Question: 1. 2. 3. please answer questions completely. Given the following information for ONAIR Co., find the WACC. Assume the company's tax rate is 35 percent.

1.

2.

3.

please answer questions completely.

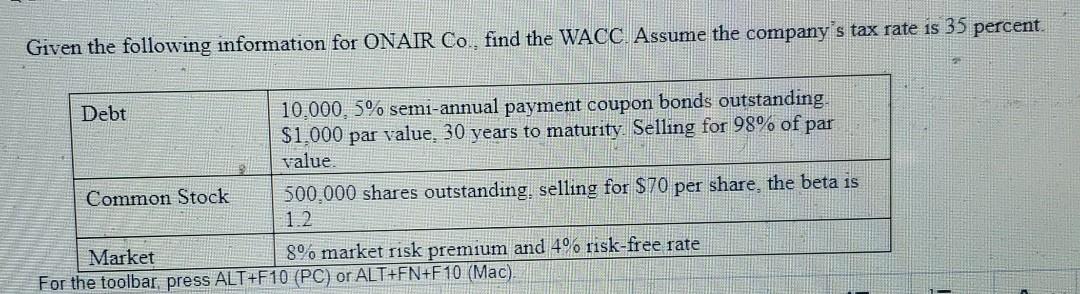

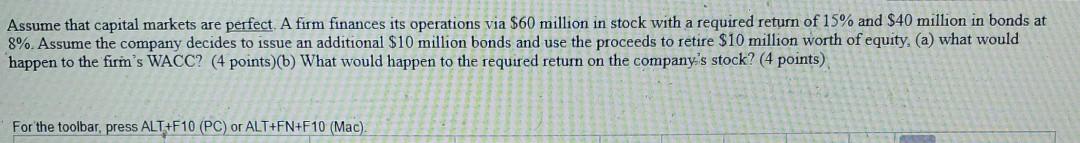

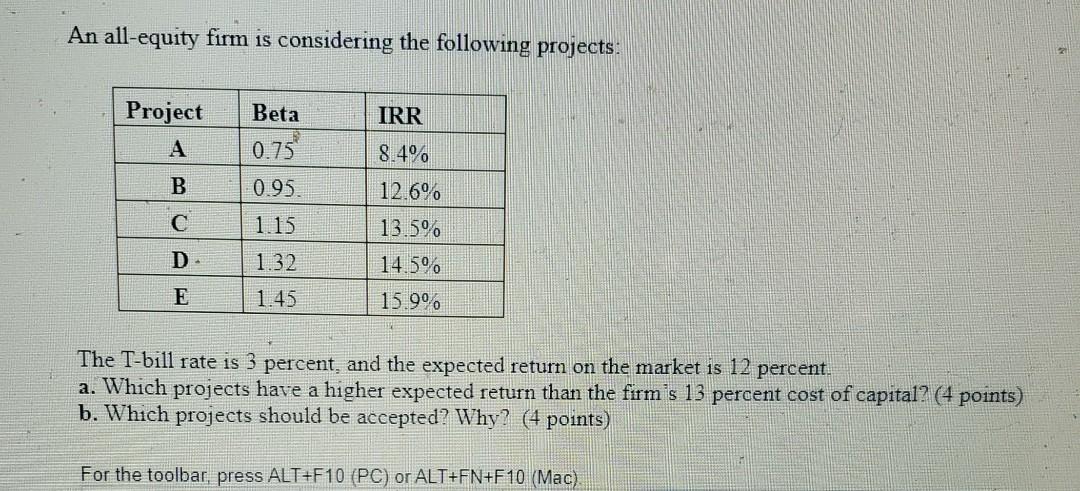

Given the following information for ONAIR Co., find the WACC. Assume the company's tax rate is 35 percent. Debt 10,000, 5% semi-annual payment coupon bonds outstanding. $1.000 par value. 30 years to maturity. Selling for 98% of par value Common Stock 500.000 shares outstanding, selling for $70 per share the beta is 1.2 Market 8% market risk premium and 4% risk-free rate For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac) IN Assume that capital markets are perfect. A firm finances its operations via $60 million in stock with a required return of 15% and $40 million in bonds at 8%. Assume the company decides to issue an additional $10 million bonds and use the proceeds to retire $10 million worth of equity, (a) what would happen to the firm's WACC? (4 points)(b) What would happen to the required return on the company's stock? (4 points) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). An all-equity firm is considering the following projects: Project IRR Beta 0.75 8.4% B 0.95. C 1.15 12.6% 13.5% 14.5% D 1.32 E 1.45 15.99 The T-bill rate is 3 percent, and the expected return on the market is 12 percent. a. Which projects have a higher expected return than the firm's 13 percent cost of capital? (4 points) b. Which projects should be accepted? Why? (4 points) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts