Question: 1 : 2 6 : Question 1 1 ( 1 0 points ) Mrs . Hardeep Kang, a marketing consultant, has sales of $ 1

::

Question points

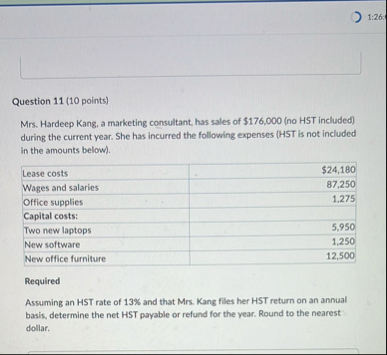

Mrs Hardeep Kang, a marketing consultant, has sales of $no HST included during the current year. She has incurred the following expenses HST is not included in the amounts below

tableLease costs,$Wages and salaries,Office supplies,Capital costs:,Two new laptops,New software,New office furniture,

Required

Assuming an HST rate of and that Mrs Kang files her HST return on an annual basis, determine the net HST payable or refund for the year. Round to the nearest dollar.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock