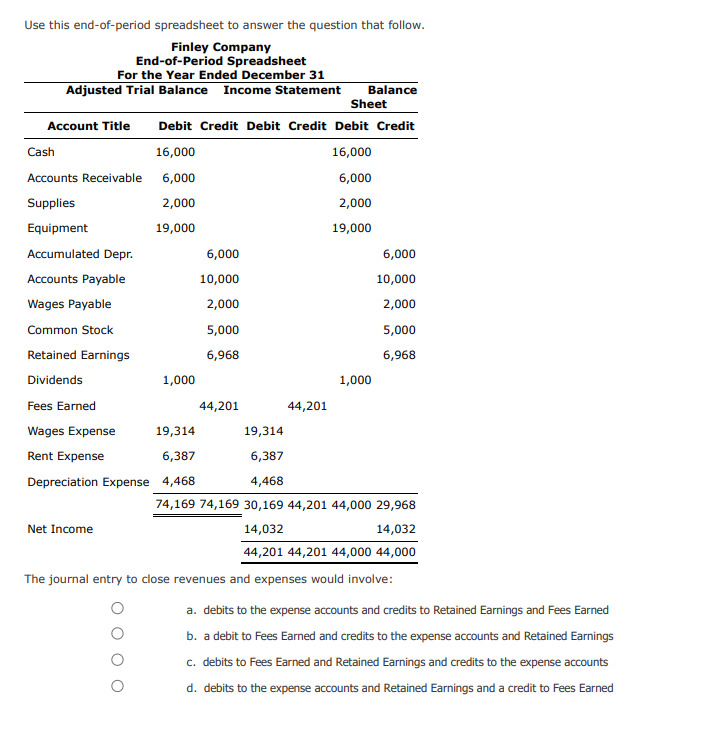

Question: 1 - 2- 3- 4- Use this end-of-period spreadsheet to answer the question that follow. Finley Company End-of-Period Spreadsheet For the Year Ended December 31

1 -

2-

3-

4-

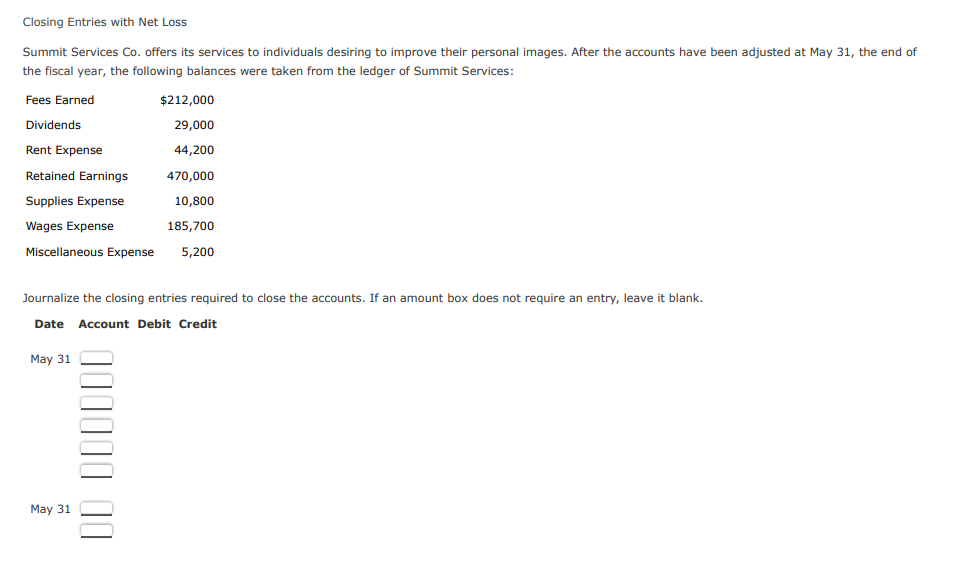

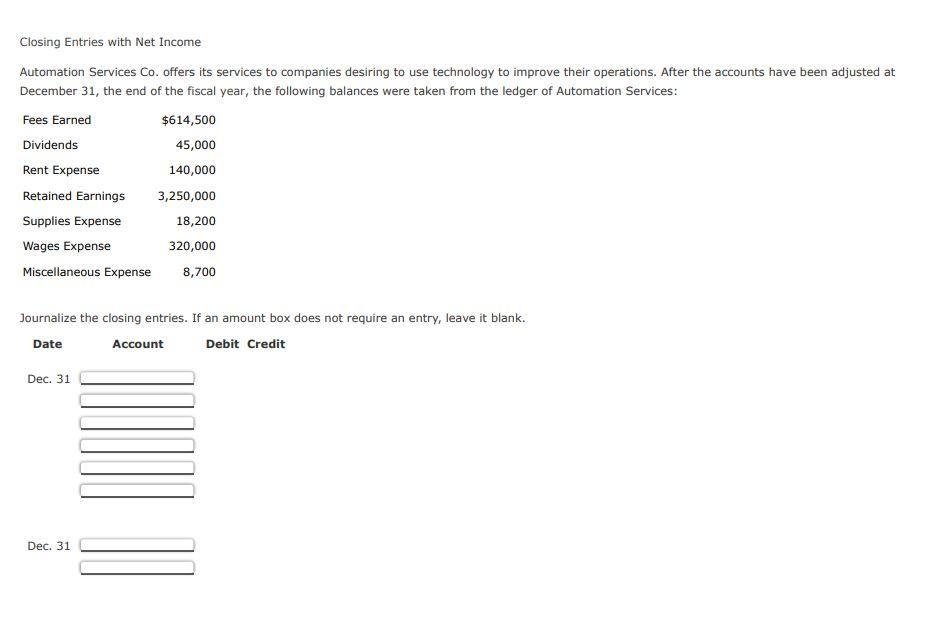

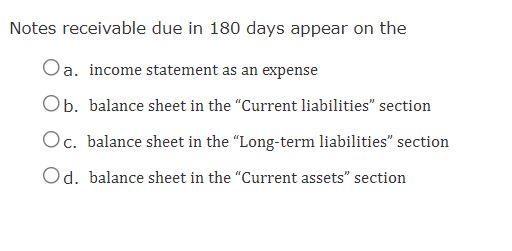

Use this end-of-period spreadsheet to answer the question that follow. Finley Company End-of-Period Spreadsheet For the Year Ended December 31 Adjusted Trial Balance Income Statement Balance Sheet Account Title Debit Credit Debit Credit Debit Credit Cash 16,000 16,000 Accounts Receivable 6,000 6,000 Supplies 2,000 2,000 Equipment 19,000 19,000 Accumulated Depr. Accounts Payable Wages Payable Common Stock Retained Earnings Dividends 1,000 Fees Earned 44,201 Wages Expense 19,314 19,314 Rent Expense 6,387 6,387 Depreciation Expense 4,468 4,468 74,169 74,169 30,169 44,201 44,000 29,968 Net Income 14,032 14,032 44,201 44,201 44,000 44,000 The journal entry to close revenues and expenses would involve: a. debits to the expense accounts and credits to Retained Earnings and Fees Earned b. a debit to Fees Earned and credits to the expense accounts and Retained Earnings c. debits to Fees Earned and Retained Earnings and credits to the expense accounts d. debits to the expense accounts and Retained Earnings and a credit to Fees Earned 6,000 10,000 2,000 5,000 6,968 44,201 1,000 6,000 10,000 2,000 5,000 6,968 Closing Entries with Net Loss Summit Services Co. offers its services to individuals desiring to improve their personal images. After the accounts have been adjusted at May 31, the end of the fiscal year, the following balances were taken from the ledger of Summit Services: Fees Earned $212,000 29,000 Dividends Rent Expense 44,200 Retained Earnings 470,000 Supplies Expense 10,800 Wages Expense 185,700 Miscellaneous Expense 5,200 Journalize the closing entries required to close the accounts. If an amount box does not require an entry, leave it blank. Date Account Debit Credit May 31 May 31 DD DD Closing Entries with Net Income Automation Services Co. offers its services to companies desiring to use technology to improve their operations. After the accounts have been adjusted at December 31, the end of the fiscal year, the following balances were taken from the ledger of Automation Services: Fees Earned $614,500 Dividends 45,000 Rent Expense 140,000 Retained Earnings 3,250,000 Supplies Expense 18,200 Wages Expense 320,000 Miscellaneous Expense 8,700 Journalize the closing entries. If an amount box does not require an entry, leave it blank. Date Account Debit Credit Dec. 31 Dec. 31 Notes receivable due in 180 days appear on the Oa. income statement as an expense Ob. balance sheet in the "Current liabilities" section Oc. balance sheet in the "Long-term liabilities" section Od. balance sheet in the "Current assets

Step by Step Solution

There are 3 Steps involved in it

Closing Journal Entries 1 Finley Company For Finley Company the closing entry involves closing reven... View full answer

Get step-by-step solutions from verified subject matter experts