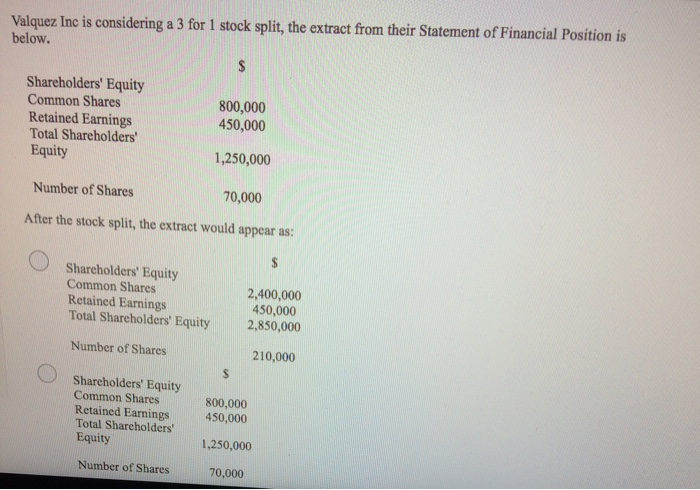

Question: 1 2 3 4 Valquez Inc is considering a 3 for 1 stock split, the extract from their Statement of Financial Position is below. $

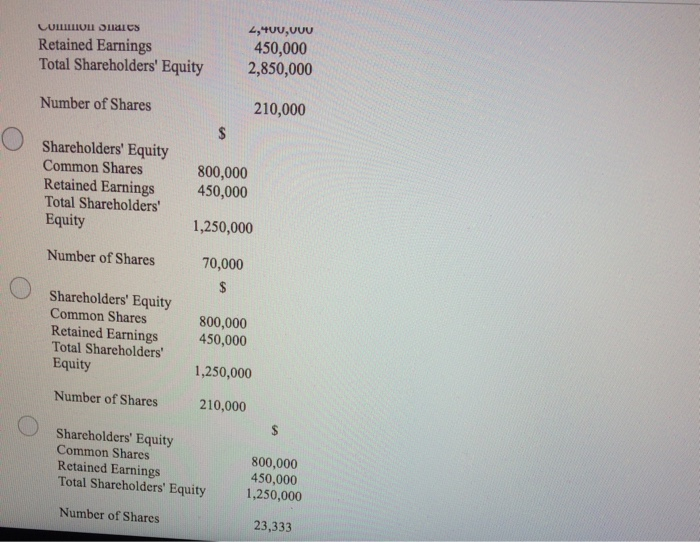

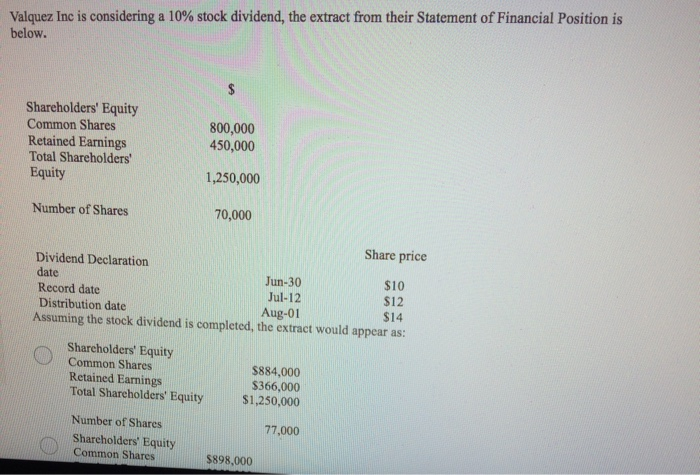

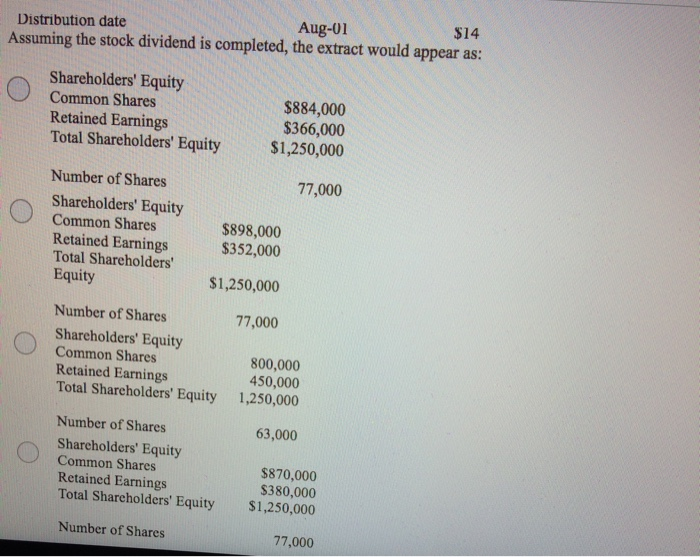

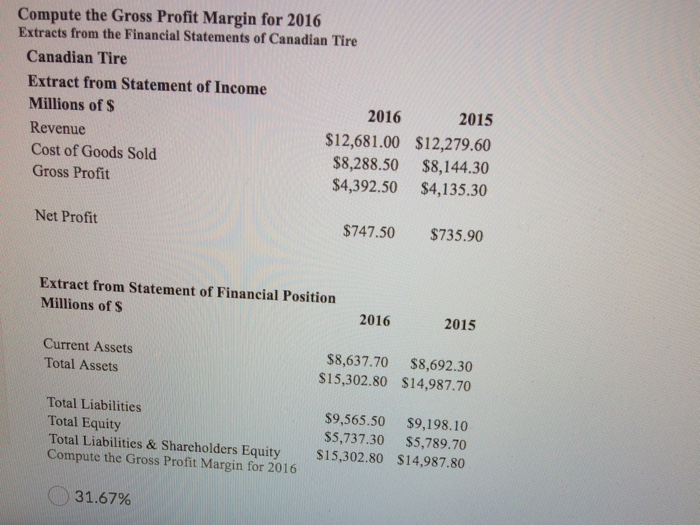

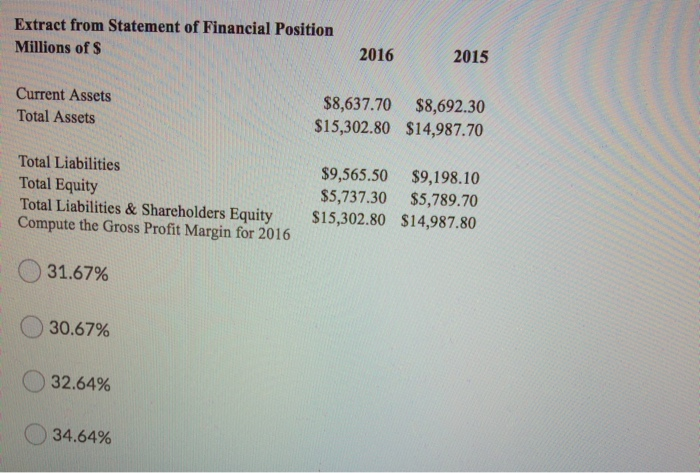

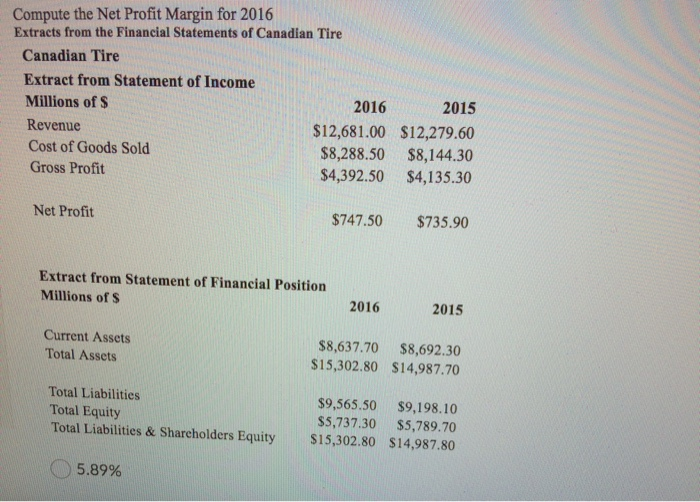

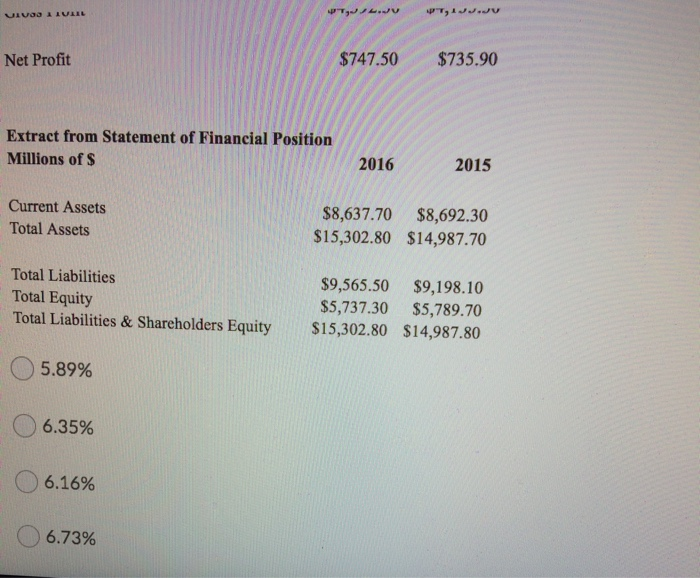

Valquez Inc is considering a 3 for 1 stock split, the extract from their Statement of Financial Position is below. $ Shareholders' Equity Common Shares Retained Earnings Total Shareholders' Equity 800,000 450,000 1,250,000 Number of Shares 70,000 After the stock split, the extract would appear as: $ Shareholders' Equity Common Shares Retained Earnings Total Shareholders' Equity 2,400,000 450,000 2,850,000 Number of Shares 210,000 S Shareholders' Equity Common Shares Retained Earnings Total Shareholders' Equity 800,000 450,000 1,250,000 Number of Shares 70,000 LUMILLIOLI SIIS Retained Earnings Total Shareholders' Equity 2,400,000 450,000 2,850,000 Number of Shares 210,000 $ Shareholders' Equity Common Shares Retained Earnings Total Shareholders' Equity 800,000 450,000 1,250,000 Number of Shares 70,000 $ Shareholders' Equity Common Shares Retained Earnings Total Shareholders' Equity 800,000 450,000 1,250,000 Number of Shares 210,000 Shareholders' Equity Common Shares Retained Earnings Total Shareholders' Equity 800,000 450,000 1,250,000 Number of Shares 23,333 Valquez Inc is considering a 10% stock dividend, the extract from their Statement of Financial Position is below. $ Shareholders' Equity Common Shares Retained Earnings Total Shareholders' Equity 800,000 450,000 1,250,000 Number of Shares 70,000 Share price Dividend Declaration date Jun-30 $10 Record date Jul-12 $12 Distribution date Aug-01 $14 Assuming the stock dividend is completed, the extract would appear as: Shareholders' Equity Common Shares $884,000 Retained Earnings $366,000 Total Shareholders' Equity $1,250,000 Number of Shares Shareholders' Equity Common Shares 77,000 $898,000 Distribution date Aug-01 $14 Assuming the stock dividend is completed, the extract would appear as: Shareholders' Equity Common Shares Retained Earnings Total Shareholders' Equity $884,000 $366,000 $1,250,000 77,000 Number of Shares Shareholders' Equity Common Shares Retained Earnings Total Shareholders Equity $898,000 $352,000 $1,250,000 77,000 Number of Shares Shareholders' Equity Common Shares Retained Earnings Total Shareholders' Equity 800,000 450,000 1,250,000 63,000 Number of Shares Shareholders' Equity Common Shares Retained Earnings Total Shareholders' Equity $870,000 $380,000 $1,250,000 Number of Shares 77,000 Compute the Gross Profit Margin for 2016 Extracts from the Financial Statements of Canadian Tire Canadian Tire Extract from Statement of Income Millions of s 2016 2015 Revenue $12,681.00 $12,279.60 Cost of Goods Sold $8,288.50 $8,144.30 Gross Profit $4,392.50 $4,135.30 Net Profit $747.50 $735.90 Extract from Statement of Financial Position Millions of s 2016 2015 Current Assets Total Assets $8,637.70 $8,692.30 $15,302.80 $14,987.70 Total Liabilities Total Equity Total Liabilities & Shareholders Equity Compute the Gross Profit Margin for 2016 $9,565.50 $9,198.10 $5,737.30 $5,789.70 $15,302.80 $14,987.80 31.67% Extract from Statement of Financial Position Millions of $ 2016 2015 Current Assets Total Assets $8,637.70 $8,692.30 $15,302.80 $14,987.70 Total Liabilities Total Equity Total Liabilities & Shareholders Equity Compute the Gross Profit Margin for 2016 $9,565.50 $9,198.10 $5,737.30 $5,789.70 $15,302.80 $14,987.80 31.67% 30.67% 32.64% 34.64% Compute the Net Profit Margin for 2016 Extracts from the Financial Statements of Canadian Tire Canadian Tire Extract from Statement of Income Millions of $ 2016 2015 Revenue $12,681.00 $12,279.60 Cost of Goods Sold $8,288.50 $8,144.30 Gross Profit $4,392.50 $4,135.30 Net Profit $747.50 $735.90 Extract from Statement of Financial Position Millions of 2016 2015 Current Assets Total Assets $8,637.70 $8,692.30 $15,302.80 $14,987.70 Total Liabilities Total Equity Total Liabilities & Shareholders Equity $9,565.50 $9,198.10 $5,737.30 $5,789.70 $15,302.80 $14,987.80 5.89% UGG LLULL Net Profit $747.50 $735.90 Extract from Statement of Financial Position Millions of $ 2016 2015 Current Assets Total Assets $8,637.70 $8,692.30 $15,302.80 $14,987.70 Total Liabilities Total Equity Total Liabilities & Shareholders Equity $9,565.50 $9,198.10 $5,737.30 $5,789.70 $15,302.80 $14,987.80 5.89% 6.35% 6.16% 6.73%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts