Question: 1. 2. Although you should generally keep tax records for 3 years from the date you file your return, you may be held responsible for

1.

2. Although you should generally keep tax records for 3 years from the date you file your return, you may be held responsible for providing back documentation up to:

10 years

5 years

3 years

7 years

4 years

Help

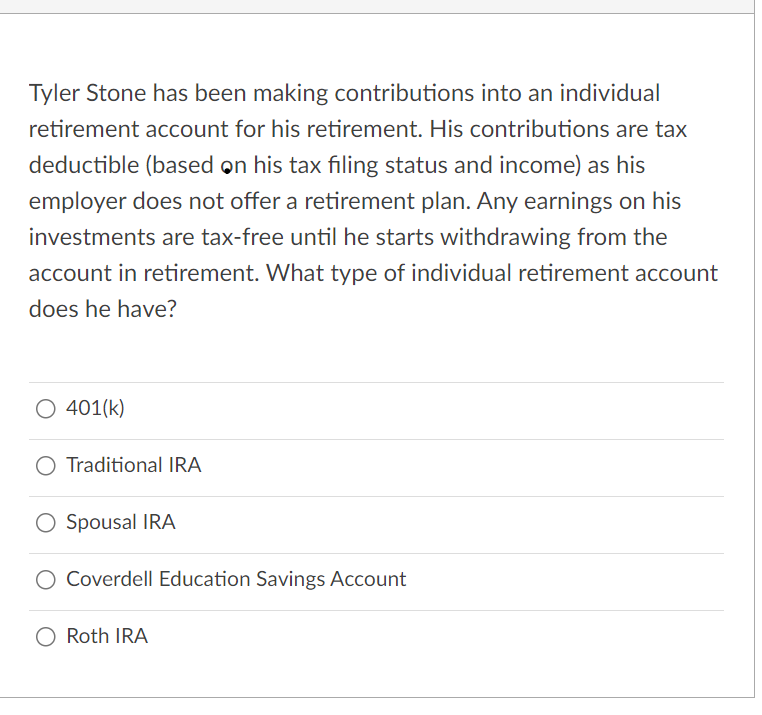

Tyler Stone has been making contributions into an individual retirement account for his retirement. His contributions are tax deductible (based on his tax filing status and income) as his employer does not offer a retirement plan. Any earnings on his investments are tax-free until he starts withdrawing from the account in retirement. What type of individual retirement account does he have? 401(k) Traditional IRA Spousal IRA Coverdell Education Savings Account Roth IRA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts