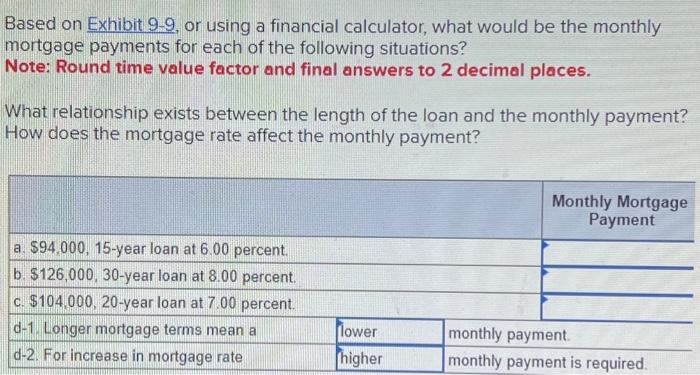

Question: 1 2 3 Based on Exhibit 9-9, or using a financial calculator, what would be the monthly mortgage payments for each of the following situations?

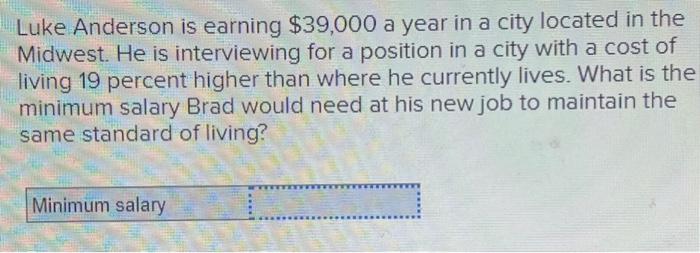

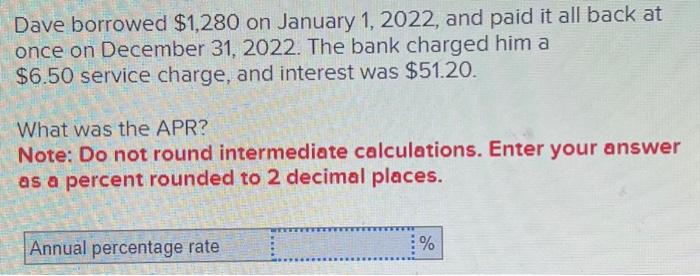

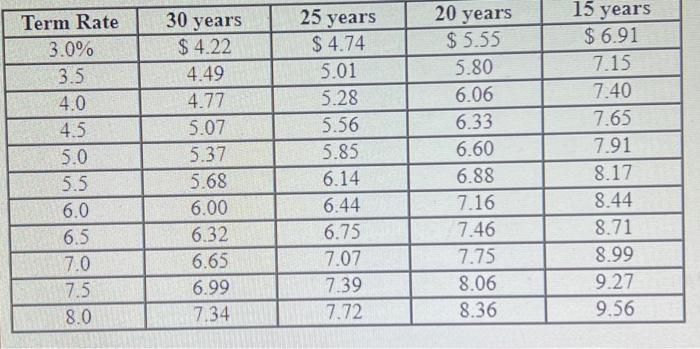

Based on Exhibit 9-9, or using a financial calculator, what would be the monthly mortgage payments for each of the following situations? Note: Round time value factor and final answers to 2 decimal places. What relationship exists between the length of the loan and the monthly payment? How does the mortgage rate affect the monthly payment? \begin{tabular}{|c|c|c|c|c|} \hline Term Rate & 30 years & 25 years & 20 years & 15 years \\ \hline 3.0% & $4.22 & $4.74 & $5.55 & $6.91 \\ \hline 3.5 & 4.49 & 5.01 & 5.80 & 7.15 \\ \hline 4.0 & 4.77 & 5.28 & 6.06 & 7.40 \\ \hline 4.5 & 5.07 & 5.56 & 6.33 & 7.65 \\ \hline 5.0 & 5.37 & 5.85 & 6.60 & 7.91 \\ \hline 5.5 & 5.68 & 6.14 & 6.88 & 8.17 \\ \hline 6.0 & 6.00 & 6.44 & 7.16 & 8.44 \\ \hline 6.5 & 6.32 & 6.75 & 7.46 & 8.71 \\ \hline 7.0 & 6.65 & 7.07 & 7.75 & 8.99 \\ \hline 7.5 & 6.99 & 7.39 & 8.06 & 9.27 \\ \hline 8.0 & 7.34 & 7.72 & 8.36 & 9.56 \\ \hline \end{tabular} Dave borrowed $1,280 on January 1,2022 , and paid it all back at once on December 31, 2022. The bank charged him a $6.50 service charge, and interest was $51.20. What was the APR? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Luke Anderson is earning $39,000 a year in a city located in the Midwest. He is interviewing for a position in a city with a cost of living 19 percent higher than where he currently lives. What is the minimum salary Brad would need at his new job to maintain the same standard of living

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts