Question: 1 2. 3 Question 11 10 11 12 Not yet answered Points out of 5.00 Finish attempt P Flag question GENERAL INSTRUCTIONS: ENTER YOUR ANSWER

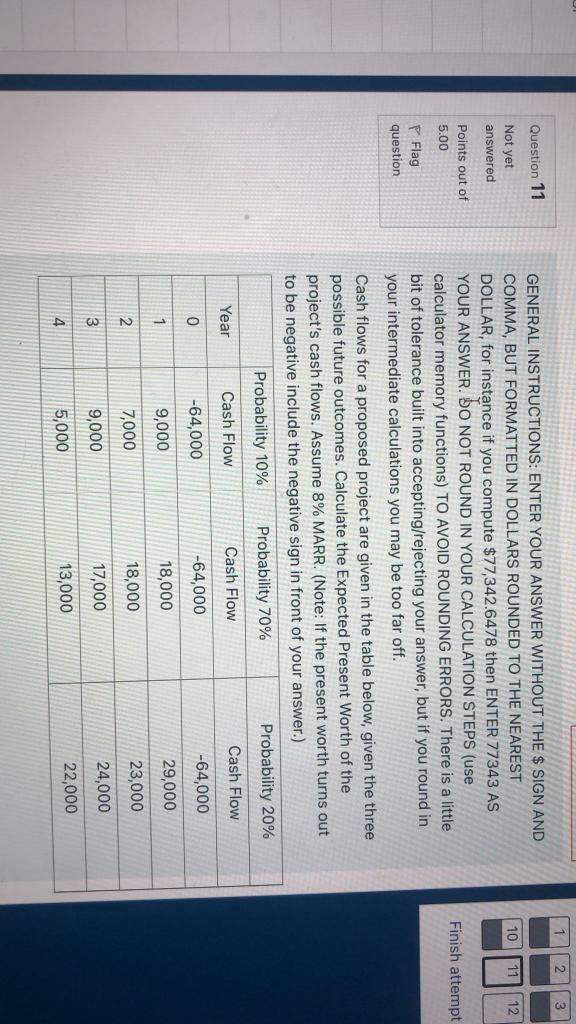

1 2. 3 Question 11 10 11 12 Not yet answered Points out of 5.00 Finish attempt P Flag question GENERAL INSTRUCTIONS: ENTER YOUR ANSWER WITHOUT THE $ SIGN AND COMMA, BUT FORMATTED IN DOLLARS ROUNDED TO THE NEAREST DOLLAR, for instance if you compute $77,342.6478 then ENTER 77343 AS YOUR ANSWER. DO NOT ROUND IN YOUR CALCULATION STEPS (use calculator memory functions) TO AVOID ROUNDING ERRORS. There is a little bit of tolerance built into accepting/rejecting your answer, but if you round in your intermediate calculations you may be too far off. Cash flows for a proposed project are given in the table below, given the three possible future outcomes. Calculate the Expected Present Worth of the project's cash flows. Assume 8% MARR. (Note: If the present worth turns out to be negative include the negative sign in front of your answer.) Probability 10% Probability 70% Probability 20% Year Cash Flow Cash Flow Cash Flow -64,000 0 -64,000 -64,000 1 9,000 18,000 29,000 7,000 2 23,000 18,000 9,000 3 24,000 17,000 22,000 4 13,000 5,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts