Question: 1. 2. 3. Please number them and break it down so that I may understand it completely. You purchase a $000 face value bond @a

1.

2.  3.

3.  Please number them and break it down so that I may understand it completely.

Please number them and break it down so that I may understand it completely.

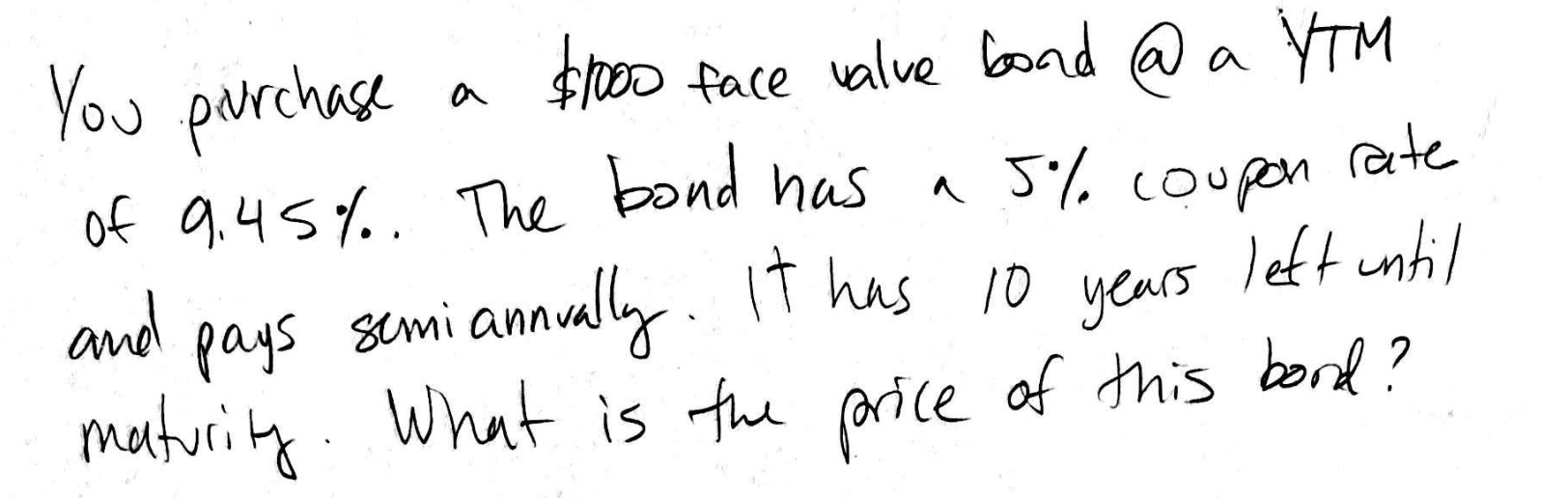

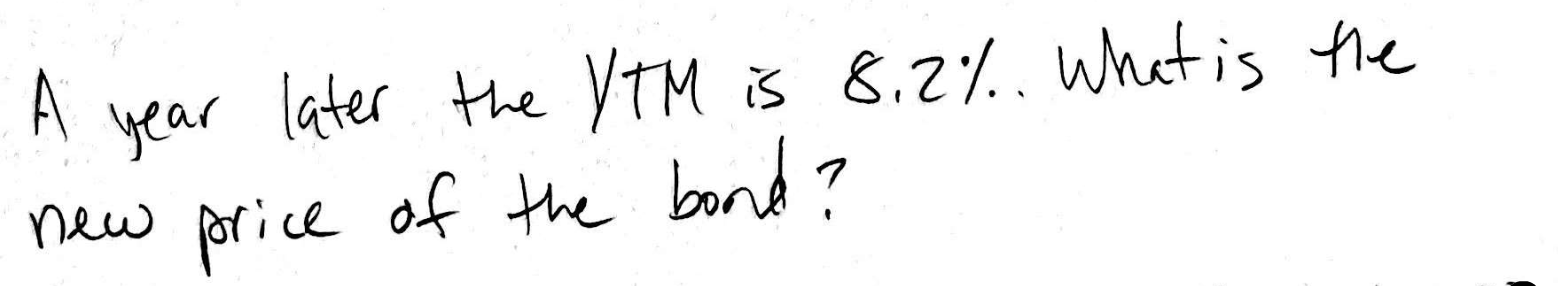

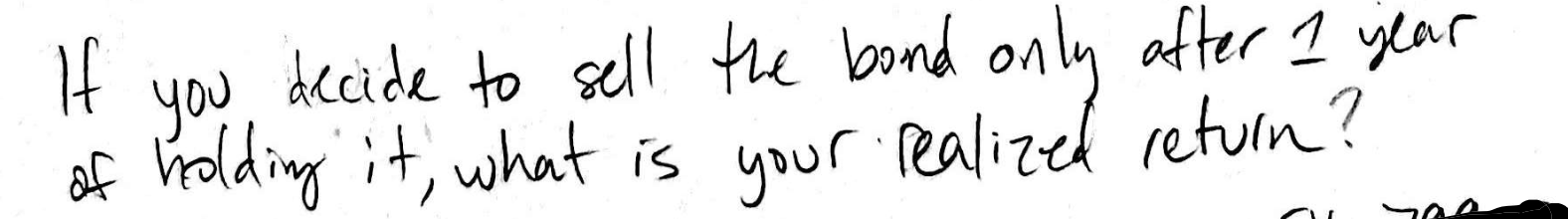

You purchase a $000 face value bond @a YTM of 9.45%. The bond has a 5% coupon rate and pays semiannually. It has 10 years left until maturity. What is the price of this bood? A year later the YTM is 8,2% What is the new price of the bound? If you decide to sell of holding it, what is the bond only after 1 year your realized return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts