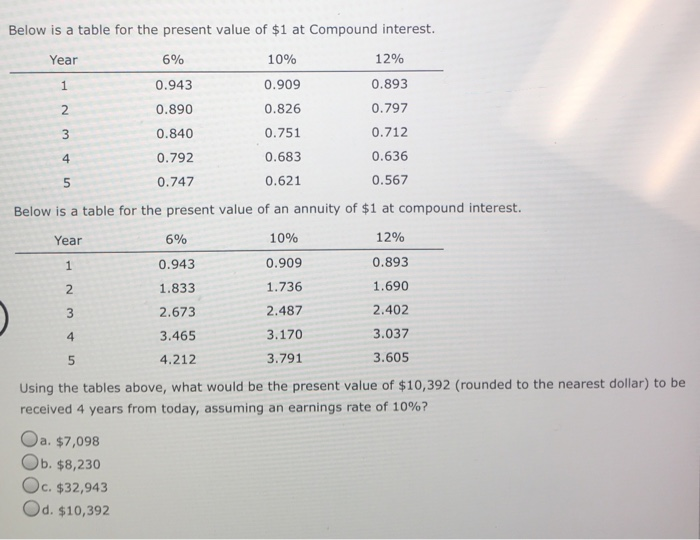

Question: 1) 2) 3) Below is a table for the present value of $1 at Compound interest. 10% 0.909 0.826 0.751 0.683 0.621 12% 0.893 0.797

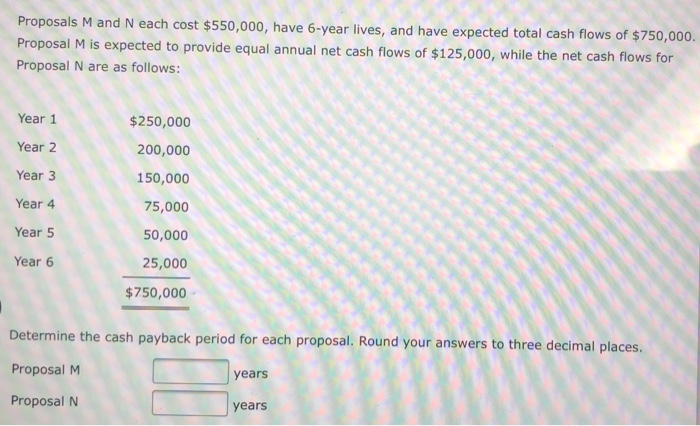

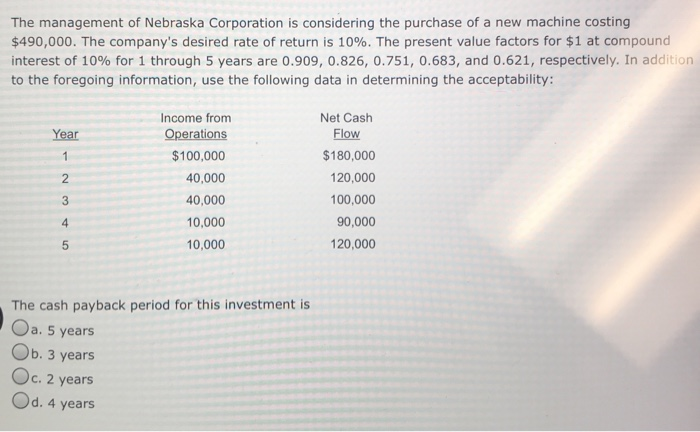

Below is a table for the present value of $1 at Compound interest. 10% 0.909 0.826 0.751 0.683 0.621 12% 0.893 0.797 0.712 0.636 0.567 6% 0.943 0.890 0.840 0.792 0.747 Year 2 4 5 Below is a table for the present value of an annuity of $1 at compound interest. 12% 0.893 1.690 2.402 3.037 3.605 10% 0.909 1.736 2.487 3.170 3.791 6% 0.943 1.833 2.673 3.465 4.212 Year 4 Using the tables above, what would be the present value of $10,392 (rounded to the nearest dollar) to be received 4 years from today, assuming an earnings rate of 10%? Oa. $7,098 Ob. $8,230 . $32,943 Od. $10,392 Proposals M and N each cost $550,000, have 6-year lives, and have expected total cash flows of $750,000. Proposal M is expected to provide equal annual net cash flows of $125,000, while the net cash Proposal N are as follows flows for Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 $250,000 200,000 150,000 75,000 50,000 25,000 $750,000 Determine the cash payback period for each proposal. Round your answers to three decimal places ProposalM ProposalN years years The management of Nebraska Corporation is considering the purchase of a new machine costing $490,000. The company's desired rate of return is 10%. The present value factors for $1 at compound interest of 10% for 1 through 5 years are 0.909, 0.826, 0.751, 0.683, and 0.621, respectively. In addition to the foregoing information, use the following data in determining the acceptability Income from Net Cash Flow Year perations $100,000 40,000 40,000 10,000 10,000 $180,000 120,000 100,000 90,000 120,000 3 4 The cash payback period for this investment is Oa. 5 years Ob. 3 years Oc. 2 years Od. 4 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts