Question: 1. 2. 3. Please answer step by step clearly and check comments later in case something is wrong. THANK YOU. Productivity Measurement, Technical and Allocative

1.

2.

3.

Please answer step by step clearly and check comments later in case something is wrong. THANK YOU.

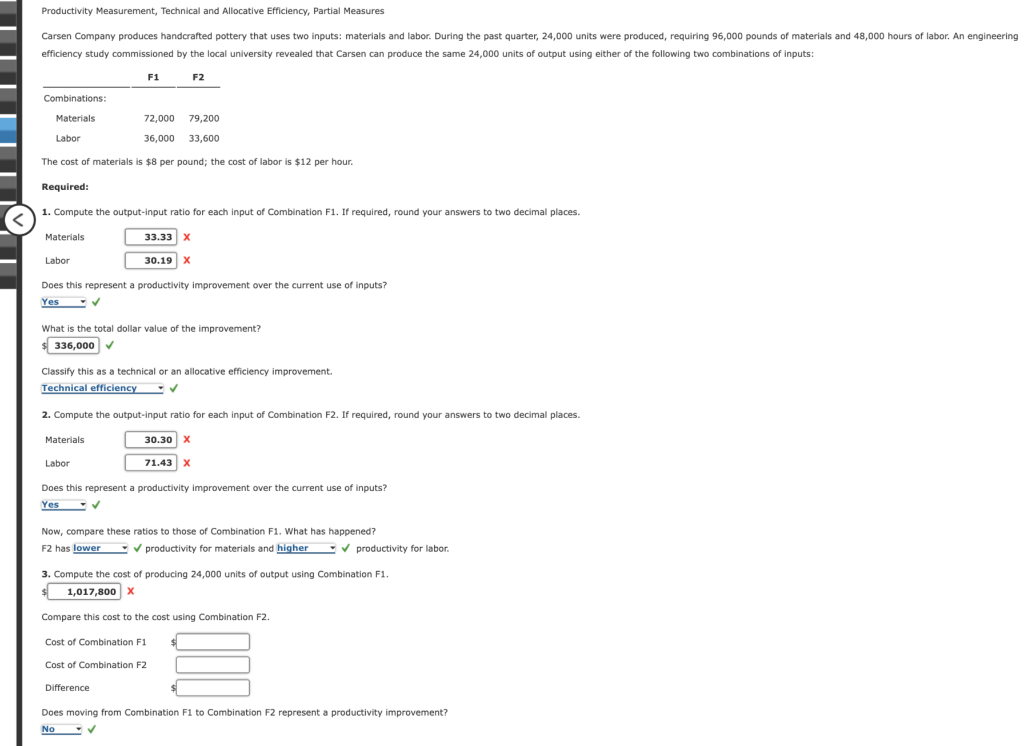

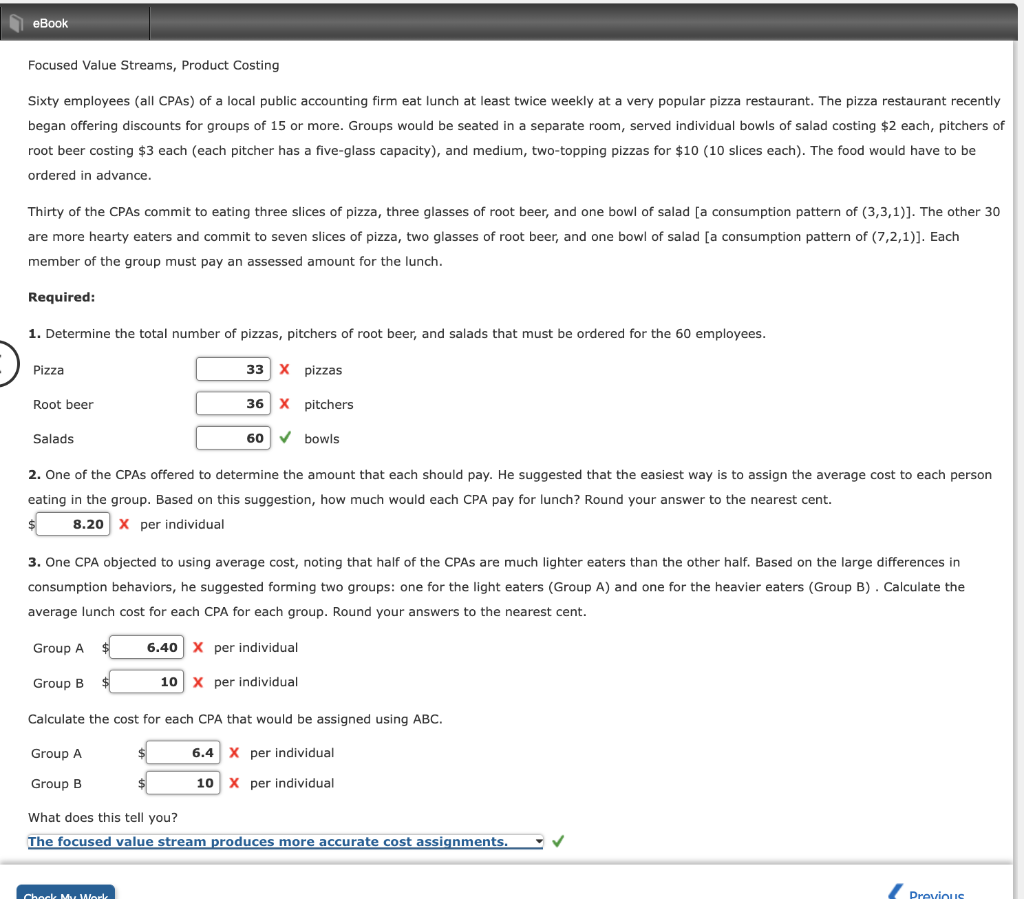

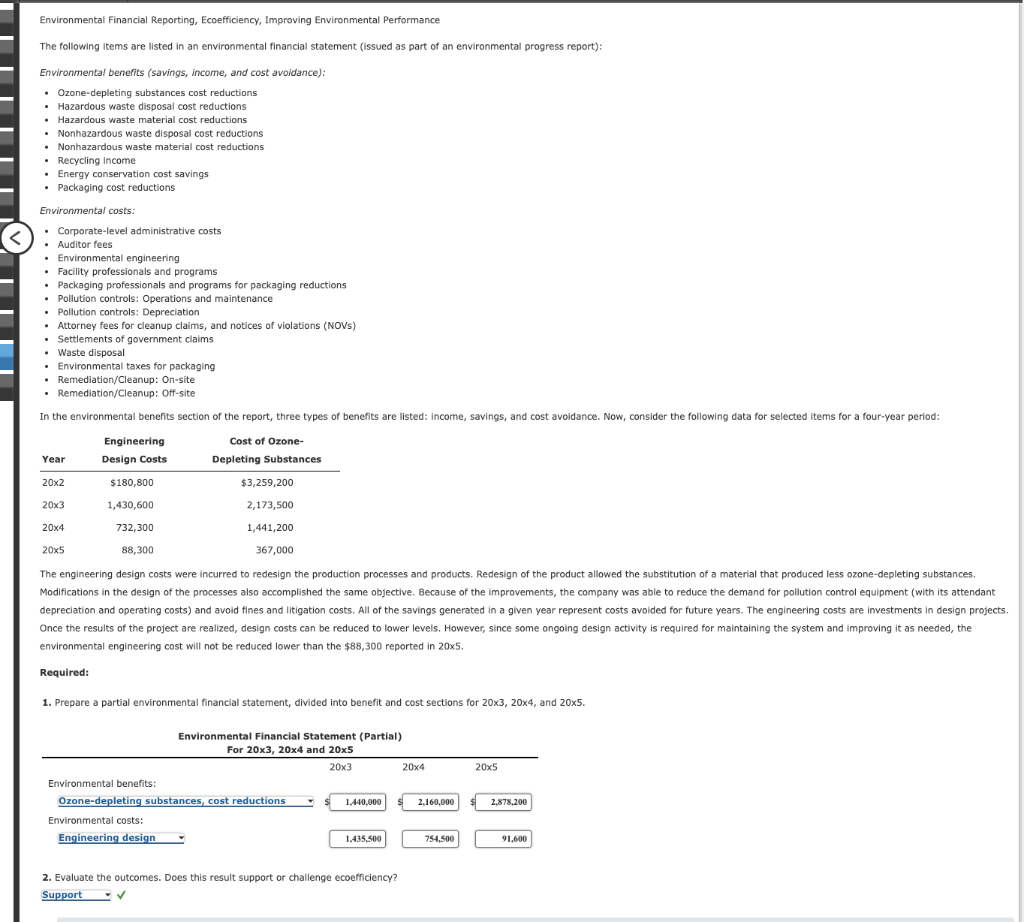

Productivity Measurement, Technical and Allocative Efficiency, Partial Measures , Carsen Company produces handcrafted pottery that uses two inputs: materials and labor. During the past quarter, 24,000 units were produced, requiring 96,000 pounds of materials and 48,000 hours of labor. An engineering efficiency study commissioned by the local university revealed that Carsen can produce the same 24,000 units of output using either of the following two combinations of inputs: F1 F2 Combinations: Materials 72,000 79,200 Labor 36,000 33,600 The cost of materials is $8 per pound; the cost of labor is $12 per hour Required: 1. Compute the output-input ratio for each input of Combination F1. If required, round your answers to two decimal places. Materials 33.33 x X Labor 30.19 x Does this represent a productivity improvement over the current use of inputs? ? Yes What is the total dollar value of the improvement? $ 336,000 Classify this as a technical or an allocative efficiency improvement. . Technical efficiency 2. Compute the output-input ratio for each input of Combination F2. If required, round your answers to two decimal places. , . Materials 30.30 x Labor 71.43 x Does this represent a productivity improvement over the current use of inputs? Yes Now, compare these ratios to those of Combination F1. What has happened? F2 has lower productivity for materials and higher productivity for labor. 3. Compute the cost of producing 24,000 units of output using Combination F1 1,017,800 X Compare this cost to the cost using Combination F2. . Cost of Combination F1 Cost of Combination F2 Difference Does moving from Combination F1 to Combination F2 represent a productivity improvement? No eBook Focused Value Streams, Product Costing Sixty employees (all CPAs) of a local public accounting firm eat lunch at least twice weekly at a very popular pizza restaurant. The pizza restaurant recently began offering discounts for groups of 15 or more. Groups would be seated in a separate room, served individual bowls of salad costing $2 each, pitchers of root beer costing $3 each (each pitcher has a five-glass capacity), and medium, two-topping pizzas for $10 (10 slices each). The food would have to be ordered in advance. Thirty of the CPAs commit to eating three slices of pizza, three glasses of root beer, and one bowl of salad [a consumption pattern of (3,3,1)]. The other 30 are more hearty eaters and commit to seven slices of pizza, two glasses of root beer, and one bowl of salad [a consumption pattern of (7,2,1)]. Each member of the group must pay an assessed amount for the lunch. Required: 1. Determine the total number of pizzas, pitchers of root beer, and salads that must be ordered for the 60 employees. Pizza 33 X pizzas Root beer 36 X pitchers Salads 60 bowls 2. One of the CPAs offered to determine the amount that each should pay. He suggested that the easiest way is to assign the average cost to each person eating in the group. Based on this suggestion, how much would each CPA pay for lunch? Round your answer to the nearest cent. 8.20 X per individual 3. One CPA objected to using average cost, noting that half of the CPAs are much lighter eaters than the other half. Based on the large differences in consumption behaviors, he suggested forming two groups: one for the light eaters (Group A) and one for the heavier eaters (Group B). Calculate the average lunch cost for each CPA for each group. Round your answers to the nearest cent. Group A 6.40 X per individual Group B 10 X per individual Calculate the cost for each CPA that would be assigned using ABC. Group A 6.4 X per individual Group B $ 10 X per individual What does this tell you? The focused value stream produces more accurate cost assignments. Chock My Work Previous Environmental Financial Reporting, Ecoefficiency, Improving Environmental Performance The following items are listed in an environmental financial statement (issued as part of an environmental progress report): Environmental benefits (savings, income, and cost avoidance): Ozone-depleting substances cost reductions Hazardous waste disposal cost reductions Hazardous waste material cost reductions Nonhazardous waste disposal cost reductions Nonhazardous waste material cost reductions Recycling income Energy conservation cost savings Packaging cost reductions Environmental costs: Corporate-level administrative costs Auditor fees Environmental engineering Facility professionals and programs Packaging professionals and programs for packaging reductions Pollution controls: Operations and maintenance Pollution controls: Depreciation Attorney fees for cleanup claims, and notices of violations (NOVS) Settlements of government claims Waste disposal Environmental taxes for packaging Remediation/Cleanup: On-site Remediation/Cleanup: Off-site In the environmental benefits section of the report, three types of benefits are listed: income, savings, and cost avoidance. Now, consider the following data for selected items for a four-year period: Engineering Cost of Ozone- Year Design Costs Depleting Substances 20x2 $180,800 $3,259,200 20x3 1,430,600 2,173,500 20x4 732,300 1,441,200 20x5 88,300 367,000 The engineering design costs were incurred to redesign the production processes and products. Redesign of the product allowed the substitution of a material that produced less ozone-depleting substances. Modifications in the design of the processes also accomplished the same objective. Because of the improvements, the company was able to reduce the demand for pollution control equipment (with its attendant depreciation and operating costs) and avoid fines and litigation costs. All of the savings generated in a given year represent costs avoided for future years. The engineering costs are investments in design projects. Once the results of the project are realized, design costs can be reduced to lower levels. However, since some ongoing design activity is required for maintaining the system and improving it as needed, the environmental engineering cost will not be reduced lower than the $88,300 reported in 20x5. Required: 1. Prepare a partial environmental financial statement, divided into benefit and cost sections for 20x3, 20x4, and 20x5. 20x5 Environmental Financial Statement (Partial) ) For 20x3, 20x4 and 20x5 20x3 20x4 Environmental benefits: Ozone-depleting substances, cost reductions 1.440.000 2,160,000 Environmental costs: Engineering design 1.435.500 754,500 2.878,200 91,600 2. Evaluate the outcomes. Does this result support or challenge ecoefficiency? Support

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts