compute depreciation expense for 2022 and 2023. Depreciation expense for 2022 Depreciation expense for 2023 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts