Question: 1. 2. 3. Do not do any interim rounding, calculate values to at least 6 decimal places before converting to a percentage, state answers as

1.

2.

3.

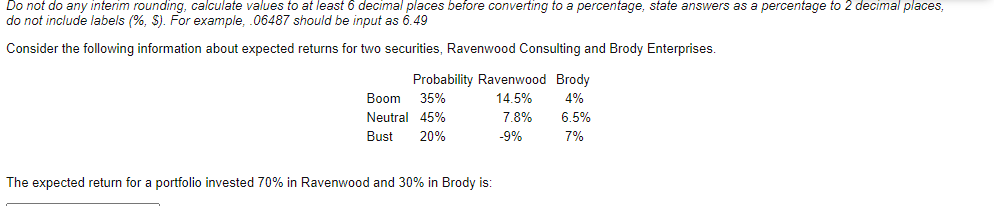

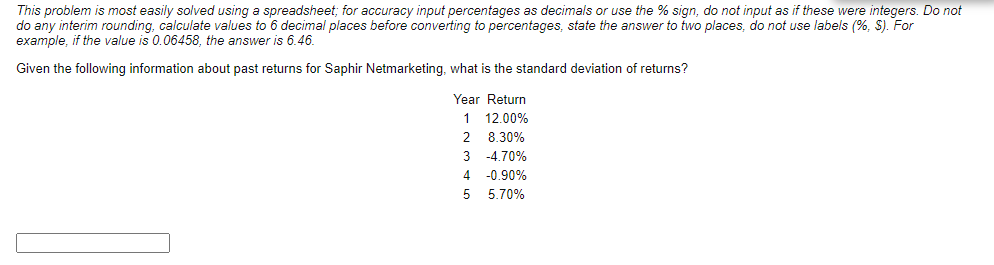

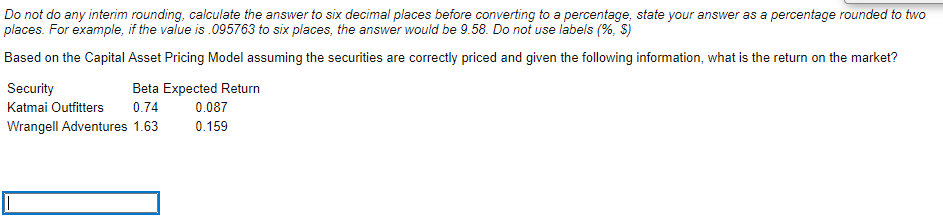

Do not do any interim rounding, calculate values to at least 6 decimal places before converting to a percentage, state answers as a percentage to 2 decimal places, do not include labels (%, $). For example, 06487 should be input as 6.49 Consider the following information about expected returns for two securities, Ravenwood Consulting and Brody Enterprises. Probability Ravenwood Brody Boom 35% 14.5% 4% Neutral 45% 7.8% 6.5% Bust 20% -9% 7% The expected return for a portfolio invested 70% in Ravenwood and 30% in Brody is: This problem is most easily solved using a spreadsheet, for accuracy input percentages as decimals or use the % sign, do not input as if these were integers. Do not do any interim rounding, calculate values to 6 decimal places before converting to percentages, state the answer to two places, do not use labels (%, $). For example, if the value is 0.06458, the answer is 6.46. Given the following information about past returns for Saphir Netmarketing, what is the standard deviation of returns? Year Return 1 12.00% 2 8.30% 3 -4.70% 4 -0.90% 5 5.70% Do not do any interim rounding, calculate the answer to six decimal places before converting to a percentage, state your answer as a percentage rounded to two places. For example, if the value is 095763 to six places, the answer would be 9.58. Do not use labels (% S) Based on the Capital Asset Pricing Model assuming the securities are correctly priced and given the following information, what is the return on the market? Security Beta Expected Return Katmai Outfitters 0.74 0.087 Wrangell Adventures 1.63 0.159

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts