Question: 1 2 5 , 8 : 4 0 PM Training detait: Curriculum estion 2 1 of 8 5 . la and Gabe are divorced and

: PM

Training detait: Curriculum

estion of

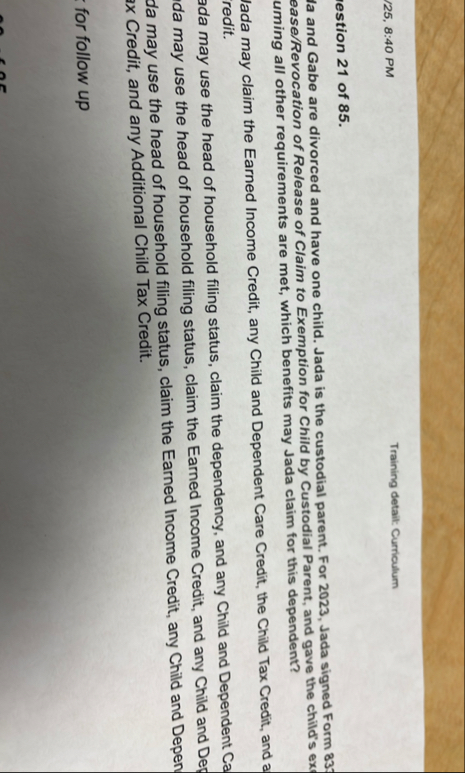

la and Gabe are divorced and have one child. Jada is the custodial parent. For Jada signed Form easeRevocation of Release of Claim to Exemption for Child by Custodial Parent, and gave the child's ex uming all other requirements are met, which benefits may Jada claim for this dependent?

lada may claim the Earned Income Credit, any Child and Dependent Care Credit, the Child Tax Credit, and a redit.

ada may use the head of household filing status, claim the dependency, and any Child and Dependent Ca da may use the head of household filing status, claim the Earned Income Credit, and any Child and Dep da may use the head of household filing status, claim the Earned Income Credit, any Child and Depen Credit, and any Additional Child Tax Credit.

for follow up

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock