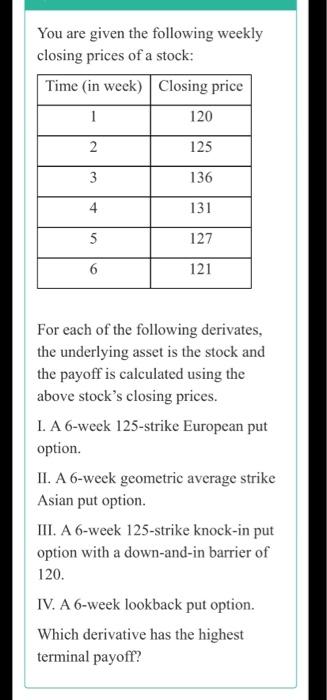

Question: 1. ----------------- 2. answer both correctly for an upvote You are given the following weekly closing prices of a stock: Time (in week) Closing price

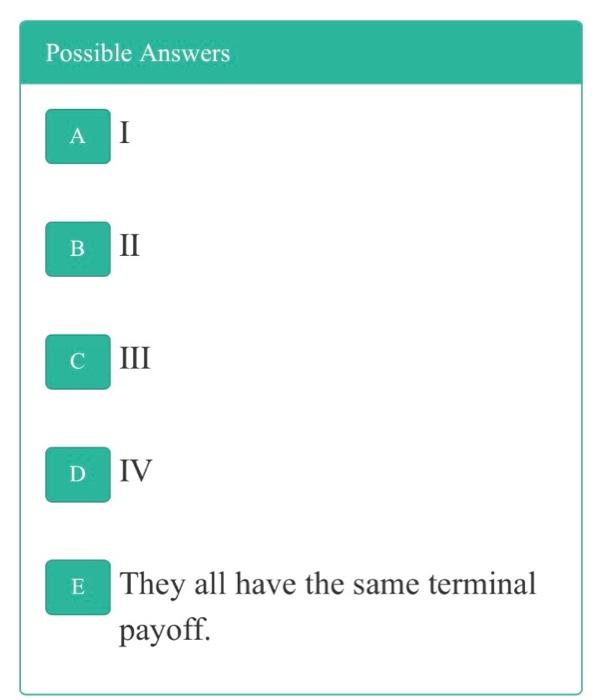

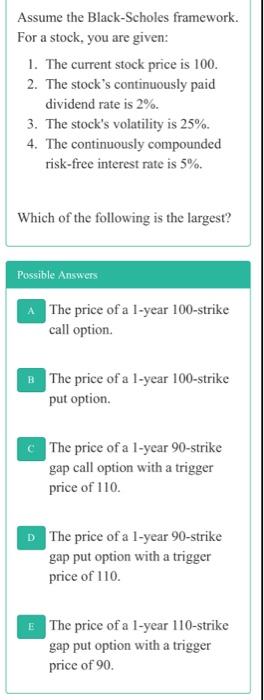

You are given the following weekly closing prices of a stock: Time (in week) Closing price 1 120 2 125 3 136 4 131 5 127 6 121 For each of the following derivates, the underlying asset is the stock and the payoff is calculated using the above stock's closing prices. 1. A 6-week 125-strike European put option. II. A 6-week geometric average strike Asian put option. III. A 6-week 125-strike knock-in put option with a down-and-in barrier of 120. IV. A 6-week lookback put option. Which derivative has the highest terminal payoff? Possible Answers A I B II C III D IV E They all have the same terminal payoff. Assume the Black-Scholes framework. For a stock, you are given: 1. The current stock price is 100. 2. The stock's continuously paid dividend rate is 2%. 3. The stock's volatility is 25%. 4. The continuously compounded risk-free interest rate is 5%. Which of the following is the largest? Possible Answers The price of a l-year 100-strike call option The price of a 1-year 100-strike put option. The price of a 1-year 90-strike gap call option with a trigger price of 110. The price of a 1-year 90-strike gap put option with a trigger price of 110. E The price of a 1-year 110-strike gap put option with a trigger price of 90. You are given the following weekly closing prices of a stock: Time (in week) Closing price 1 120 2 125 3 136 4 131 5 127 6 121 For each of the following derivates, the underlying asset is the stock and the payoff is calculated using the above stock's closing prices. 1. A 6-week 125-strike European put option. II. A 6-week geometric average strike Asian put option. III. A 6-week 125-strike knock-in put option with a down-and-in barrier of 120. IV. A 6-week lookback put option. Which derivative has the highest terminal payoff? Possible Answers A I B II C III D IV E They all have the same terminal payoff. Assume the Black-Scholes framework. For a stock, you are given: 1. The current stock price is 100. 2. The stock's continuously paid dividend rate is 2%. 3. The stock's volatility is 25%. 4. The continuously compounded risk-free interest rate is 5%. Which of the following is the largest? Possible Answers The price of a l-year 100-strike call option The price of a 1-year 100-strike put option. The price of a 1-year 90-strike gap call option with a trigger price of 110. The price of a 1-year 90-strike gap put option with a trigger price of 110. E The price of a 1-year 110-strike gap put option with a trigger price of 90

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts