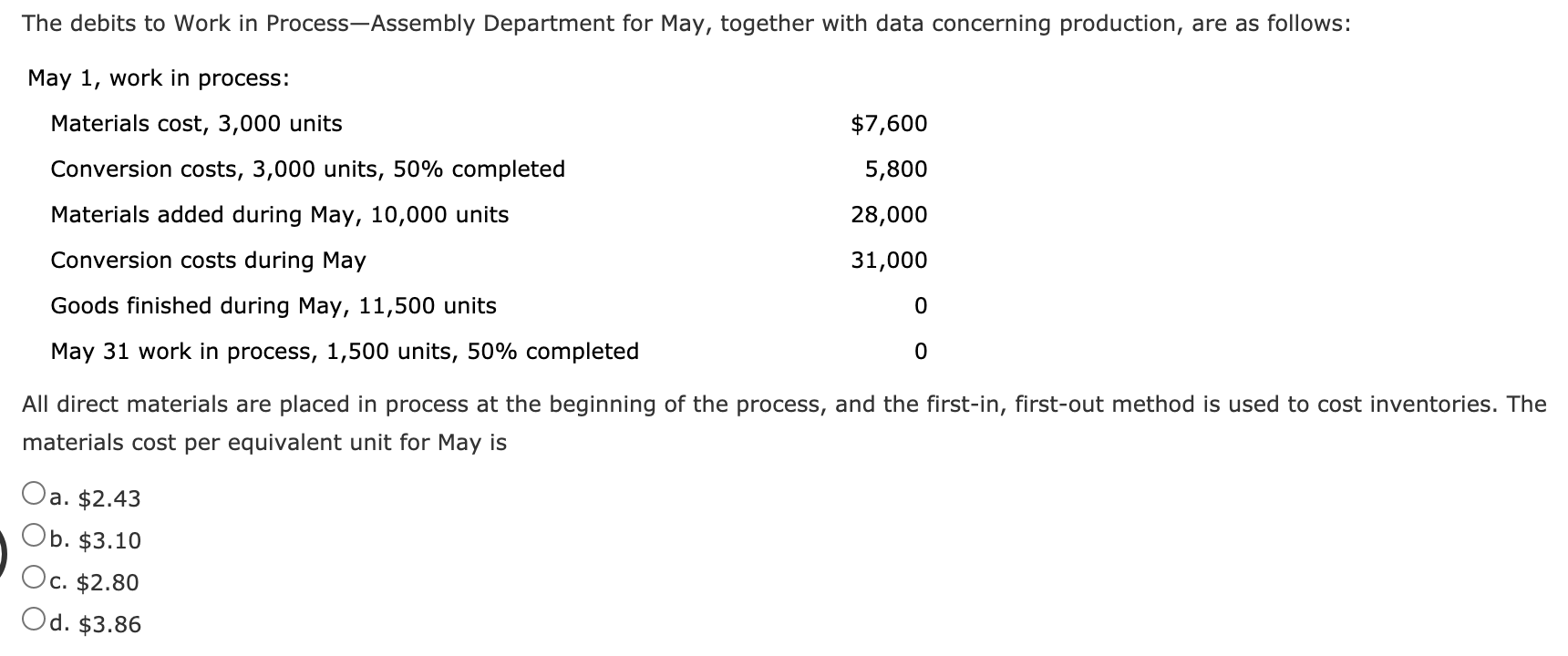

Question: 1 2 3 The debits to Work in Process-Assembly Department for May, together with data concerning production, are as follows: May 1, work in process:

1

2

3

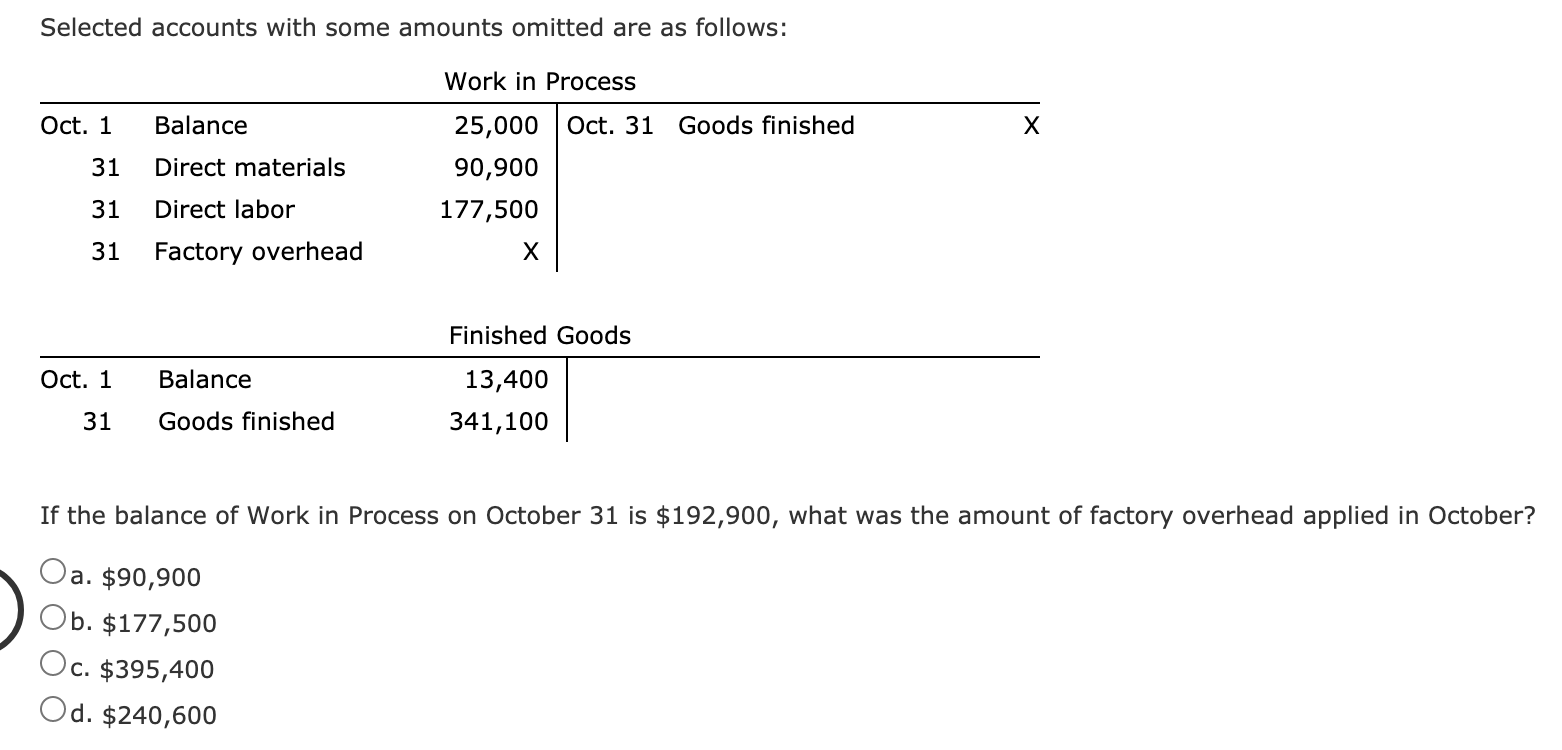

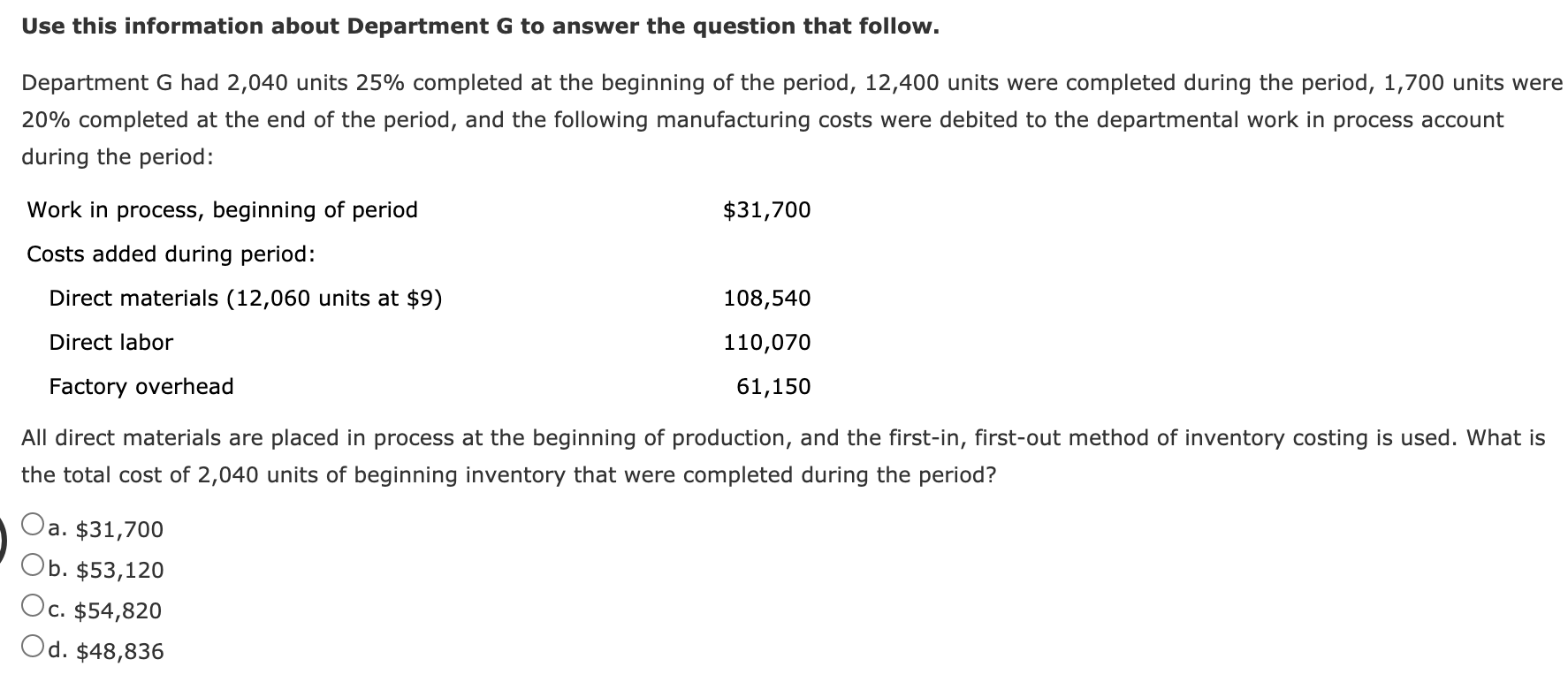

The debits to Work in Process-Assembly Department for May, together with data concerning production, are as follows: May 1, work in process: Materials cost, 3,000 units $7,600 5,800 Conversion costs, 3,000 units, 50% completed Materials added during May, 10,000 units 28,000 Conversion costs during May 31,000 Goods finished during May, 11,500 units 0 May 31 work in process, 1,500 units, 50% completed 0 All direct materials are placed in process at the beginning of the process, and the first-in, first-out method is used to cost inventories. The materials cost per equivalent unit for May is Oa. $2.43 Ob. $3.10 Oc. $2.80 Od. $3.86 Selected accounts with some amounts omitted are as follows: Oct. 1 Balance Work in Process 25,000 Oct. 31 Goods finished 90,900 177,500 31 Direct materials 31 Direct labor 31 Factory overhead Finished Goods Oct. 1 Balance 13,400 341,100 31 Goods finished If the balance of Work in Process on October 31 is $192,900, what was the amount of factory overhead applied in October? Oa. $90,900 Ob. $177,500 Oc. $395,400 Od. $240,600 Use this information about Department G to answer the question that follow. Department G had 2,040 units 25% completed at the beginning of the period, 12,400 units were completed during the period, 1,700 units were 20% completed at the end of the period, and the following manufacturing costs were debited to the departmental work in process account during the period: $31,700 Work in process, beginning of period Costs added during period: Direct materials (12,060 units at $9) 108,540 110,070 Direct labor Factory overhead 61,150 All direct materials are placed in process at the beginning of production, and the first-in, first-out method of inventory costing is used. What is the total cost of 2,040 units of beginning inventory that were completed during the period? Oa. a. $31,700 Ob. $53,120 Oc. $54,820 Od. $48,836

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts