Question: 1. 2. 3. tructions Student Instructions: 1. You will have only one attempt. 2. This task has a value of 50 points. 3. You need

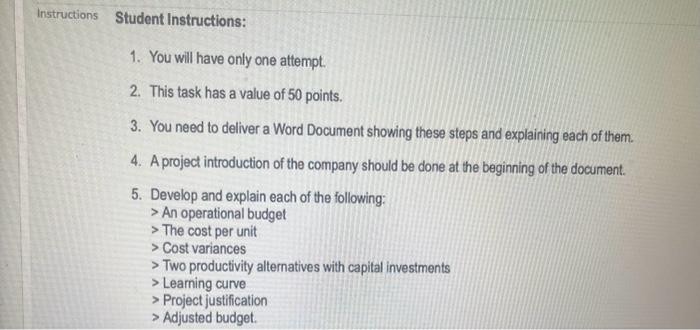

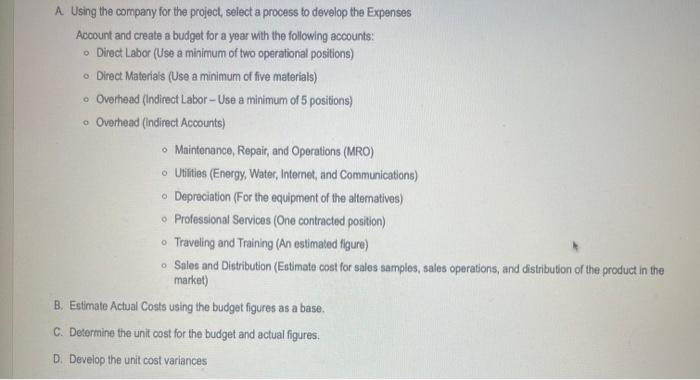

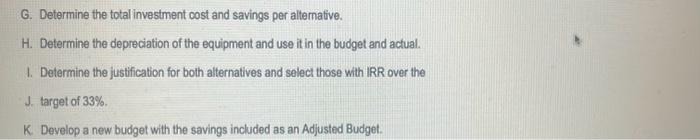

tructions Student Instructions: 1. You will have only one attempt. 2. This task has a value of 50 points. 3. You need to deliver a Word Document showing these steps and explaining each of them. 4. A project introduction of the company should be done at the beginning of the document. 5. Develop and explain each of the following: > An operational budget > The cost per unit > Cost variances > Two productivity alternatives with capital investments > Learning curve > Project justification > Adjusted budget. A. Using the company for the project, select a process to develop the Expenses Account and create a budget for a year with the following accounts: - Direct Labor (Use a minimum of two operational positions) - Direct Materia's (Use a minimum of five materials) - Overhead (indirect Labor - Use a minimum of 5 positions) - Overhead (indirect Accounts) - Maintenance, Repair, and Operations (MRO) - Ubitties (Energy, Water, Internet, and Communications) - Depreciation (For the equipment of the alternatives) - Professional Services (One contracted position) - Traveling and Training (An estimated figure) - Sales and Distribution (Eotmate cost for sales samples, sales operations, and distribution of the product in the market) B. Estimate Actual Costs using the budget figures as a base. C. Determine the unit cost for the budget and actual figures. D. Develop the unit cost variances G. Determine the total investment cost and savings per alternative. H. Determine the depreciation of the equipment and use it in the budget and actual. 1. Determine the justification for both alternatives and select those with IRR over the J. target of 33%. K. Develop a new budget with the savings included as an Adjusted Budget. tructions Student Instructions: 1. You will have only one attempt. 2. This task has a value of 50 points. 3. You need to deliver a Word Document showing these steps and explaining each of them. 4. A project introduction of the company should be done at the beginning of the document. 5. Develop and explain each of the following: > An operational budget > The cost per unit > Cost variances > Two productivity alternatives with capital investments > Learning curve > Project justification > Adjusted budget. A. Using the company for the project, select a process to develop the Expenses Account and create a budget for a year with the following accounts: - Direct Labor (Use a minimum of two operational positions) - Direct Materia's (Use a minimum of five materials) - Overhead (indirect Labor - Use a minimum of 5 positions) - Overhead (indirect Accounts) - Maintenance, Repair, and Operations (MRO) - Ubitties (Energy, Water, Internet, and Communications) - Depreciation (For the equipment of the alternatives) - Professional Services (One contracted position) - Traveling and Training (An estimated figure) - Sales and Distribution (Eotmate cost for sales samples, sales operations, and distribution of the product in the market) B. Estimate Actual Costs using the budget figures as a base. C. Determine the unit cost for the budget and actual figures. D. Develop the unit cost variances G. Determine the total investment cost and savings per alternative. H. Determine the depreciation of the equipment and use it in the budget and actual. 1. Determine the justification for both alternatives and select those with IRR over the J. target of 33%. K. Develop a new budget with the savings included as an Adjusted Budget

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts