Question: 1. 2. 3. 4. True (T) or False (F) (5 points each). Do NOT include an explanation. The liability of sole proprietors is limited to

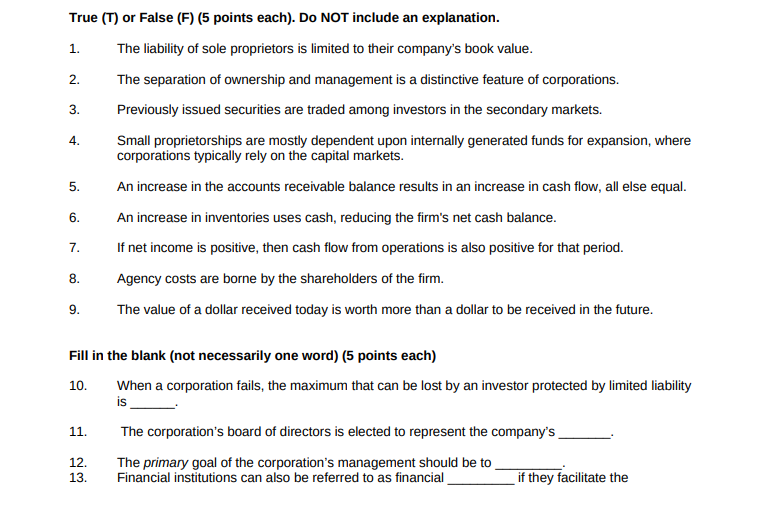

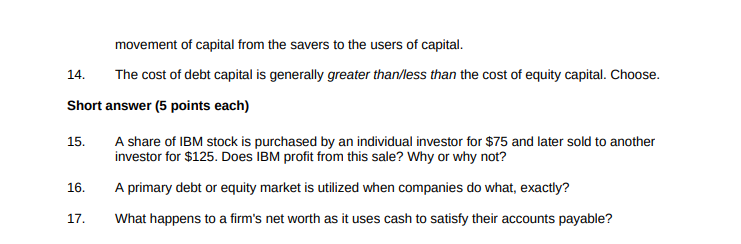

1. 2. 3. 4. True (T) or False (F) (5 points each). Do NOT include an explanation. The liability of sole proprietors is limited to their company's book value. The separation of ownership and management is a distinctive feature of corporations. Previously issued securities are traded among investors in the secondary markets. Small proprietorships are mostly dependent upon internally generated funds for expansion, where corporations typically rely on the capital markets. An increase in the accounts receivable balance results in an increase in cash flow, all else equal. An increase in inventories uses cash, reducing the firm's net cash balance. 7. If net income is positive, then cash flow from operations is also positive for that period. 8. Agency costs are borne by the shareholders of the firm. 9. The value of a dollar received today is worth more than a dollar to be received in the future. 5. 6. Fill in the blank (not necessarily one word) (5 points each) When a corporation fails, the maximum that can be lost by an investor protected by limited liability is 10. 11. The corporation's board of directors is elected to represent the company's 12. 13. The primary goal of the corporation's management should be to Financial institutions can also be referred to as financial if they facilitate the 14. movement of capital from the savers to the users of capital. The cost of debt capital is generally greater than/less than the cost of equity capital. Choose. Short answer (5 points each) 15. A share of IBM stock is purchased by an individual investor for $75 and later sold to another investor for $125. Does IBM profit from this sale? Why or why not? 16. A primary debt or equity market is utilized when companies do what, exactly? What happens to a firm's net worth as it uses cash to satisfy their accounts payable? 17

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts