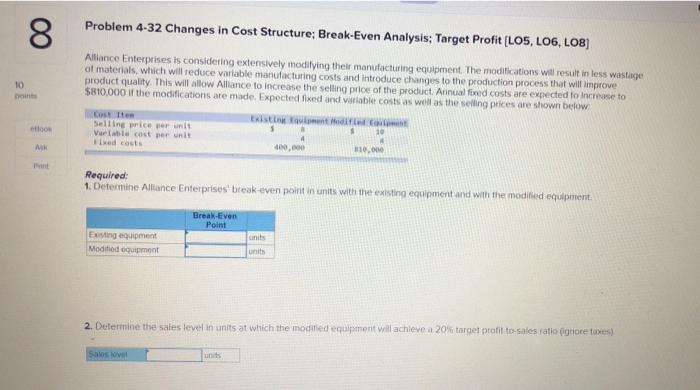

Question: 1. 2. 8 Problem 4-32 Changes in Cost Structure; Break-Even Analysis; Target Profit (LOS, LO6, LO8) 10 Alliance Enterprises is considering extensively modifying their manufacturing

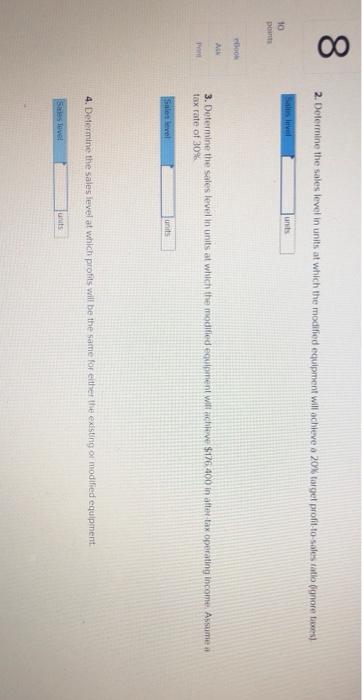

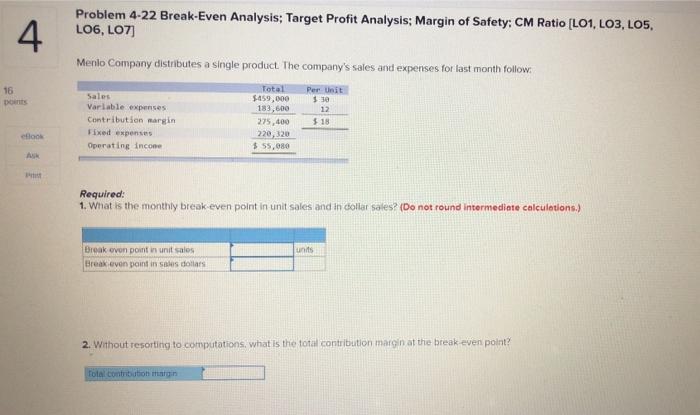

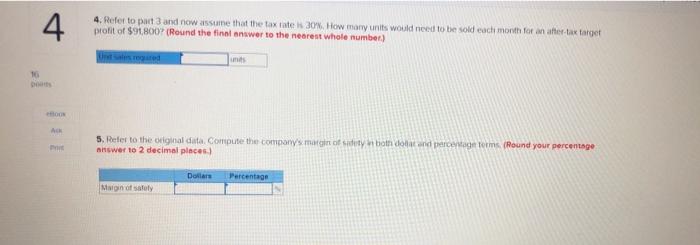

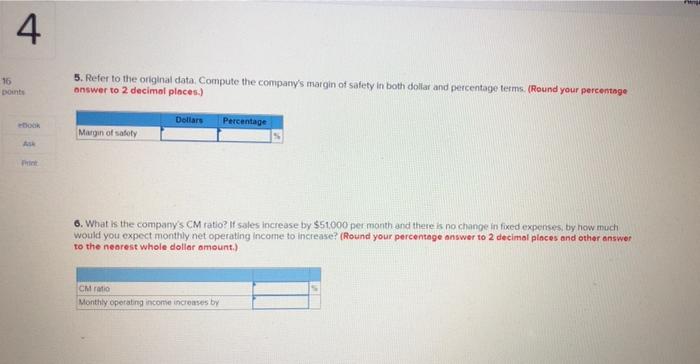

8 Problem 4-32 Changes in Cost Structure; Break-Even Analysis; Target Profit (LOS, LO6, LO8) 10 Alliance Enterprises is considering extensively modifying their manufacturing equipment. The modifications will result in less wastage of materials, which will reduce variable manufacturing costs and introduce changes to the production process that will improve product quality. This will allow Alliance to increase the selling price of the product. Annual fored costs are expected to increase to $810,000 it the modifications are made. Expected fixed and variable costs as well as the selling prices are shown below Cost Item Existing in Hd Selling price per unit Variable cost per unit ved costs 40,000 110,000 efloor 5 MK Required: 1. Determine Alliance Enterprises break-even point in units with the existing equipment and with the modified equipment Break-even Point Eating equipment Modified equipment units hits 2. Determine the sales level in units at which the modified equipment will achieve a 20% target profitto-sales ratio ignore taxes) Sales units 00 8 2. Determine the sales level in units at which the modified equipment will achieve a 20% target profit-to-sales tatlo onores units 10 posts book 3. Determine the sales level in units at which the modified equipment will achieve $126400 in after tax operating Income. Asume tax rate of 30% Sale level units 4. Determine the sales level at which profits will be the same for either the existing or modified equipment Sa lovel units 4. Problem 4-22 Break-Even Analysis; Target Profit Analysis: Margin of Safety; CM Ratio (LO1, LO3, LO5, LOG, LO7) Menlo Company distributes a single product. The company's sales and expenses for last month follow: Total 16 Dots Sales Variable expenses Contribution margin Fixed expenses Operating income $-459,000 183,600 275,400 220,320 $ 55,080 Per Unit 3:30 12 518 efloor AK Required: 1. What is the monthly break even point in unit sales and in collar sales? (Do not round intermediate calculations.) units Break even point in unit salos Break even point in sales dollars 2. Without resorting to computations, what is the total contribution margin at the break even point? Total contribution in 4 3-0. How many units would have to be sold each month to earn a target profit of $91.800? Use the formula method Units sold units 16 points cBook 3-b. Verify your answer by preparing a contribution format income statement at the target sales level. Print Mento Company Contribution Income Statement Total Per unit 0 $ 0 5 0 4 4. Refer to part 3 and now assume that the tax rates 30%. How many units would need to be sold each month for an after tax target profit of $91,800 (Round the final answer to the nearest whole number.) Ungd 10 ON A 5. Refer to the original data Compute the company's margin of duty to do and percentage torms (Round your percentage answer to 2 decimal places) Dollars Percentage Margin of safety 4 16 points 5. Refer to the original data. Compute the company's margin of safety in both dollar and percentage terms. (Round your percentage answer to 2 decimal places.) Dollars Percentage Margin of safety 6. What is the company's CM ratio? if sales increase by $51.000 per month and there is no change in fived experises, by how much would you expect monthly net operating income to increase? (Round your percentage answer to 2 decimal places and other answer to the nearest whole dollar amount.) CM Monthly operating income increases by

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts