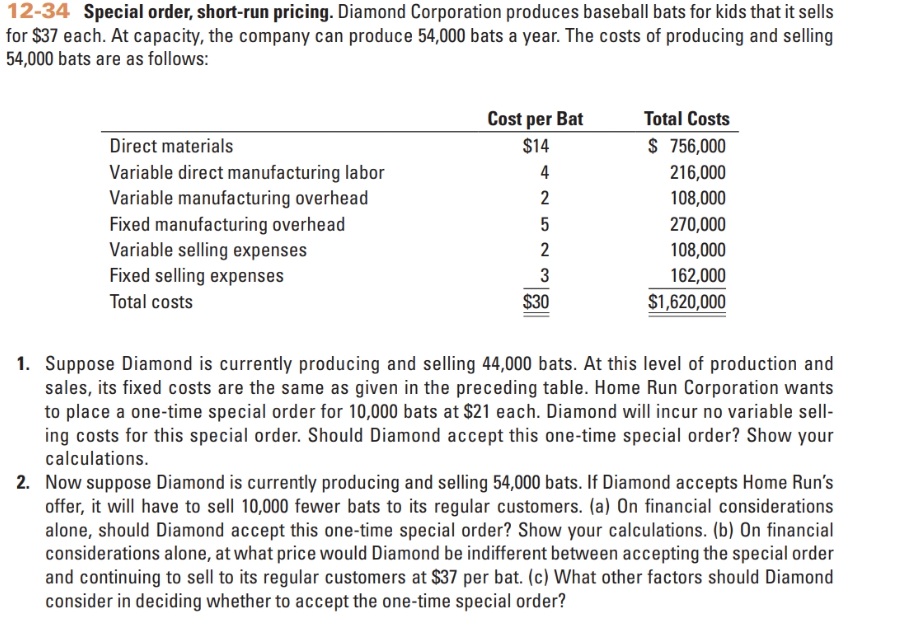

Question: 1 2 - 3 4 Special order, short - run pricing. Diamond Corporation produces baseball bats for kids that it sells for $ 3 7

Special order, shortrun pricing. Diamond Corporation produces baseball bats for kids that it sells for $ each. At capacity, the company can produce bats a year. The costs of producing and selling bats are as follows: Direct materials Variable direct manufacturing labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling expenses Fixed selling expenses Total costs Required Cost per Bat $ $ Total Costs $ $ Suppose Diamond is currently producing and selling bats. At this level of production and sales, its fixed costs are the same as given in the preceding table. Home Run Corporation wants to place a onetime special order for bats at $ each. Diamond will incur no variable selling costs for this special order. Should Diamond accept this onetime special order? Show your calculations. Now suppose Diamond is currently producing and selling bats. If Diamond accepts Home Runs offer, it will have to sell fewer bats to its regular customers. a On financial considerations alone, should Diamond accept this onetime special order? Show your calculations. b On financial considerations alone, at what price would Diamond be indifferent between accepting the special order and continuing to sell to its regular customers at $ per bat. c What other factors should Diamond consider in deciding whether to accept the onetime special order?

Closing down divisions. Ainsley Corporation has four operating divisions. The budgeted revenues and expenses for each division for follow:

Division A Sales Cost of goods sold

Selling, general, and administrative expenses Operating incomeloss

B

$ $

$

$ C D

$ $ $

$

Further analysis of costs reveals the following percentages of variable costs in each division: Cost of goods sold

Selling, general, and administrative expenses

Required

Closing down any division would result in savings of of the fixed costs of that division. Top management is very concerned about the unprofitable divisions A and B and is considering closing them for the year. Calculate the increase or decrease in operating income if Ainsley closes division A Calculate the increase or decrease in operating income if Ainsley closes division B What other factors should the top management of Ainsley consider before making a decision?

Please show all calculations for both problems.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock