Question: 1. 2. 3. Compute the MIRR static for Project I if the appropriate cost of capital is 12 percent. (Do not round intermediate calculations and

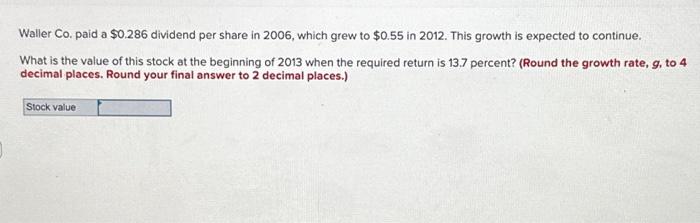

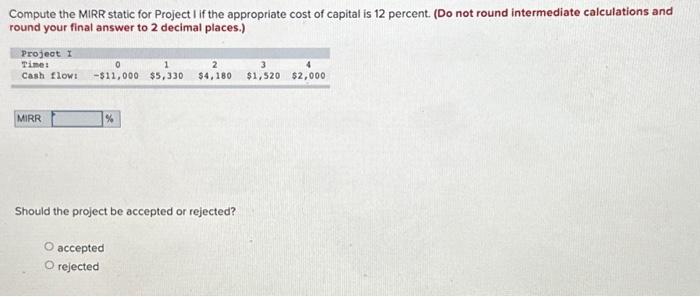

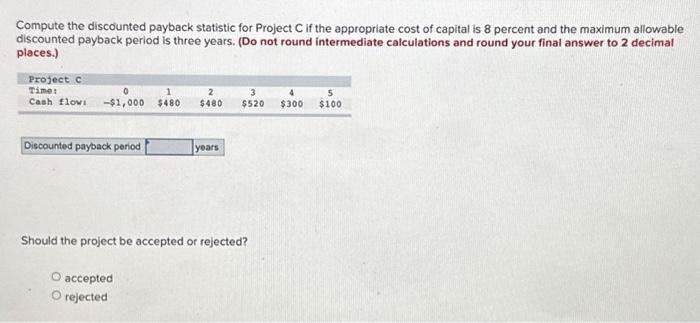

Compute the MIRR static for Project I if the appropriate cost of capital is 12 percent. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Should the project be accepted or rejected? accepted rejected Waller Co. paid a \\( \\$ 0.286 \\) dividend per share in 2006 , which grew to \\( \\$ 0.55 \\) in 2012 . This growth is expected to continue. What is the value of this stock at the beginning of 2013 when the required return is 13.7 percent? (Round the growth rate, \\( g \\), to 4 decimal places. Round your final answer to 2 decimal places.) Compute the discounted payback statistic for Project \\( \\mathrm{C} \\) if the appropriate cost of capital is 8 percent and the maximum allowable discounted payback period is three years. (Do not round intermediate calculations and round your final answer to \\( \\mathbf{2} \\) decimal places.) Should the project be accepted or rejected? accepted rejected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts